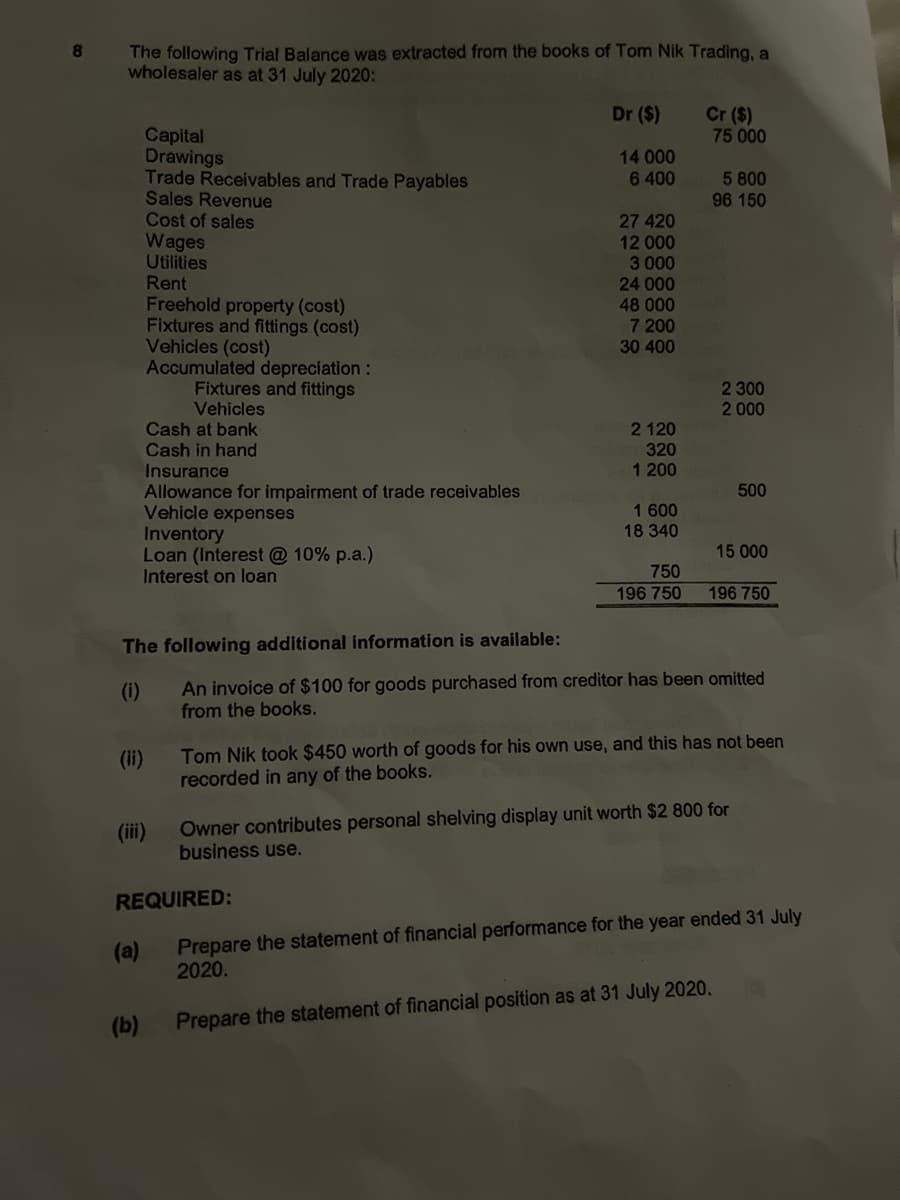

8 The following Trial Balance was extracted from the books of Tom Nik Trading, a wholesaler as at 31 July 2020: Capital Drawings Trade Receivables and Trade Payables Sales Revenue Cost of sales (ii) Wages Utilities Rent (a) (b) Freehold property (cost) Fixtures and fittings (cost) Vehicles (cost) Accumulated depreciation : Fixtures and fittings Vehicles Insurance Allowance for impairment of trade receivables Vehicle expenses Inventory (iii) Cash at bank Cash in hand Loan (Interest @ 10% p.a.) Interest on loan Dr ($) REQUIRED: 14 000 6 400 27 420 12 000 3 000 24 000 48 000 7 200 30 400 2120 320 200 1 600 18 340 750 196 750 Cr ($) 75 000 5 800 96 150 The following additional information is available: (i) An invoice of $100 for goods purchased from creditor has been omitted from the books. 2 300 2 000 500 15 000 196 750 Tom Nik took $450 worth of goods for his own use, and this has not been recorded in any of the books. Owner contributes personal shelving display unit worth $2 800 for business use. Prepare the statement of financial performance for the year ended 31 July 2020. Prepare the statement of financial position as at 31 July 2020.

8 The following Trial Balance was extracted from the books of Tom Nik Trading, a wholesaler as at 31 July 2020: Capital Drawings Trade Receivables and Trade Payables Sales Revenue Cost of sales (ii) Wages Utilities Rent (a) (b) Freehold property (cost) Fixtures and fittings (cost) Vehicles (cost) Accumulated depreciation : Fixtures and fittings Vehicles Insurance Allowance for impairment of trade receivables Vehicle expenses Inventory (iii) Cash at bank Cash in hand Loan (Interest @ 10% p.a.) Interest on loan Dr ($) REQUIRED: 14 000 6 400 27 420 12 000 3 000 24 000 48 000 7 200 30 400 2120 320 200 1 600 18 340 750 196 750 Cr ($) 75 000 5 800 96 150 The following additional information is available: (i) An invoice of $100 for goods purchased from creditor has been omitted from the books. 2 300 2 000 500 15 000 196 750 Tom Nik took $450 worth of goods for his own use, and this has not been recorded in any of the books. Owner contributes personal shelving display unit worth $2 800 for business use. Prepare the statement of financial performance for the year ended 31 July 2020. Prepare the statement of financial position as at 31 July 2020.

Intermediate Accounting: Reporting And Analysis

3rd Edition

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Chapter11: Depreciation, Depletion, Impairment, And Disposal

Section: Chapter Questions

Problem 17P: On December 31, 2019, Vail Company owned the following assets: Vail computes depreciation and...

Related questions

Concept explainers

Depreciation Methods

The word "depreciation" is defined as an accounting method wherein the cost of tangible assets is spread over its useful life and it usually denotes how much of the assets value has been used up. The depreciation is usually considered as an operating expense. The main reason behind depreciation includes wear and tear of the assets, obsolescence etc.

Depreciation Accounting

In terms of accounting, with the passage of time the value of a fixed asset (like machinery, plants, furniture etc.) goes down over a specific period of time is known as depreciation. Now, the question comes in your mind, why the value of the fixed asset reduces over time.

Topic Video

Question

Transcribed Image Text:8

The following Trial Balance was extracted from the books of Tom Nik Trading, a

wholesaler as at 31 July 2020:

Capital

Drawings

Trade Receivables and Trade Payables

Sales Revenue

Cost of sales

(a)

Wages

Utilities

Rent

Freehold property (cost)

Fixtures and fittings (cost)

Vehicles (cost)

Accumulated depreciation :

Fixtures and fittings

Vehicles

Cash at bank

Cash in hand

Insurance

Allowance for impairment of trade receivables

Vehicle expenses

Inventory

Loan (Interest @ 10% p.a.)

Interest on loan

Dr ($)

14 000

6 400

REQUIRED:

27 420

12 000

3 000

24 000

48 000

7 200

30 400

2 120

320

1 200

1 600

18 340

750

196 750

Cr ($)

75 000

5 800

96 150

2 300

2 000

The following additional information is available:

(i)

An invoice of $100 for goods purchased from creditor has been omitted

from the books.

500

15 000

196 750

Tom Nik took $450 worth of goods for his own use, and this has not been

recorded in any of the books.

Owner contributes personal shelving display unit worth $2 800 for

business use.

(b) Prepare the statement of financial position as at 31 July 2020.

Prepare the statement of financial performance for the year ended 31 July

2020.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps with 4 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Financial Accounting

Accounting

ISBN:

9781337272124

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Financial Accounting

Accounting

ISBN:

9781337272124

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College