The month-end journal entry to adjust its cash balance to agree to the adjusted book balance should include a: a) debit to interest revenue for $125 b) credit to service revenue for $4000 c) credit to bank service charge expense for $35 d) credit to note receivable for $2500

The month-end journal entry to adjust its cash balance to agree to the adjusted book balance should include a: a) debit to interest revenue for $125 b) credit to service revenue for $4000 c) credit to bank service charge expense for $35 d) credit to note receivable for $2500

Chapter8: Fraud, Internal Controls, And Cash

Section: Chapter Questions

Problem 11EB: Using the following information, prepare a bank reconciliation. Bank balance: $12,565. Book...

Related questions

Question

The month-end journal entry to adjust its cash balance to agree to the adjusted book balance should include a:

a) debit to interest revenue for $125

b) credit to service revenue for $4000

c) credit to bank service charge expense for $35

d) credit to note receivable for $2500

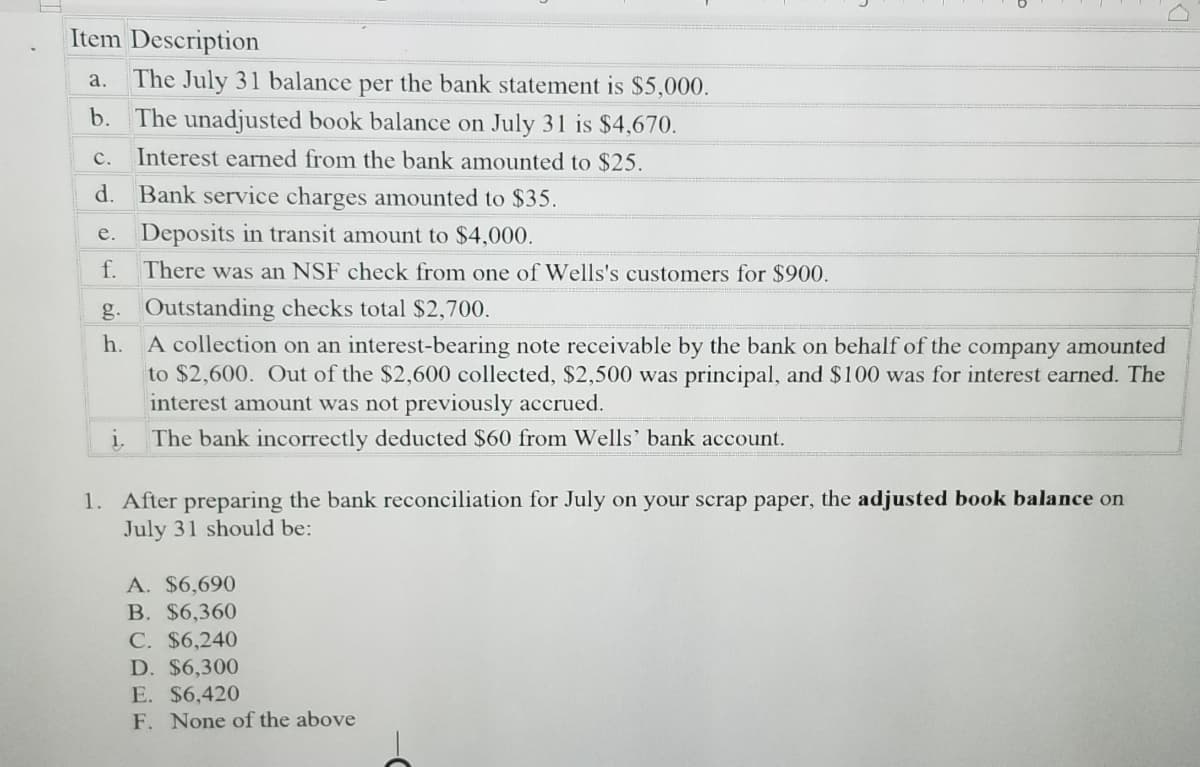

Transcribed Image Text:Item Description

a. The July 31 balance per the bank statement is $5,000.

b. The unadjusted book balance on July 31 is $4,670.

C. Interest earned from the bank amounted to $25.

d. Bank service charges amounted to $35.

e. Deposits in transit amount to $4,000.

f. There was an NSF check from one of Wells's customers for $900.

g. Outstanding checks total $2,700.

h.

1.

A collection on an interest-bearing note receivable by the bank on behalf of the company amounted

to $2,600. Out of the $2,600 collected, $2,500 was principal, and $100 was for interest earned. The

interest amount was not previously accrued.

The bank incorrectly deducted $60 from Wells' bank account.

1. After preparing the bank reconciliation for July on your scrap paper, the adjusted book balance on

July 31 should be:

A. $6,690

B. $6,360

C. $6,240

D. $6,300

E. $6,420

F. None of the above

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Follow-up Questions

Read through expert solutions to related follow-up questions below.

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

College Accounting (Book Only): A Career Approach

Accounting

ISBN:

9781337280570

Author:

Scott, Cathy J.

Publisher:

South-Western College Pub

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

College Accounting (Book Only): A Career Approach

Accounting

ISBN:

9781337280570

Author:

Scott, Cathy J.

Publisher:

South-Western College Pub

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

Century 21 Accounting Multicolumn Journal

Accounting

ISBN:

9781337679503

Author:

Gilbertson

Publisher:

Cengage

Financial Accounting

Accounting

ISBN:

9781305088436

Author:

Carl Warren, Jim Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Financial And Managerial Accounting

Accounting

ISBN:

9781337902663

Author:

WARREN, Carl S.

Publisher:

Cengage Learning,