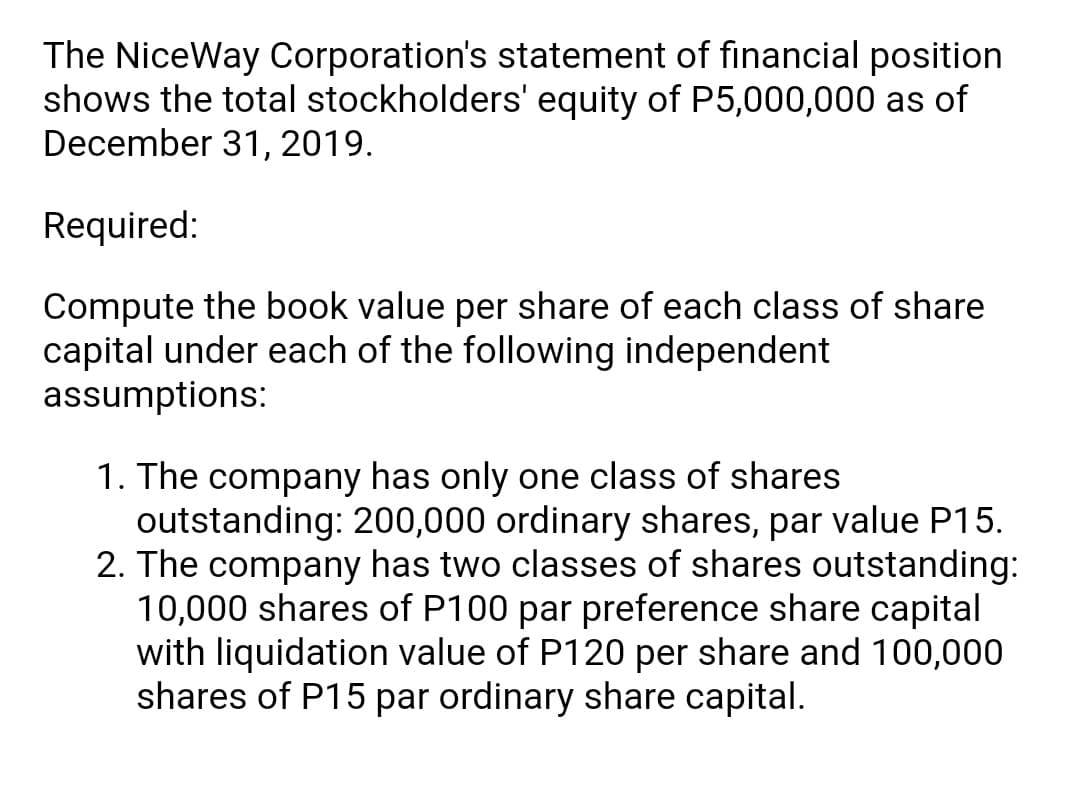

The NiceWay Corporation's statement of financial position shows the total stockholders' equity of P5,000,000 as of December 31, 2019. Required: Compute the book value per share of each class of share capital under each of the following independent assumptions: 1. The company has only one class of shares outstanding: 200,000 ordinary shares, par value P15. 2. The company has two classes of shares outstanding: 10,000 shares of P100 par preference share capital with liquidation value of P120 per share and 100,000 shares of P15 par ordinary share capital.

Q: 8. A company purchased $4,000 worth of merchandise. Transportation costs were an additional $350. Th...

A: In this question, we will find out the total amount paid for merchandise.

Q: Assume an investor purchases bonds at a premium the bonds are to be held as a long-term investment w...

A: When a Bond is issued at premium, the interest revenue is always less than periodic amount of cash r...

Q: On October 1 of the current year, an entity received a one-year note receivable bearing interest at ...

A: The accrued interest is the interest earned but not received yet and hence, reported as current asse...

Q: Purchased office equipment for cash Php65,000. a. Debit Office Equipment, Credit Cash b. Debit Off...

A: The golden rule of accounting says that, if assets come in then it should be debited, and if assets ...

Q: During the year 2021, Johnny is having a hard time fin decided to set up a small business in order t...

A: The answer is stated below:

Q: Krueger Corporation manufactures a single product whose selling price is $134 per unit and whose var...

A: Formula: Units to be sold to get a target profit = ( Fixed cost + Target profit ) / Unit contributio...

Q: Problem 23-17 (IAA) retained earnings on December 31, 2020? • Declared and issued a 30% share divide...

A: According to the question, on January 1, 2020, the Elvis company reported the following shareholders...

Q: Malachi Department Store starts its business on May 1, 2022 and completes the following transactions...

A: Credit Card Sales are the sales when the customer pays through credit cards and the money transfer f...

Q: A credit sale of $4,000 is made on April 25, terms 2/10, n/30, on which a return of $250 is granted ...

A: Here terms 2/10, n/30 means 2% discount will be given if payment is made within 10 days. And final ...

Q: Calculate retum on net operating assets and net borrowing costs for 2021.

A: The formula as follows:- Return on Net operating asset= Net ProfitCurrent asset-Current Liabilities ...

Q: Which of the following accounts is credited in a journal entry for a like-kind asset exchange? A Tru...

A: Asset Purchase in Asset Exchange: Occasionally, a new automobile purchase is followed with the "trad...

Q: Part VI Prepare a Cash Flow Statement using the DIRECT Method. DO NOT use the INDIRECT Metho...

A: Solution Cash flow statement is the statement which provides the data regarding all cash inflow and ...

Q: 19. The heading of income statement might include the line "As of December 31, 2020". True False

A: Since you have posted multiple questions , we will do the first one for you . To get the other quest...

Q: How do you differ a public corporation from a private corporation? give examples-names, purpose or o...

A: Corporation- A corporation is a legal entity with the identity of a legal person that was formed by ...

Q: Trotman Company had three intangible assets at the end of 2019 (end of the accounting year): Comp...

A: The question is related to Intangible Assets. The amortization in case of Intangible Assets is calcu...

Q: ABC Company has sales of $500,000, COGS of $250,000, operating expenses of $200,000, net income of $...

A: Formula: Times interest ratio = Operating income / interest expense

Q: 2. The following items were deduced from the accounting records of JC Company's income statement for...

A: Administrative expenses are those business expenses which are used in office and by the administrati...

Q: Krueger Corporation manufactures a single product whose selling price is $134 per unit and whose var...

A: Units sales to attain target profit = (Fixed expenses + Target Profit)/Contribution margin per unit ...

Q: Rank the following inventory methods in terms of their record-keeping cost. For answer choices, the...

A: LIFO stands for the last in first out, it is a method of valuing the inventory which the company is ...

Q: Indicate whether each of the following companies is primarily a service, merchandies, or manufacturi...

A: Manufacturing business - This help in converting the raw materials to finished goods or products. Se...

Q: Which of the following is true about the operating cycle concept? It causes the distinction between...

A: Lets understand the basics. Operating cycle is a cycle of converting inventories into cash. It inclu...

Q: At the beginning of the year, Morgan Company had total assets of $425,000 and total liabilitiesof $2...

A: The accounting equation depicts the interaction of assets, liabilities, and capital. It serves as th...

Q: Drake Company produces a single product. Last year's income statement is as follows: Sales (21,000 ...

A: Break even point is the units sold at which the company is in no-profit, no-loss situation. This mea...

Q: The allowance for doubtful accounts of Beta Care Limited had a credit balance of $1,500 at December...

A: “Since you have posted a question with multiple sub-parts, we will solve first three sub-parts for y...

Q: Gelbart Company manufactures gas grills. Fixed costs amount to $20,688,000 per year. Variable costs ...

A: Contribution per unit = Selling price per unit - Variable cost per unit Break-even point ( in units ...

Q: 7. Received Php20,000 for the sale of a lot a. Debit cash, Credit Commission Income b. Debit Cash, ...

A:

Q: Pyramid Corporation is assessed a $40 fee as the result of a $126 NSF check received from a customer...

A: NSF check is a check that was received from a customer and deposited in the Bank account. However, l...

Q: 16. Revenue cannot be recognized unless delivery of goods has occurred or services have been rendere...

A: 16. Revenue can be recognized as soon as the rights and property in goods has been transferred, the ...

Q: Hal, Dal, & Stal Dairy Farmers, Inc., produces whole milk, 2% milk, and cream. The joint cost of...

A: Under Market Value method, joint costs are allocated on the basis of joint costs of all products pro...

Q: Euclid acquires a 7-year class asset on May 9, 2021, for $80,000 (the only asset acquired during the...

A: Calculation of cost recovery deduction are as follows

Q: McWherter Instruments sold $450 million of 8% bonds, dated January 1, on January 1, 2021. The bonds ...

A: The question is based on the concept of Financial Accounting. As per the Bartleby guidelines we are ...

Q: Use the following information to calculate total ending cash and equivalents: Beginning Cash and Equ...

A: Introduction: Statement of cash flows: All cash in and out flows are shown in cash flow statements. ...

Q: If an employee has the chance of receiving cash in lieu of lodging w business reasons, the amount is...

A: Lodging refers to the facility that is provided for accommodation as well as some other basic facili...

Q: Bon cap 720,000 Bien cap 700,000 The partnership is to be liquidated on installment. First sale of n...

A: Partnership When two or more people joined together to operate the business and share profits and lo...

Q: A sole proprietor may use both cash basis and accrual basis accounting, but only when the business a...

A: Sole proprietorship refers to the individual entrepreneur which is a kind of enterprise owned as wel...

Q: a. the distortionary effect of taxes, making them more popular compared to Treasuries b. the distort...

A: Municipal Bond Municipal Bond which can be made available either for tax exempt basis or taxable bas...

Q: INCOME STATEMENT, SINGLE STEP INCOME TATEMENT AND BALANCE SHEET (EXTRACTS) Walmart Inc. is an Americ...

A: Note: As per the norms of Bartleby, only first 3 sub parts of the question can be answered in a sing...

Q: Listed below are the ledger accounts for Borges Inc. at December 31, 2019. All accounts have normal ...

A: Trial Balance: Trial balance is a statement in which closing balance of all ledger accounts are tran...

Q: Perfect Co. discovered the following errors in 2022. Identify the error that Perfect will not need ...

A: Inventory refers to the goods held by an entity for the purpose of production or sale. Inventory may...

Q: n - Equipment (300,000) Goodwill 30,000 All items of property, plant and equipment are measured ...

A: Impairment loss refers to the sum value of money which carrying value or the cash developing unit en...

Q: Mercury Company has only one inventory pool. On December 31, 2021, Mercury adopted the dollar-value ...

A: Using LIFO method, the inventory at last would be sold first and old inventory would be in ending in...

Q: Part III Record the following T Accounts 1. Recorded revenue from cash patients of $30,000.00 2. Pai...

A: The T-accounts are prepared to post the transactions from the journal book to specific accounts.

Q: Steinberg Company produces commercial printers. One is the regular model, a basic model that is desi...

A: Break even point is the point where the sales amount is equals to the cost of the product. In short,...

Q: Describe two separate and distinct ways to calculate goods available for sale.

A: Goods available for sale is the cost of total units of finished goods (this includes both manufactur...

Q: The term income a. includes revaluation of land b. includes adjustment of prior period error c. i...

A: Income Statement An income statement refers to an important financial statement that provides inform...

Q: Last period Hartig Corporation sold 40.000 units, total sales were $303,000, total variable expenses...

A: Given that: No of units sold = 40000 Sales = $303,000 Variable expenses = $227250 Fixed Expense = $3...

Q: Parker Plastic, Ic., manufactures plastic mats to use with rolling office chairs. Its standard cost ...

A: The question is based on the concept of Cost Accounting.

Q: Matt Simpson owns and operates Quality Craft Rentals, which offers canoe rentals and shuttle service...

A: Formulas that are used:-

Q: . A company estimated $420,000 of factory overhead cost and 16,000 direct labor hours for the period...

A: Factory overhead applied = Actual direct labor hours incurred x factory overhead rate where, Factory...

Q: Naper Inc. manufactures power equipment. Naper has two primary products-generators and air compresso...

A: The activity-based costing (ABC) method assigns overhead and indirect expenses to connected products...

Answer in excel

Step by step

Solved in 2 steps

- Lyon Company shows the following condensed income statement information for the year ended December 31, 2019: Lyon declared dividends of 6,000 on preferred stock and 17,280 on common stock. At the beginning of 2019, 10,000 shares of common stock were outstanding. On May 1, 2019, the company issued 2,000 additional common shares, and on October 31, 2019, it issued a 20% stock dividend on its common stock. The preferred stock is not convertible. Required: 1. Compute the 2019 basic earnings per share. 2. Show the 2019 income statement disclosure of basic earnings per share. 3. Draft a related note to accompany the 2019 financial statements.Outstanding Stock Lars Corporation shows the following information in the stockholders equity section of its balance sheet: The par value of common stock is S5, and the total balance in the Common Stock account is $225,000. There are 13,000 shares of treasury stock. Required: What is the number of shares outstanding? Use the following information for Exercises 10-58 and 10-59: Stahl Company was incorporated as a new business on January 1, 2019. The company is authorized to issue 600,000 shares of $2 par value common stock and 80,000 shares of 6%, S20 par value, cumulative preferred stock. On January 1, 2019, the company issued 75,000 shares of common stock for $15 per share and 5,000 shares of preferred stock for $25 per share. Net income for the year ended December 31, 2019, was $500,000.Monona Company reported net income of 29,975 for 2019. During all of 2019, Monona had 1,000 shares of 10%, 100 par, nonconvertible preferred stock outstanding, on which the years dividends had been paid. At the beginning of 2019, the company had 7,000 shares of common stock outstanding. On April 2, 2019, the company issued another 2,000 shares of common stock so that 9,000 common shares were outstanding at the end of 2019. Common dividends of 17,000 had been paid during 2019. At the end of 2019, the market price per share of common stock was 17.50. Required: 1. Compute Mononas basic earnings per share for 2019. 2. Compute the price/earnings ratio for 2019.

- Anoka Company reported the following selected items in the shareholders equity section of its balance sheet on December 31, 2019, and 2020: In addition, it listed the following selected pretax items as a December 31, 2019 and 2020: The preferred shares were outstanding during all of 2019 and 2020; annual dividends were declared and paid in each year. During 2019, 2,000 common shares were sold for cash on October 4. During 2020, a 20% stock dividend was declared and issued in early May. At the end of 2019 and 2020, the common stock was selling for 25.75 and 32.20, respectively. The company is subject to a 30% income tax rate. Required: 1. Prepare the comparative 2019 and 2020 income statements (multiple-step), and the related note that would appear in Anokas 2020 annual report. 2. Next Level Compute the price/earnings ratio for 2020. How does this compare to 2019? Why is it different?On January 1, 2019, Kittson Company had a retained earnings balance of 218,600. It is subject to a 30% corporate income tax rate. During 2019, Kittson earned net income of 67,000, and the following events occurred: 1. Cash dividends of 3 per share on 4,000 shares of common stock were declared and paid. 2. A small stock dividend was declared and issued. The dividend consisted of 600 shares of 10 par common stock. On the date of declaration, the market price of the companys common stock was 36 per share. 3. The company recalled and retired 500 shares of 100 par preferred stock. The call price was 125 per share; the stock had originally been issued for 110 per share. 4. The company discovered that it had erroneously recorded depreciation expense of 45,000 in 2018 for both financial reporting and income tax reporting. The correct depreciation for 2018 should have been 20,000. This is considered a material error. Required: 1. Prepare journal entries to record Items 1 through 4. 2. Prepare Kittsons statement of retained earnings for the year ended December 31, 2019.Contributed Capital Adams Companys records provide the following information on December 31, 2019: Additional information: 1. Common stock has a 5 par value, 50,000 shares are authorized, 15,000 shares have been issued and are outstanding. 2. Preferred stock has a 100 par value, 3,000 shares are authorized, 800 shares have been issued and are outstanding. Two hundred shares have been subscribed at 120 per share. The stock pays an 8% dividend, is cumulative, and is callable at 130 per share. 3. Bonds payable mature on January 1, 2023. They carry a 12% annual interest rate, payable semiannually. Required: Prepare the Contributed Capital section of the December 31, 2019, balance sheet for Adams. Include appropriate parenthetical notes.

- Raun Company had the following equity items as of December 31, 2019: Preferred stock, 9% cumulative, 100 par, convertible Paid-in capital in excess of par value on preferred stock Common stock, 1 stated value Paid-in capital in excess of stated value on common stock| Retained earnings The following additional information about Raun was available for the year ended December 31, 2019: 1. There were 2 million shares of preferred stock authorized, of which 1 million were outstanding. All 1 million shares outstanding were issued on January 2, 2016, for 120 a share. The preferred stock is convertible into common stock on a 1-for-1 basis until December 31, 2025; thereafter, the preferred stock ceases to be convertible and is callable at par value by the company. No preferred stock has been converted into common stock, and there were no dividends in arrears at December 31, 2019. 2. The common stock has been issued at amounts above stated value per share since incorporation in 2002. Of the 5 million shares authorized, 3,580,000 were outstanding at January 1, 2019. The market price of the outstanding common stock has increased slowly but consistently for the last 5 years. 3. Raun has an employee share option plan where certain key employees and officers may purchase shares of common stock at 100% of the marker price at the date of the option grant. All options are exercisable in installments of one-third each year, commencing 1 year after the date of the grant, and expire if not exercised within 4 years of the grant date. On January 1, 2019, options for 70,000 shares were outstanding at prices ranging from 47 to 83 a share. Options for 20,000 shares were exercised at 47 to 79 a share during 2019. During 2019, no options expired and additional options for 15,000 shares were granted at 86 a share. The 65,000 options outstanding at December 31, 2019, were exercisable at 54 to 86 a share; of these, 30,000 were exercisable at that date at prices ranging from 54 to 79 a share. 4. Raun also has an employee share purchase plan whereby the company pays one-half and the employee pays one-half of the market price of the stock at the date of the subscription. During 2019, employees subscribed to 60,000 shares at an average price of 87 a share. All 60,000 shares were paid for and issued late in September 2019. 5. On December 31, 2019, there was a total of 355,000 shares of common stock set aside for the granting of future share options and for future purchases under the employee share purchase plan. The only changes in the shareholders equity for 2019 were those described previously, the 2019 net income, and the cash dividends paid. Required: Prepare the shareholders equity section of Rauns balance sheet at December 31, 2019. Substitute, where appropriate, Xs for unknown dollar amounts. Use good form and provide full disclosure. Write appropriate notes as they should appear in the publisher financial statements.Statement of Stockholders' Equity At the end of 2019, Stanley Utilities Inc. had the following equity accounts and balances: During 2020, Haley engaged in the following transactions involving its equity accounts: Sold 5,000 shares of common stock for $19 per share. Sold 1.200 shares of 12%, $50 par preferred stock at $75 per share. Declared and paid cash dividends of $22,000. Repurchased 1,000 shares of treasury stock (common) for $24 per share. Sold 300 of the treasury shares for $26 per share. Required: Prepare the journal entries for Transactions a through e. Assume that 2020 net income was $123,700. Prepare a statement of stockholders equity at December 31, 2020.Statement of Stockholders' Equity At the end of 2019, Stanley Utilities Inc. had the following equity accounts and balances: During 2020, Stanley Utilities engaged in the following transactions involving its equity accounts: Sold 3,300 shares of common stock for $15 per share. Sold 1,000 shares of 12%, $100 par preferred stock at $105 per share. Declared and paid cash dividends of $8,000. Repurchased 1,000 shares of treasury stock (common) for $38 per share. Sold 400 of the treasury shares for $42 per share. Required: Prepare the journal entries for Transactions a through e. Assume that 2020 net income was $87,000. Prepare a statement of stockholders equity at December 31, 2020.

- Calculating the Number of Shares Issued Castalia Inc. issued shares of its $0.80 par value common stock on September 4, 2019, for $8 per share. The Additional Paid-In Capital-Common Stock account was credited for 5612,000 in the journal entry to record this transaction. Required: How many shares were issued on September 4, 2019?Hyde Corporations capital structure at December 31, 2018, was as follows: On July 2, 2019, Hyde issued a 10% stock dividend on its common stock and paid a cash dividend of 2.00 per share on its preferred stock. Net income for the year ended December 31, 2019, was 780,000. What should be Hydes 2019 basic earnings per share? a. 7.80 b. 7.09 c. 7.68 d. 6.73Percy Company has 15,000 shares of common stock outstanding during all of 2019. It also has 2 convertible securities outstanding at the end of 2019. These are: 1. Convertible preferred stock: 1,000 shares of 9%, 100 par, preferred stock were issued in 2015 for 140 per share. Each share of preferred stock is convertible into 3.5 shares of common stock. The current dividends have been paid. To date, no preferred stock has been converted. 2. Convertible bonds: Bonds with a face value of 100,000 and an interest rate of 10% were issued at par on July 1, 2019. Each 1,000 bond is convertible into 35 shares of common stock. To date, no bonds have been converted. Percy earned net income of 54,000 during 2019. Its income tax rate is 30%. Required: Compute the 2019 diluted earnings per share. What earnings per share amount(s) would Percy report on its 2019 income statement?