The Neal Company wants to estimate next year's return on equity (ROE) under different financial leverage ratios. Neal's total capital is $20 million, it currently uses only common equity, has no future plans to use preferred stock in its capital structure, and its federal-plus-state tax rate is 25%. Neal is a small firm with average sales of $25 million or less during the past years, so it is exempt from the interest deduction limitation. The CFO has estimated next year's EBIT for three possible states of the world: $4.1 million with a 0.2 probability, $2.2 millio with a 0.5 probability, and $700,000 with a 0.3 probability. Calculate Neal's expected ROE, standard deviation, and coefficient of variation for each of the following debt-to-capital ratios. not round intermediate calculations. Round your answers to two decimal places. Debt/Capital ratio is 0. RỘE: % % CV: Debt/Capital ratio is 10%, interest rate is 9%. RÔE: % % CV: Debt/Capital ratio is 50%, interest rate is 11%. RÔE: % % CV: Debt/Capital ratio is 60%, interest rate is 14%. RÔE: % % CV:

The Neal Company wants to estimate next year's return on equity (ROE) under different financial leverage ratios. Neal's total capital is $20 million, it currently uses only common equity, has no future plans to use preferred stock in its capital structure, and its federal-plus-state tax rate is 25%. Neal is a small firm with average sales of $25 million or less during the past years, so it is exempt from the interest deduction limitation. The CFO has estimated next year's EBIT for three possible states of the world: $4.1 million with a 0.2 probability, $2.2 millio with a 0.5 probability, and $700,000 with a 0.3 probability. Calculate Neal's expected ROE, standard deviation, and coefficient of variation for each of the following debt-to-capital ratios. not round intermediate calculations. Round your answers to two decimal places. Debt/Capital ratio is 0. RỘE: % % CV: Debt/Capital ratio is 10%, interest rate is 9%. RÔE: % % CV: Debt/Capital ratio is 50%, interest rate is 11%. RÔE: % % CV: Debt/Capital ratio is 60%, interest rate is 14%. RÔE: % % CV:

Chapter13: Capital Structure Concepts

Section: Chapter Questions

Problem 3P

Related questions

Question

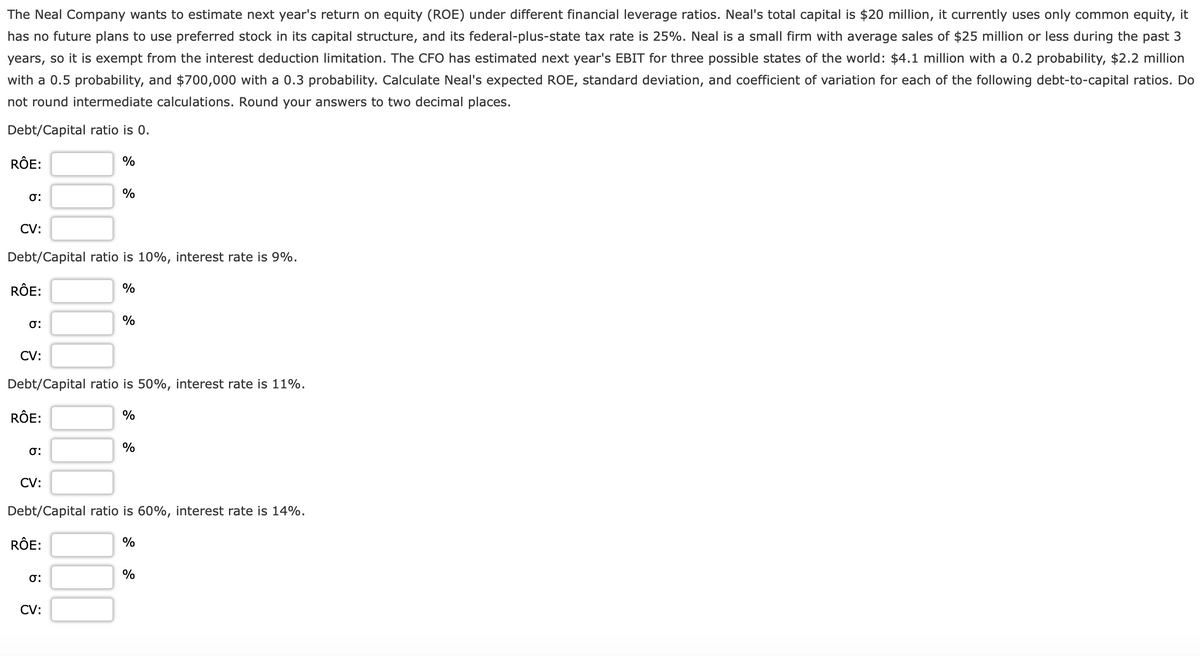

Transcribed Image Text:The Neal Company wants to estimate next year's return on equity (ROE) under different financial leverage ratios. Neal's total capital is $20 million, it currently uses only common equity, it

has no future plans to use preferred stock in its capital structure, and its federal-plus-state tax rate is 25%. Neal is a small firm with average sales of $25 million or less during the past 3

years, so it is exempt from the interest deduction limitation. The CFO has estimated next year's EBIT for three possible states of the world: $4.1 million with a 0.2 probability, $2.2 million

with a 0.5 probability, and $700,000 with a 0.3 probability. Calculate Neal's expected ROE, standard deviation, and coefficient of variation for each of the following debt-to-capital ratios. Do

not round intermediate calculations. Round your answers to two decimal places.

Debt/Capital ratio is 0.

RÔE:

%

%

σ:

CV:

Debt/Capital ratio is 10%, interest rate is 9%.

RÔE:

%

CV:

Debt/Capital ratio is 50%, interest rate is 11%.

RÔE:

%

%

CV:

Debt/Capital ratio is 60%, interest rate is 14%.

RÔE:

%

%

CV:

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 5 steps with 8 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Recommended textbooks for you

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Financial Accounting

Accounting

ISBN:

9781305088436

Author:

Carl Warren, Jim Reeve, Jonathan Duchac

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Financial Accounting

Accounting

ISBN:

9781305088436

Author:

Carl Warren, Jim Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning