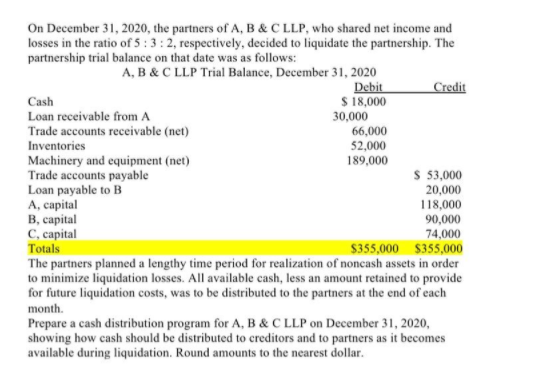

On December 31, 2020, the partners of A, B & C LLP, who shared net income and losses in the ratio of 5 : 3: 2, respectively, decided to liquidate the partnership. The partnership trial balance on that date was as follows: A, B & C LLP Trial Balance, December 31, 2020 Debit S 18,000 Credit Cash Loan receivable from A Trade accounts receivable (net) Inventories Machinery and equipment (net) Trade accounts payable Loan payable to B A, capital В, саpital C, capital Totals The partners planned a lengthy time period for realization of noncash assets in order to minimize liquidation losses. All available cash, less an amount retained to provide for future liquidation costs, was to be distributed to the partners at the end of cach 30,000 66,000 52,000 189,000 $ 3,000 20,000 118,000 90,000 74,000 $355,000 $355,000 month. Prepare a cash distribution program for A, B & C LLP on December 31, 2020, showing how cash should be distributed to creditors and to partners as it becomes available during liquidation. Round amounts to the nearest dollar.

On December 31, 2020, the partners of A, B & C LLP, who shared net income and losses in the ratio of 5 : 3: 2, respectively, decided to liquidate the partnership. The partnership trial balance on that date was as follows: A, B & C LLP Trial Balance, December 31, 2020 Debit S 18,000 Credit Cash Loan receivable from A Trade accounts receivable (net) Inventories Machinery and equipment (net) Trade accounts payable Loan payable to B A, capital В, саpital C, capital Totals The partners planned a lengthy time period for realization of noncash assets in order to minimize liquidation losses. All available cash, less an amount retained to provide for future liquidation costs, was to be distributed to the partners at the end of cach 30,000 66,000 52,000 189,000 $ 3,000 20,000 118,000 90,000 74,000 $355,000 $355,000 month. Prepare a cash distribution program for A, B & C LLP on December 31, 2020, showing how cash should be distributed to creditors and to partners as it becomes available during liquidation. Round amounts to the nearest dollar.

Chapter10: Partnerships: Formation, Operation, And Basis

Section: Chapter Questions

Problem 59P

Related questions

Question

Transcribed Image Text:On December 31, 2020, the partners of A, B & C LLP, who shared net income and

losses in the ratio of 5 : 3 : 2, respectively, decided to liquidate the partnership. The

partnership trial balance on that date was as follows:

A, B & C LLP Trial Balance, December 31, 2020

Debit

S 18,000

30,000

Credit

Cash

Loan receivable from A

Trade accounts receivable (net)

Inventories

Machinery and equipment (net)

Trade accounts payable

Loan payable to B

А, саpital

В саpital

С, сарital

Totals

The partners planned a lengthy time period for realization of noncash assets in order

to minimize liquidation losses. All available cash, less an amount retained to provide

for future liquidation costs, was to be distributed to the partners at the end of each

month.

Prepare a cash distribution program for A, B &C LLP on December 31, 2020,

showing how cash should be distributed to creditors and to partners as it becomes

available during liquidation. Round amounts to the nearest dollar.

66,000

52,000

189,000

$ 53,000

20,000

118,000

90,000

74,000

$355,000 $355,000

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Financial Accounting

Accounting

ISBN:

9781305088436

Author:

Carl Warren, Jim Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Financial Accounting

Accounting

ISBN:

9781305088436

Author:

Carl Warren, Jim Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Financial Accounting

Accounting

ISBN:

9781337272124

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College