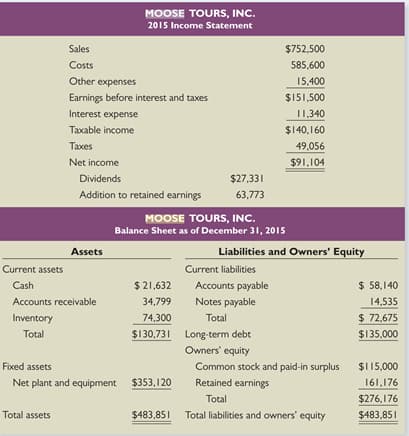

The most recent finical statements for Moose Tours, Inc., appear below. Sales for 2016 are projected to grow by 20 percent. Interest expense will remain constant; the tax rate and dividend payout rate will also remain constant. Costs, other expenses, current assets, fixed assets, and accounts payable increase spontaneously with sales. If the firm is operating at full capacity and no neb debt or equity issues, what external financing is needed to support the 20 percent growth rates in sales?

The most recent finical statements for Moose Tours, Inc., appear below. Sales for 2016 are projected to grow by 20 percent. Interest expense will remain constant; the tax rate and dividend payout rate will also remain constant. Costs, other expenses, current assets, fixed assets, and accounts payable increase spontaneously with sales. If the firm is operating at full capacity and no neb debt or equity issues, what external financing is needed to support the 20 percent growth rates in sales?

Financial Accounting: The Impact on Decision Makers

10th Edition

ISBN:9781305654174

Author:Gary A. Porter, Curtis L. Norton

Publisher:Gary A. Porter, Curtis L. Norton

Chapter13: Financial Statement Analysis

Section: Chapter Questions

Problem 13.12E

Related questions

Question

The most recent finical statements for Moose Tours, Inc., appear below. Sales for 2016 are projected to grow by 20 percent. Interest expense will remain constant; the tax rate and dividend payout rate will also remain constant. Costs, other expenses, current assets, fixed assets, and accounts payable increase spontaneously with sales. If the firm is operating at full capacity and no neb debt or equity issues, what external financing is needed to support the 20 percent growth rates in sales?

Transcribed Image Text:MOOSE TOURS, INC.

2015 Income Statement

Sales

$752,500

Costs

585,600

Other expenses

15,400

Earnings before interest and taxes

$151,500

Interest expense

11,340

Taxable income

$140,160

Тахes

49,056

Net income

$91,104

Dividends

$27,331

Addition to retained earnings

63,773

MOOSE TOURS, INC.

Balance Sheet as of December 31, 2015

Assets

Liabilities and Owners' Equity

Current assets

Current liabilities

Cash

$ 21,632

Accounts payable

$ 58,140

34,799

Notes payable

Total

14,535

$ 72,675

Accounts receivable

Inventory

74,300

Total

$130,731 Long-term debt

$135,000

Owners' equity

Fixed assets

Common stock and paid-in surplus

Retained earnings

$I15,000

Net plant and equipment $353,120

161,176

Total

$276,176

Total assets

$483,851 Total liabilities and owners' equity

$483,851

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps with 3 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Century 21 Accounting Multicolumn Journal

Accounting

ISBN:

9781337679503

Author:

Gilbertson

Publisher:

Cengage

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Century 21 Accounting Multicolumn Journal

Accounting

ISBN:

9781337679503

Author:

Gilbertson

Publisher:

Cengage

Corporate Financial Accounting

Accounting

ISBN:

9781305653535

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Financial & Managerial Accounting

Accounting

ISBN:

9781285866307

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Fundamentals of Financial Management, Concise Edi…

Finance

ISBN:

9781305635937

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning