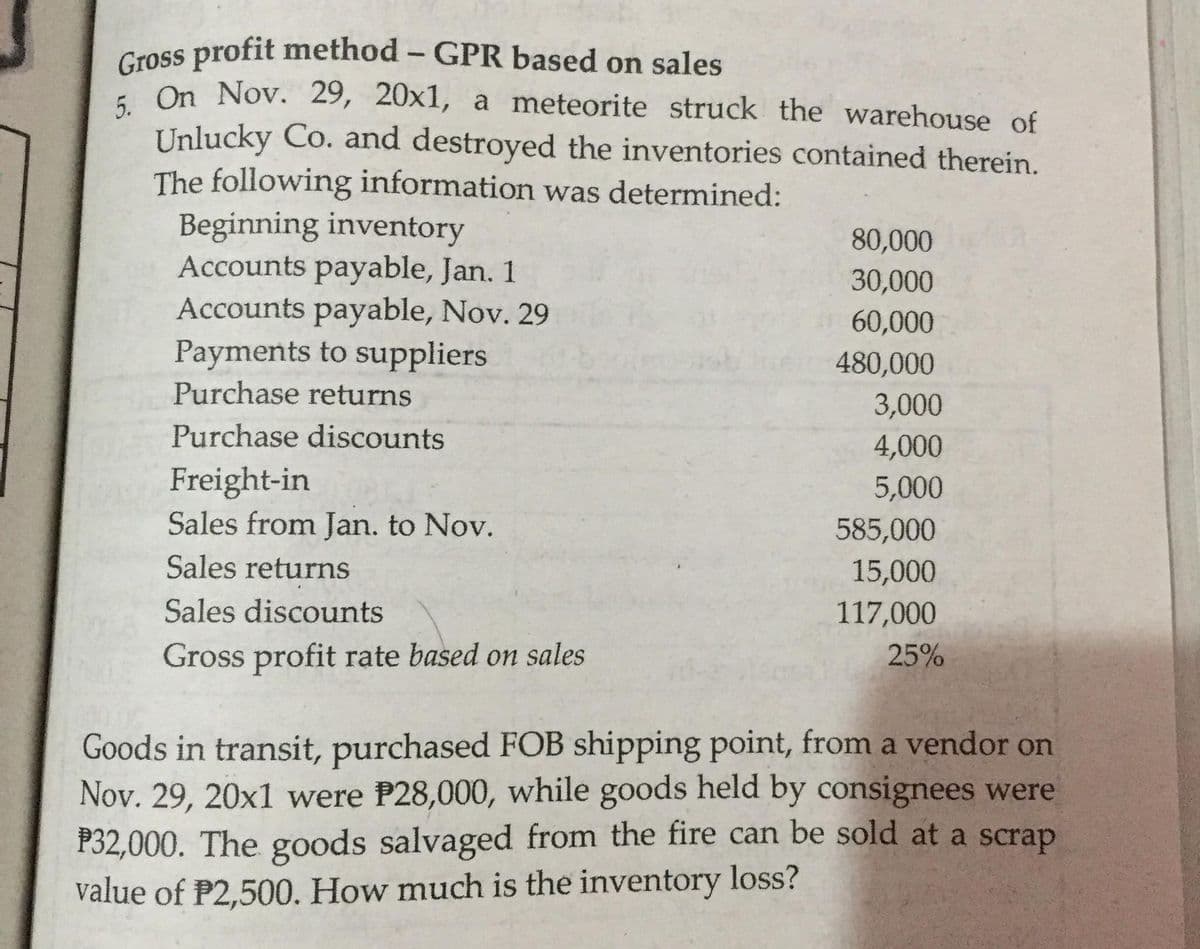

Gross profit method - GPR based on sales - - On Nov. 29, 20x1, a meteorite struck the warehouse of Unlucky Co. and destroyed the inventories contained therein. The following information was determined: Beginning inventory Accounts payable, Jan. 1 Accounts payable, Nov. 29 Payments to suppliers Purchase returns 80,000 30,000 60,000 480,000 3,000 Purchase discounts 4,000 Freight-in Sales from Jan. to Nov. 5,000 585,000 Sales returns 15,000 117,000 Sales discounts Gross profit rate based on sales 25% Goods in transit, purchased FOB shipping point, from a vendor on Nov. 29, 20x1 were P28,000, while goods held by consignees were 32,000. The goods salvaged from the fire can be sold at a scrap alue of P2,500. How much is the inventory loss?

Gross profit method - GPR based on sales - - On Nov. 29, 20x1, a meteorite struck the warehouse of Unlucky Co. and destroyed the inventories contained therein. The following information was determined: Beginning inventory Accounts payable, Jan. 1 Accounts payable, Nov. 29 Payments to suppliers Purchase returns 80,000 30,000 60,000 480,000 3,000 Purchase discounts 4,000 Freight-in Sales from Jan. to Nov. 5,000 585,000 Sales returns 15,000 117,000 Sales discounts Gross profit rate based on sales 25% Goods in transit, purchased FOB shipping point, from a vendor on Nov. 29, 20x1 were P28,000, while goods held by consignees were 32,000. The goods salvaged from the fire can be sold at a scrap alue of P2,500. How much is the inventory loss?

Century 21 Accounting General Journal

11th Edition

ISBN:9781337680059

Author:Gilbertson

Publisher:Gilbertson

Chapter20: Accounting For Inventory

Section20.3: Estimating Inventory

Problem 1OYO

Related questions

Topic Video

Question

Transcribed Image Text:Gross profit method - GPR based on sales

- On Nov. 29, 20x1, a meteorite struck the warehouse of

Unlucky Co. and destroyed the inventories contained therein.

The following information was determined:

Beginning inventory

Accounts payable, Jan. 1

Accounts payable, Nov. 29

Payments to suppliers

Purchase returns

80,000

30,000

60,000

480,000

3,000

Purchase discounts

4,000

Freight-in

Sales from Jan. to Nov.

5,000

585,000

Sales returns

15,000

Sales discounts

117,000

Gross profit rate based on sales

25%

Goods in transit, purchased FOB shipping point, from a vendor on

Nov. 29, 20x1 were P28,000, while goods held by consignees were

P32,000. The goods salvaged from the fire can be sold at a scrap

value of P2,500. How much is the inventory loss?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps with 1 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Financial And Managerial Accounting

Accounting

ISBN:

9781337902663

Author:

WARREN, Carl S.

Publisher:

Cengage Learning,

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Financial And Managerial Accounting

Accounting

ISBN:

9781337902663

Author:

WARREN, Carl S.

Publisher:

Cengage Learning,

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning