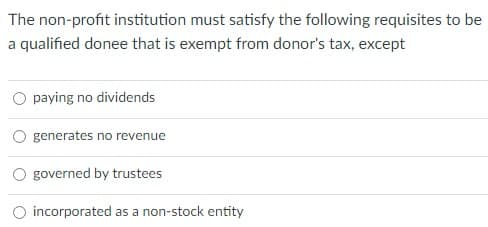

The non-profit institution must satisfy the following requisites to be a qualified donee that is exempt from donor's tax, except paying no dividends generates no revenue governed by trustees incorporated as a non-stock entity

Q: P 430,000

A: Opportunity cost refers to the cost which is incurred on the next best alternative that should be…

Q: Barga Company's net sales for Year 1 and Year 2 are $665,000 and $749,000, respectively. Its…

A: Days sales uncollected is a liquidity ratio that is used to estimate the number of days before…

Q: You want to buy a $13,000.00 car. You can make a 10% down payment, and will finance the balance with…

A: The Equal Montly installment is calculated with the help of following formula EMI = P × r(1 + r)n…

Q: Required: Briefly explain whether these amounts ($500,000, the $3 per album that Lily received prior…

A: In legal parlance, a "agreement" is a promise/commitment or a series of reciprocal promises that…

Q: Creative Technology reports inventory using the lower of cost and net realizable value (NRV). Below…

A: As per IAS inventory to be valued at cost or NRV which ever is lower

Q: 1. What is the contribution margin per the constrained resource for table saw blades? 2. What is the…

A: When the availability of resources required to produce the required production are less, then these…

Q: Velcro Saddles is contemplating the acquisition of Skiers’ Airbags Inc. The values of the two…

A: A merger can be evaluated by considering three elements such as economic gain , cost of merger and…

Q: PA8-3 (Algo) Recording Notes Receivable Transactions [LO 8-3] C&S Marketing (CSM) recently hired a…

A: A record is often kept in the accounting records, but it can also be kept in a single account,…

Q: Expenses for a Pizza restaurant include raw material for pizza at $4.00 per slice, $102.00 as…

A: Total sales made today = $2600 200 × $13 The total material cost = $800 200 × $4

Q: Suppose the exchange rate for Japanese yen, S0, is currently Yen160 = $1. If the interest rate in…

A: The question is based on the concept of Financial Management. In order to prevent the covered…

Q: An adverse opinion is most likely to be included in an audit report when Multiple Choice A…

A: There are 4 types of audit opinions. 1.unqualified 2.Qualified 3.Disclaimer 4.Adverse opinion

Q: At the end of 2021, Mr. Vaughn sold both his city home and his summer cottage. Every year he has…

A: at the sale, to Minimise the amount of tax he should adopt the Deduction OF Section 54 as…

Q: ABC Company established a branch in Pasig on March 1, 2022. Shipments of merchandise at billed…

A: INTRODUCTION: Net income, often known as net profit, is a computation that determines how much total…

Q: Employee Gross Pay Karine 3,700 Kelsey 2,100 Dani 3,400 Brooke 2,600 11,800 Total Claim Code 5 4 1…

A: The primary reporting of the business transactions in the books of accounts on daily basis is…

Q: A domestic corporation in its 8th year of operations as of January MSME under CREATE law, has the…

A: In the context of the given question, we are required to income tax payable for the year 2021 and…

Q: 1. Outline the roles and responsibilities of auditing standard setting bodies.

A: “Since you have asked multiple questions, we will solve the first question for you. If you want any…

Q: Magenta Corporation wants to raise $50.6 million in a seasoned equity offering, net of all fees.…

A: The desired shares to be sold are determined with respect to the net price per share, after…

Q: If management’s assumptions hold, what is the expected per-share market price after repurchase?

A: Expected market price per share is the share price which is the price on which the shares of the…

Q: 3. Kate is in need of an immediate cash infusion and Matt has advised her to sell some of her…

A: Factoring type of recourse and non-recourse depends upon who bears the credit risk of factoring.…

Q: A. Would either Mendoza or Cope violate the Code of Ethics for Professional Accountants by offering…

A: The "Code of Ethics for Professional Accountants" sets forth the principles and values that guide…

Q: 38 Use the following data to compute total factory overhead costs for the month: Sales commissions…

A: Solution:- Amount ($) Indirect Material 16,500 Factory Utilities 10,300 Indirect Labor…

Q: A Leading manufacturer of Action Figures is about to introduce four new Action Figures. The…

A:

Q: Nicole Murphy and Ashley Drake formed a partnership, investing $270,000 and $90,000, respectively.…

A: Given that total net income is = $350000

Q: The interest rate for the first five years of a $95,000 mortgage is 7.2% compounded semiannually.…

A: Amortization is an accounting procedure that reduces the book value of a loan or intangible asset on…

Q: The interest earned in 6 years on Php 400,000 deposited in an account paying 9% interest, compounded…

A: Lets understand the basics. For answering this question, we need to check how much amount will be…

Q: UESTION 3 Oster Company Ltd. manufactures dusk to dawn lamps. The following are the details of…

A: Disclaimer: “Since you have posted a question with multiple sub-parts, we will solve the first three…

Q: Mark Goldsmith's broker has shown him two bonds issued by different companies. Each has a maturity…

A: As per our guidelines only first question of the 3 asked here can be solved. So here is the solution…

Q: Crane Company reports the following Inventory Accounts Payable End of Year $24700 $204800. O…

A: Cash paid to suppliers means the amount of money paid to the suppliers for purchasing inventory from…

Q: A man is paid on a salary-plus-commission basis. He receives $275 weekly in salary and a commission…

A: Given information Weekly salary = $275 Commission = 5% over Sales of $2020 Weekly sales = $7825

Q: Under what circumstances are external auditors likely to be involved in operational auditing? Can…

A: Introduction:- An operational audit is systematic review of effectiveness, efficiency of operation.…

Q: Golden Diamond Jeweler Inc is currently forecasting a revenue of Php2,000,000, Php3,200,000 and…

A: A cash budget is a determination of the cash flows of a company's business transactions over a…

Q: Bond A is priced at par with a duration of 6.5 years and yielding 4%. Bond B is priced at 99, has a…

A: Bonds are financial instruments in which an investor loans money to a firm or government for a…

Q: On January 1, DogMart Company purchased a two-year liability insurance policy for $34,320 cash. The…

A: There are several items of expenses which are paid in advance in the normal course of business…

Q: What is the present value

A: Present Value can be calculated using the following formula: Present Value = Annual cash flow /…

Q: Current information for the Healey Company follows: Beginning raw materials inventory Raw material…

A: Cost of goods manufactured includes the total cost of goods that are finished during the period.…

Q: Which of the following statement is not true about the del-credere commission? Select one: a. If…

A: Consignment- Consignment is a sale arrangement in which the consignor sends the goods to the…

Q: Ross Enterprises has a contract with Big Steel Company Limited in respect of Information Technology…

A: IRAC method: The framework of legal analysis known as "Issue, Rule, Application, and Conclusion" is…

Q: An equipment was bought in the beginning of January 2014 with the Original Cost of $48.000. The…

A: As per our guidelines we are supposed to answer only 3 sub parts

Q: Tina deposited $20 in a savings account earning 5% interest, compounded annually. To the nearest…

A: Interest is the amount charged or received for loan taken or investment made. There can be simple…

Q: Show solution in good accounting form. a. Assuming there is no separate records maintained, compute…

A: You have posted multiple-pat questions, so s per our policy only first three sub parts are answered.…

Q: Analyze the following: I – All entities that issue an annual report may issue interim financial…

A: An entity prepares financial statement at the year-end which shows many components in summaries or…

Q: 1. Prepare an annual income statement for the iLeather product.

A: This question belongs to costing. In part 1, the net income will be calculated by calculating gross…

Q: On 1 January 2020 Company A acquired a 70% controlling interest the ordinary share capital of…

A: Any asset which has a value less in the books of account over and above the market fair value of the…

Q: Should a firm have a firm grasp of the concepts of differential cost, opportunity cost and sunk cost…

A: Differential cost is the difference between two alternative projects or decisions. If a company has…

Q: Darren corp has the following details for one of its subsidiaries: Long-term debt: 9% payable for…

A: Earnings per share= Net Income earned - Preferred dividends paid * / Weighted average number of…

Q: EMC Corporation manufactures large-scale, high-performance computer systems. In a recent annual…

A: Bad debt expense for 2015=Balance of allowance for uncollectible accounts in 2014+Bad Debts written…

Q: The Bomb Pop Corporation sold ice cream equipment for $18,500. The equipment was originally…

A: Introduction: Depreciation: Decreasing value of fixed assets over its useful life period called as…

Q: If the transaction is using 100% of Acquiring Co.'s stock, the exchange ratio is The number of new…

A: Acquiring Company is considering the acquisition of Target Company in which Target Company would…

Q: Compute the issue price of the bonds of Pluto corp issues P560,000 of 9% bonds, due in 9 years, with…

A: Issue of bonds is one of the way to raise money for various purposes where the entity has to pay…

Q: Analyze the following: I – An entity shall classify a noncurrent asset as held for sale when the…

A: Non-Current Asset: Non-Current Asset is an asset which is acquired by a company in hoping to get…

The non-profit institution must satisfy the following requisites to be a qualified donee that is exempt from donor's tax, except

Step by step

Solved in 2 steps

- ZZZ is a non-stock and non-profit educational institution. Which of the following is TRUE? * Its income from related activities is exempt from income tax. Its income from unrelated activities is exempt from income tax. Both income from related and unrelated activities are subject to income tax. None of the aboveWhat is the best definition of an S Corporation? A. Type of nonprofit that is not required to pay certain types of taxes B. Private-public corporation that meets certain requirements for tax exemption C. Type of for-profit business that also has a social mission D. Type of corporation with pass-through taxation on incomeWhich of the following characteristics identify a nonprofit as it relates to tax-status? (Choose all that apply.) Select one or more: a. They don't generate profit that gets reinvested into their mission. b. They are governed by a compensated board of directors c. They are primarily funded by membership fees d. They have a mission that is based around serving the public need

- For federal income tax purposes, what term refers to the business entity not being a separate entity from the owners? This type of entity is not taxed but the owner(s) must record the earnings from the business on his/her individual income tax return. Group of answer choices pass-through entity non-profit entity election entity mutual entityWhich of the following is tax exempt on its income earned as such? Religious corporation organized as non-stock Non-stock, non-profit educational institution Government educational institution Government owned and controlled corporationWhich statement is true? In computing the net taxable income of a corporation availing of the optional standard deduction, the OSD shall be deducted from the total sales or revenue. A corporate taxpayer is not qualified to avail of NOLCO as this is only applicable to individual taxpayers. The income of a business partnership shall be taxed with the regular corporate income tax and the share of each partner from the income of the partnership shall be subject to the regular income tax as well. Generally, government owned or controlled corporations are taxable.

- XYZ is a religious corporation duly registered as such. BIR assessed income tax on its income from several properties leased out to various tenants. XYZ contested the assessment and argued that the rental income should be tax exempt because it is used by the corporation in its religious activities. DECIDE. * The rental income is tax exempt because it is used for religious purposes. The rental income is tax exempt because the corporation is a non-stock and non-profit corporation. The rental income is taxable because it is derived from an activity conducted for profit regardless of whether it is used for the purpose of the corporation or not. The rental income is taxable if the tenants are non-members of the church.Saint Bernard University is registered with SEC as a non-stock and non-profit educational institution. STATEMENT 1: Accordingly, it is granted with automatic tax exemption by the law on its income earned as such institution. STATEMENT 2: The nature of activities of the university determines whether its income is tax exempt or not. True, True False, False True, False False, TrueAll of the listed features or obligations differentiate a registered charity from a private corporation except one. Which one? Ability to issue donors official tax receipts Required to file Form T3010 Charity can incorporate like a private company Requirement to meet annual spending quota

- ABC Foundation is a non-stock corporation engaged in providing relief to disasters areas. One of its member donated a property in favor of the corporation for its principal office. However the corporation and the member failed to agree on the return of the property upon dissolution. When ABC Foundation decided to dissolve, how will the property be distributed?Which of the following is true regarding a not-for-profit organization’s reporting of gains and losses on investments purchased with permanently restricted assets?a. gains and losses can only be reported net of expenses in the statement of activities.b. unless explicitly restricted by donor or law, gains and losses should be reported in the statement of activities as increases or decreases in unrestricted net assets.c. gains may not be netted against losses in the statement of activities.d. unless explicitly restricted by donor or law, gains and losses should be reported in the statement of activities as increases or decreases in permanently restricted net assets.The following questions concern the accounting principles and procedures applicable to a private not-for-profit entity. Write answers to each question.a. What is the difference between revenue and public support?b. What is the significance of the statement of functional expenses?c. What accounting process does a private charity use in connection with donated materials? d. What is the difference in the two types of restricted net assets found in the financial records of a private not-for-profit organization?e. Under what conditions should the entity record donated services?f. What is the proper handling of costs associated with direct mail and other solicitations for money that also contain educational materials?g. A not-for-profit receives a painting. Under what conditions can this painting be judged as a work of art? If it meets the criteria for a work of art, how is the financial reporting of the entity affected?