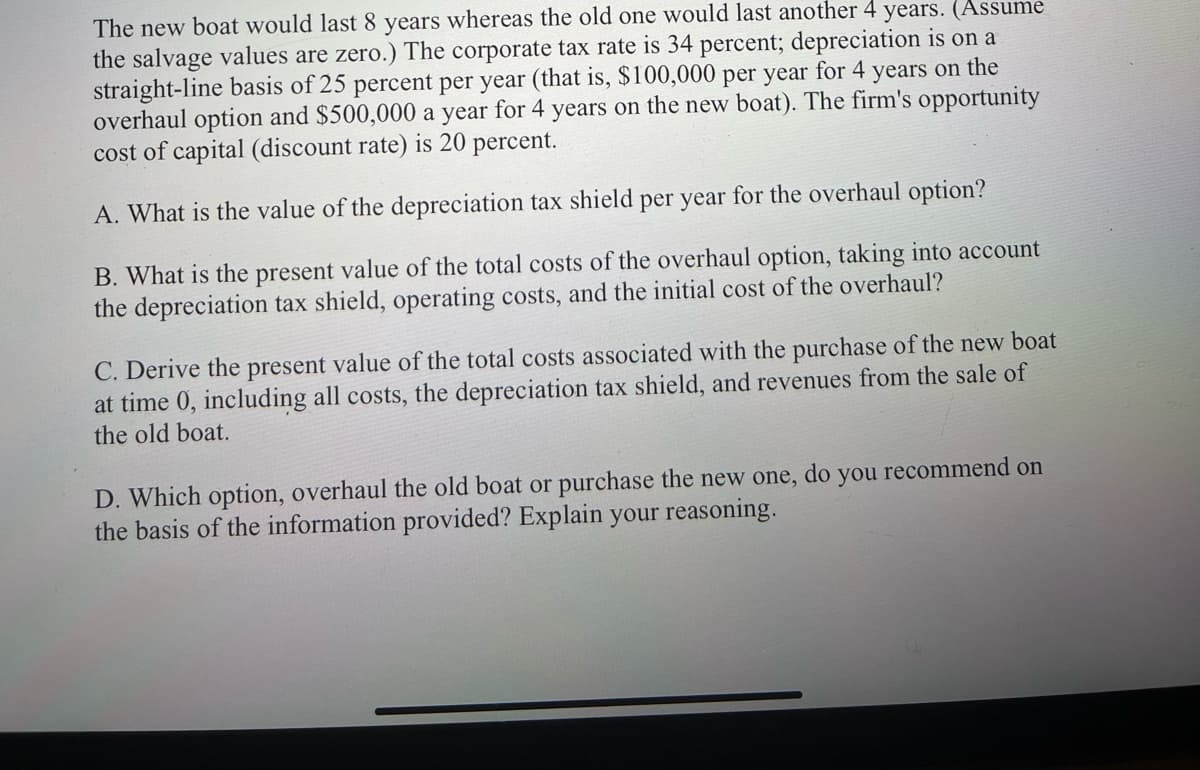

The new boat would last 8 years whereas the old one would last another 4 years. (Assume the salvage values are zero.) The corporate tax rate is 34 percent; depreciation is on a straight-line basis of 25 percent per year (that is, $100,000 per year for 4 years on the overhaul option and $500,000 a year for 4 years on the new boat). The firm's opportunity cost of capital (discount rate) is 20 percent. A. What is the value of the depreciation tax shield per year for the overhaul option? B. What is the present value of the total costs of the overhaul option, taking into account the depreciation tax shield, operating costs, and the initial cost of the overhaul? C. Derive the present value of the total costs associated with the purchase of the new boat at time 0, including all costs, the depreciation tax shield, and revenues from the sale of the old boat. D. Which option, overhaul the old boat or purchase the new one, do you recommend on the basis of the information provided? Explain your reasoning.

The new boat would last 8 years whereas the old one would last another 4 years. (Assume the salvage values are zero.) The corporate tax rate is 34 percent; depreciation is on a straight-line basis of 25 percent per year (that is, $100,000 per year for 4 years on the overhaul option and $500,000 a year for 4 years on the new boat). The firm's opportunity cost of capital (discount rate) is 20 percent. A. What is the value of the depreciation tax shield per year for the overhaul option? B. What is the present value of the total costs of the overhaul option, taking into account the depreciation tax shield, operating costs, and the initial cost of the overhaul? C. Derive the present value of the total costs associated with the purchase of the new boat at time 0, including all costs, the depreciation tax shield, and revenues from the sale of the old boat. D. Which option, overhaul the old boat or purchase the new one, do you recommend on the basis of the information provided? Explain your reasoning.

Cornerstones of Cost Management (Cornerstones Series)

4th Edition

ISBN:9781305970663

Author:Don R. Hansen, Maryanne M. Mowen

Publisher:Don R. Hansen, Maryanne M. Mowen

Chapter19: Capital Investment

Section: Chapter Questions

Problem 18E

Related questions

Question

Transcribed Image Text:The new boat would last 8 years whereas the old one would last another 4 years. (Assume

the salvage values are zero.) The corporate tax rate is 34 percent; depreciation is on a

straight-line basis of 25 percent per year (that is, $100,000 per year for 4 years on the

overhaul option and $500,000 a year for 4 years on the new boat). The firm's opportunity

cost of capital (discount rate) is 20 percent.

A. What is the value of the depreciation tax shield per year for the overhaul option?

B. What is the present value of the total costs of the overhaul option, taking into account

the depreciation tax shield, operating costs, and the initial cost of the overhaul?

C. Derive the present value of the total costs associated with the purchase of the new boat

at time 0, including all costs, the depreciation tax shield, and revenues from the sale of

the old boat.

D. Which option, overhaul the old boat or purchase the new one, do you recommend on

the basis of the information provided? Explain your reasoning.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 4 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Recommended textbooks for you

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Fundamentals Of Financial Management, Concise Edi…

Finance

ISBN:

9781337902571

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning

Financial And Managerial Accounting

Accounting

ISBN:

9781337902663

Author:

WARREN, Carl S.

Publisher:

Cengage Learning,