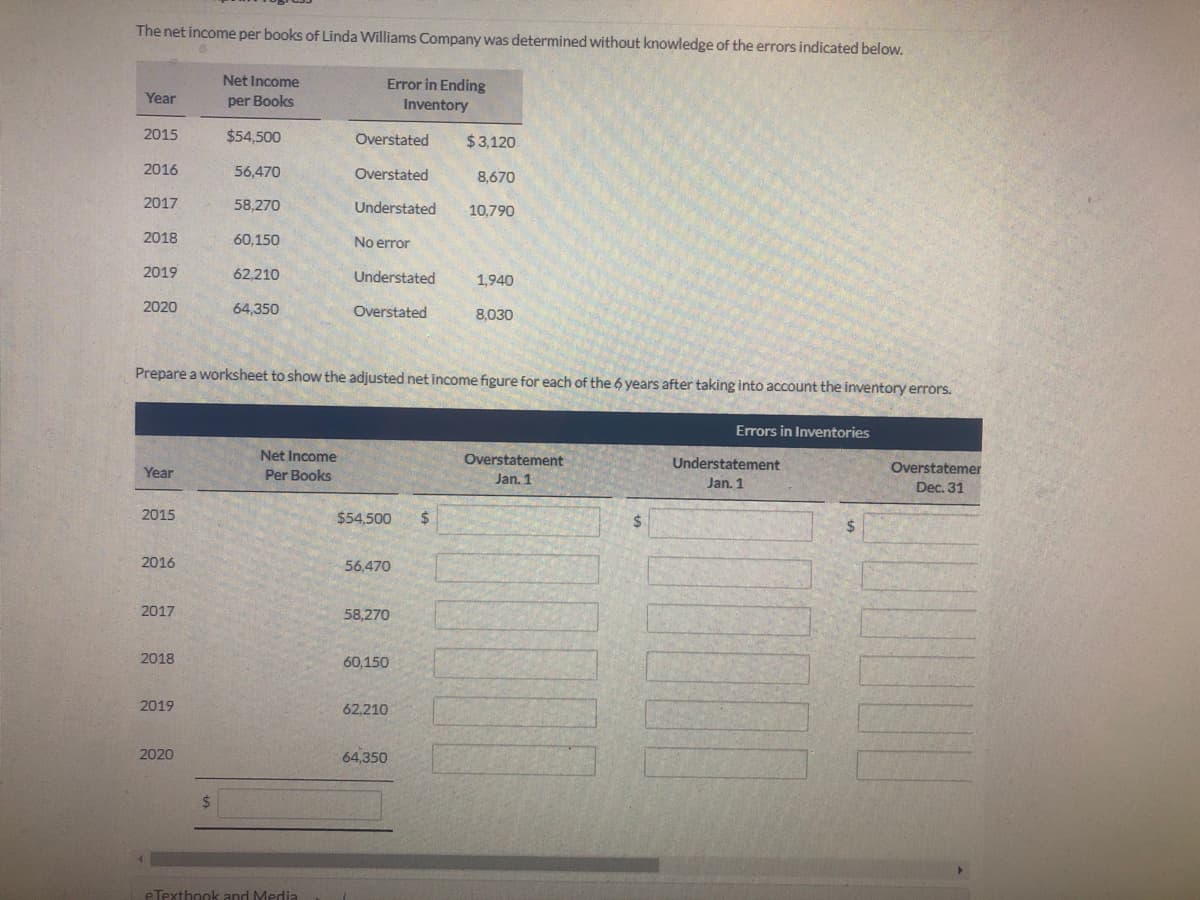

The net income per books of Linda Williams Company was determined without knowledge of the errors indicated below. Net Income Error in Ending Year per Books Inventory 2015 $54,500 Overstated $3,120 2016 56,470 Overstated 8,670 2017 58,270 Understated 10,790 2018 60,150 No error 2019 62,210 Understated 1,940 2020 64,350 Overstated 8,030 Prepare a worksheet to show the adjusted net income figure for each of the 6 years after taking into account the inventory errors. Errors in Inventories Net Income Overstatement Understatement Year Per Book Overstatemer Jan. 1 Jan. 1 Dec. 31 2015 $54,500 2$ %24 2016 56,470 2017 58,270 2018 60.150 2019 62,210 2020 64,350

The net income per books of Linda Williams Company was determined without knowledge of the errors indicated below. Net Income Error in Ending Year per Books Inventory 2015 $54,500 Overstated $3,120 2016 56,470 Overstated 8,670 2017 58,270 Understated 10,790 2018 60,150 No error 2019 62,210 Understated 1,940 2020 64,350 Overstated 8,030 Prepare a worksheet to show the adjusted net income figure for each of the 6 years after taking into account the inventory errors. Errors in Inventories Net Income Overstatement Understatement Year Per Book Overstatemer Jan. 1 Jan. 1 Dec. 31 2015 $54,500 2$ %24 2016 56,470 2017 58,270 2018 60.150 2019 62,210 2020 64,350

Intermediate Accounting: Reporting And Analysis

3rd Edition

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Chapter22: Accounting For Changes And Errors.

Section: Chapter Questions

Problem 11P: A review of Anderson Corporations books indicates that the errors and omissions pertaining to the...

Related questions

Question

Transcribed Image Text:The net income per books of Linda Williams Company was determined without knowledge of the errors indicated below.

Net Income

Error in Ending

Year

per Books

Inventory

2015

$54,500

Overstated

$3,120

2016

56,470

Overstated

8,670

2017

58,270

Understated

10.790

2018

60,150

No error

2019

62,210

Understated

1,940

2020

64,350

Overstated

8,030

Prepare a worksheet to show the adjusted net income figure for each of the 6 years after taking into account the inventory errors.

Errors in Inventories

Net Income

Overstatement

Understatement

Year

Per Books

Overstatemer

Jan. 1

Jan. 1

Dec. 31

2015

$54,500

$4

$4

%24

2016

56,470

2017

58,270

2018

60,150

2019

62.210

2020

64,350

%24

eTexthook and Media

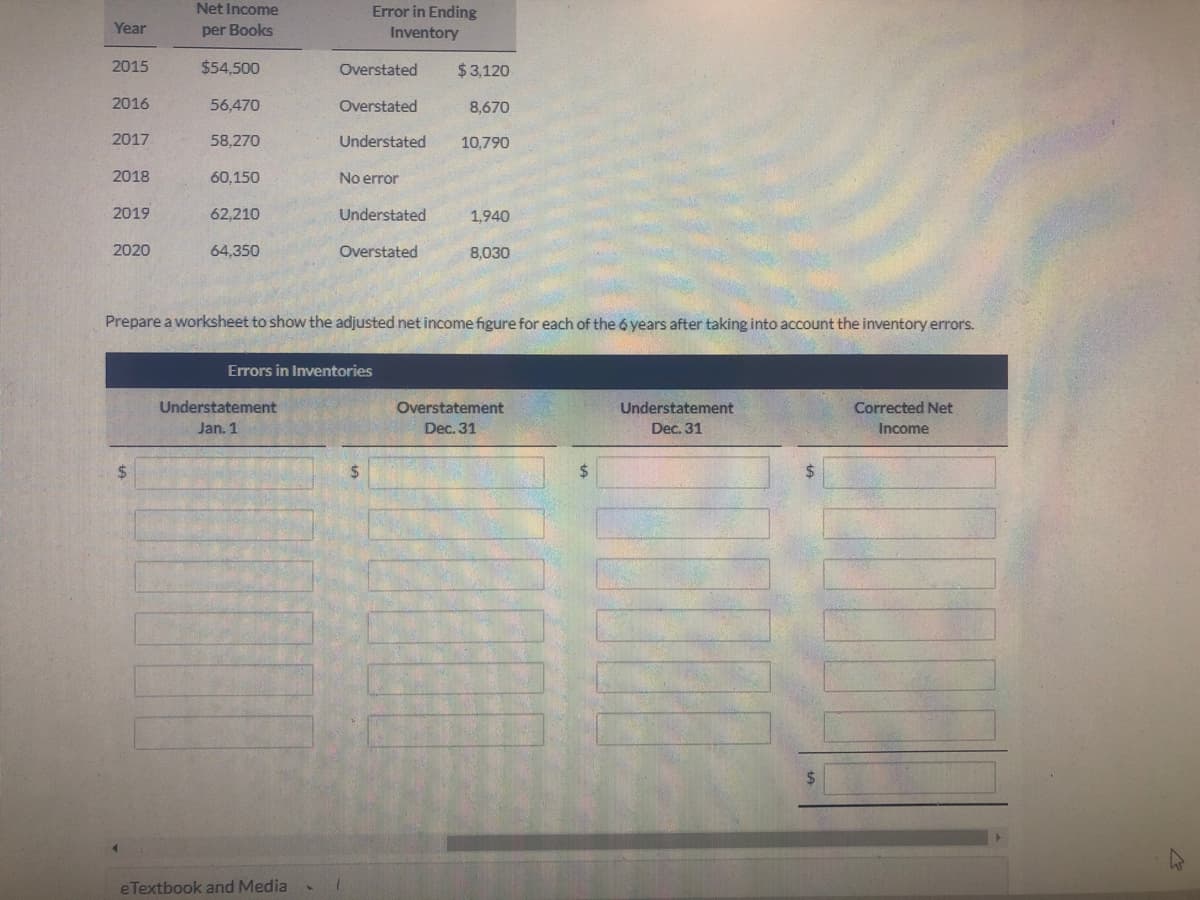

Transcribed Image Text:Net Income

Error in Ending

Year

per Books

Inventory

2015

$54,500

Overstated

$3,120

2016

56,470

Overstated

8,670

2017

58,270

Understated

10,790

2018

60,150

No error

2019

62,210

Understated

1,940

2020

64,350

Overstated

8,030

Prepare a worksheet to show the adjusted net income figure for each of the 6 years after taking into account the inventory errors.

Errors in Inventories

Understatement

Overstatement

Understatement

Corrected Net

Jan. 1

Dec. 31

Dec. 31

Income

24

eTextbook and Media

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps with 1 images

Recommended textbooks for you

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College