The partnership of C, A, and G named BREAKEVEN decided to liquidate their partnership on May 31, 2021. Before liquidating and sharing of na income, their capital balances are as follows: C (30%) P250,000, A (30% P180,000, and G (40%) P220,000. Net income from January 1 to May 31 is P120,000. Liabilities of the partnership amounted to P210,000 and its total assets include cash amounting to P70,000. A. Unsettled liabilities are P110,000. C invested additional cash enough to settle their partnership's indebtedness. A is personally solvent, G personally insolvent, and C becomes insolvent after investing the cash needed by the partnership. 30,ov0 1. How much were the proceeds from the sale of the partnership's non-cash assets? 90,000 2. How much cash will A invest in the partnership? 90,0w 3. How much will C receive as a result of their liquidation?

The partnership of C, A, and G named BREAKEVEN decided to liquidate their partnership on May 31, 2021. Before liquidating and sharing of na income, their capital balances are as follows: C (30%) P250,000, A (30% P180,000, and G (40%) P220,000. Net income from January 1 to May 31 is P120,000. Liabilities of the partnership amounted to P210,000 and its total assets include cash amounting to P70,000. A. Unsettled liabilities are P110,000. C invested additional cash enough to settle their partnership's indebtedness. A is personally solvent, G personally insolvent, and C becomes insolvent after investing the cash needed by the partnership. 30,ov0 1. How much were the proceeds from the sale of the partnership's non-cash assets? 90,000 2. How much cash will A invest in the partnership? 90,0w 3. How much will C receive as a result of their liquidation?

Chapter21: Partnerships

Section: Chapter Questions

Problem 11BCRQ

Related questions

Question

Transcribed Image Text:The partnership of C, A, and G named BREAKEVEN decided to liquidate

their partnership on May 31, 2021. Before liquidating and sharing of net

Supply the answer. On the space provided for each number, write the

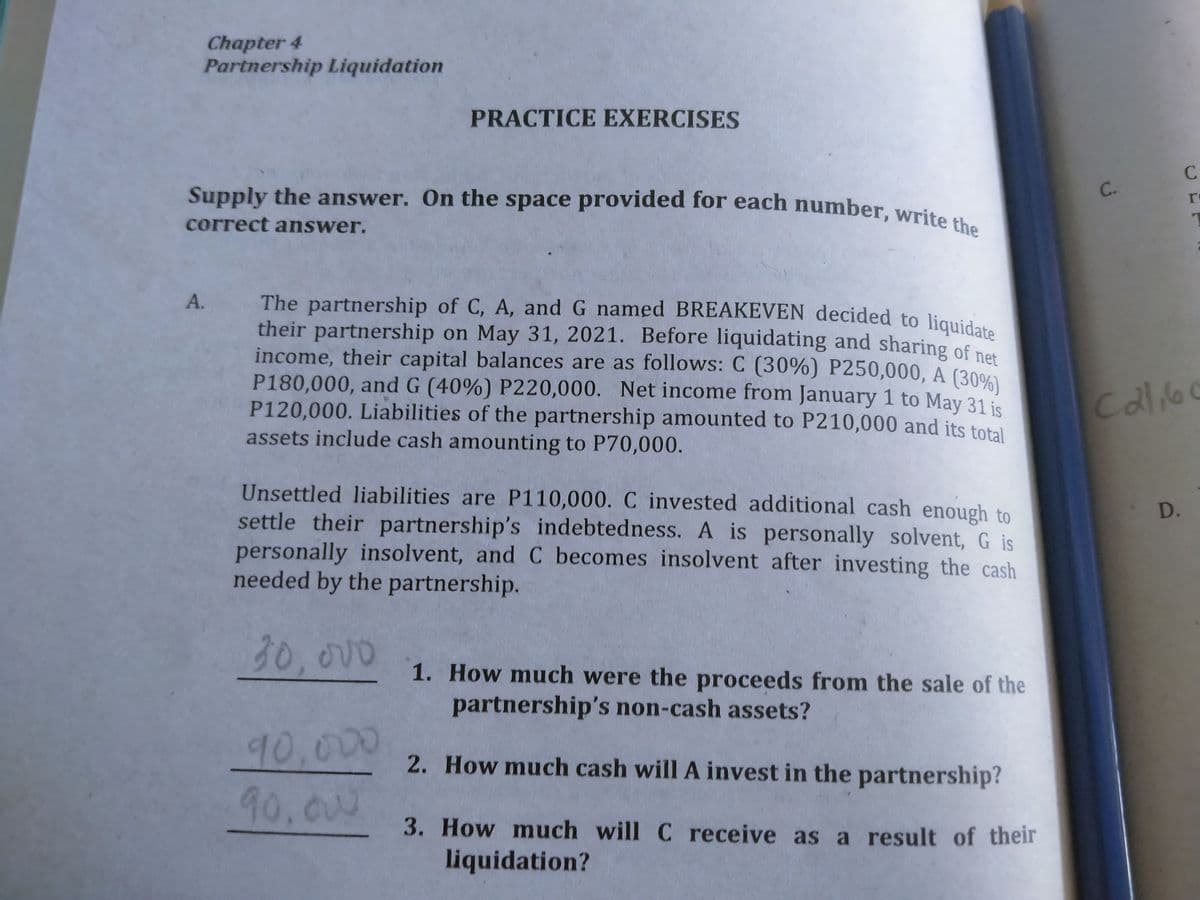

Chapter 4

Partnership Liquidation

PRACTICE EXERCISES

Supply the answer. On the space provided for each number writ

C.

correct answer.

The partnership of C, A, and G named BREAKEVEN decided to liguia

their partnership on May 31, 2021. Before liquidating and sharing of ne

income, their capital balances are as follows: C (30%) P250,000, A (30%

P180,000, and G (40%) P220,000. Net income from January 1 to May 31 is

P120,000. Liabilities of the partnership amounted to P210,000 and its total

assets include cash amounting to P70,000.

Callo

Unsettled liabilities are P110,000. C invested additional cash enough to

settle their partnership's indebtedness. A is personally solvent, G is

personally insolvent, and C becomes insolvent after investing the cash

needed by the partnership.

D.

30,00

1. How much were the proceeds from the sale of the

partnership's non-cash assets?

90,000

90,ow

2. How much cash will A invest in the partnership?

3. How much will C receive as a result of their

liquidation?

A.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps with 1 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,

Financial Accounting

Accounting

ISBN:

9781305088436

Author:

Carl Warren, Jim Reeve, Jonathan Duchac

Publisher:

Cengage Learning