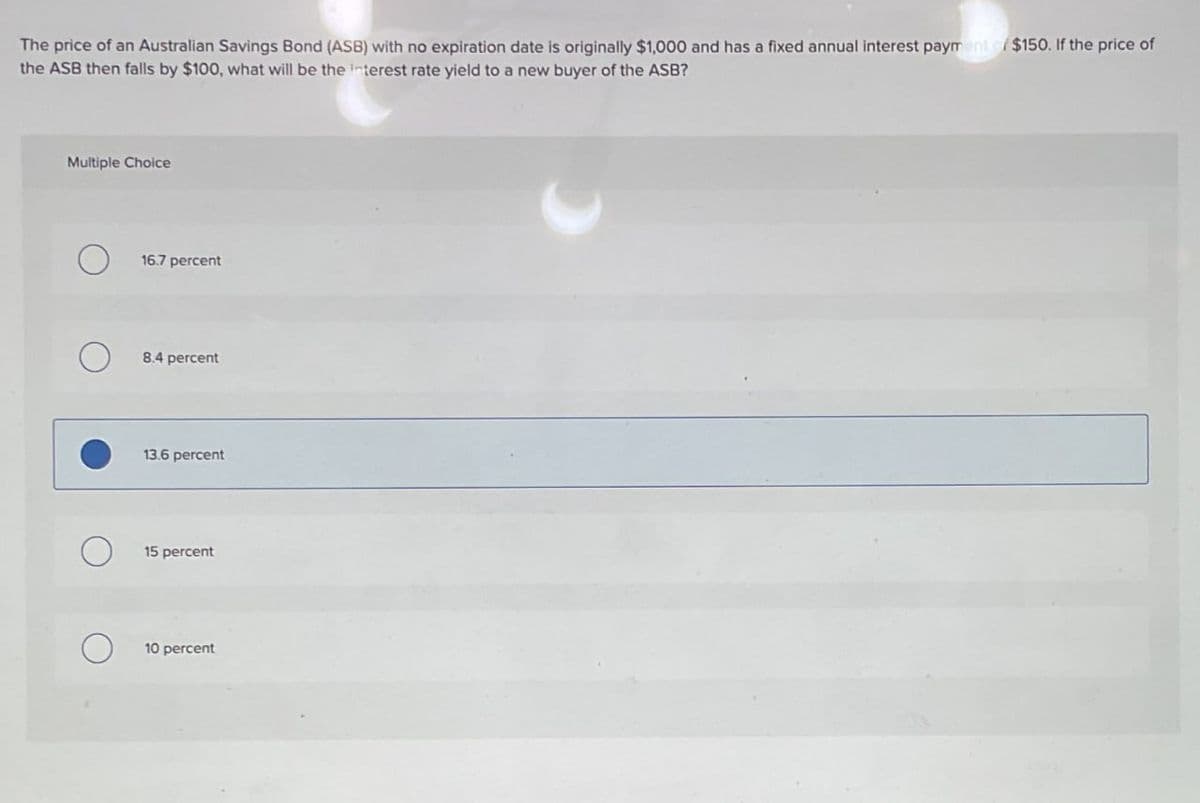

The price of an Australian Savings Bond (ASB) with no expiration date is originally $1,000 and has a fixed annual interest payment of $150. If the price of the ASB then falls by $100, what will be the interest rate yield to a new buyer of the ASB? Multiple Choice 16.7 percent О 8.4 percent 13.6 percent О 15 percent О 10 percent

Q: If your answer is 41719.11 it's wrong

A: Step 1: The calculation of future value ABCDD1YearCashflowYears remaingFVF @ 7.90%FV of Cashflow21 $…

Q: Lakonishok equipment has an investment opportunity in Europe. The project cost 14,750,000 in europe…

A: Step 1: Convert Euro Cash Flows to U.S. DollarsGiven the spot exchange rate is $0.83 per Euro, the…

Q: What statistic should we use if we wanted to see if there was a difference between three ethnic…

A: Here is a brief explanation of why ANOVA is appropriate for this scenario:1. Assumption of…

Q: Problem 21-9 Lease or Buy The Wildcat Oil Company is trying to decide whether to lease or buy a new…

A: Answer information:Step 1:a.NAL = cost of asset - present value of depreciation tax shield - present…

Q: What is the total amount you will pay if you do not pay the loan within the term and meet all the…

A: Step 1:Given: Loan amount = $5400Period of loan = 72 monthsFinal loan amount = $6965.35Interest is…

Q: Bhuptbhai

A: Tranche A, being senior, will get its principal repayment before Tranche B; therefore, assuming no…

Q: Let R be the one-year LIBOR rate with annual compounding that will be determined in 6 years from…

A: A financial derivative is a type of contract where the value is based on how well an underlying…

Q: Price $925.93 YTM 8.00% 853.39 8.25 782.92 8.50 15.00 8.75 650.00 9.00 a. Calculate the forward rate…

A: Part 2: ExplanationStep 1: Calculate the forward rate for each year using the formula:\[ Forward\…

Q: a.Distinguish between systematic and unsystematic risk and explain the significance of the…

A: The Capital Asset Pricing Model (CAPM) is a widely used framework in finance that helps investors…

Q: Six years ago the Templeton Company issued 25-year bonds with a 15% annual coupon rate at their…

A: Step 1:PV-1000 FV1090(1000*109%)PMT150(1000*15%)NPER6 YTC16.00% Rate (6.150,-1000,1090) Step 2:III)…

Q: During a particular investment period, a wealth management company held an investment portfolio that…

A: The excess return per unit of risk (standard deviation) of an investment portfolio relative to a…

Q: Bhupatbhai

A: let's break down the calculations step by step for both the abdicate to development (YTM) and the…

Q: Quartz Corporation is a relatively new firm. Quartz has experienced enough losses during its early…

A: a. Reservation price = PMT(Borrowing rate, term of lease (years), purchase cost) = $185,059.99Where…

Q: Bhupatbhai

A: Answer image: Here is the quote for the Lake Lead Group:FieldValueStock (Div)Lake Lead…

Q: You have the following two mortgage choices on the table attached. Please show how to calculate teh…

A: Step 1:To calculate the APR for each mortgage choice using Excel:Fixed-rate Mortgage:Calculate…

Q: You manage a pension fund that will provide retired workers with lifetime annuities. You expect a…

A: DataBond ABond BSettlement Date01-01-202001-01-2020Maturity Period520Coupon Rate (Annual…

Q: None

A: Step 1: The calculation of the arithmetic, geometric, and dollar average rate of return…

Q: Questions 4 Question 1. Consider the following information relating to three companies, which are…

A: The objective of the question is to estimate the value of Tasty Foods Ltd based on the average…

Q: suppose you buy an non-dividend paying asset at $50 and sell a 6 month futures contract at $53. What…

A: When there is an agreement between the two parties to trade the selected lot size of an asset at a…

Q: Rossdale Company stock currently sells for $72.43 per share and has a beta of 1.20. The market risk…

A: To estimate the cost of equity for Rossdale Company, we utilized two widely recognized models: the…

Q: Math 1324 Project Mohsen Manouchehri plans to purchase a $300,000 home with a down payment of 20%…

A: Given:Cost of house = $300,000downpayment = 20% ($300,000) = $60,000Amount for financing (P) =…

Q: A Treasury note has 2 years left to maturity, a $1,000 face value, and a coupon rate of 4.4%, with…

A: Step 1: The calculation of the yield to maturity AB1Face value $1,000.00 2Years23Coupon…

Q: Baghiben

A: Step 1:Bond duration is a metric that reveals how much a bond's price may move in response to…

Q: A company has just paid a $1.00 dividend per share and dividends are expected to grow at a rate of…

A: Use the Gordon Growth Model, which is a formula used to calculate the intrinsic value of a stock…

Q: SLM, Inc., with sales of $800, has the following balance sheet: SLM, Incorporated Balance Sheet…

A: A. Determine the balance sheet entries for sales of 1400 using the percent of sales forecasting…

Q: Corporate Finance If a company is profitable and pays taxes, why is the cost of its debt rd(1-t),…

A: Why Profitable, Tax-Paying Companies Enjoy a Lower Cost of Debt (rd(1-t)) For prosperous enterprises…

Q: For problem 2, use the following information: Consider 3-month options with premium Strike 35 Call…

A: Option Strategies Analysis:We'll analyze the payoff functions, profit diagrams, and key…

Q: Nikul

A: Current Dividend, D0 = $2.05Dividend grow by 20% for the next 5 years.D1 = $2.05*1.20 = $2.460D2 =…

Q: Nikulbhai...

A: The objective of this question is to calculate the variance of a portfolio with equal investments in…

Q: Kale Inc. forecasts the free cash flows (in millions) shown below. Assume the firm has zero…

A: Using the provided information:FCF0=−40 millionFCF1=150 millionWACC=11%g=4%We can now calculate…

Q: Hasan Electric declared a dividend of $.48 per share on Monday, October 18. The dividend will be…

A: When it comes to investors, the ex-dividend date is an extremely important marker since it…

Q: None

A: Let's talk more in-depth about the points you raised: 16. Spare Parts Inventory: Opulent Oceans…

Q: You are attempting to value a call option with an exercise price of $108 and one year to expiration.…

A: Calculate the Up and Down Factors (u and d):u = S_u / S = $136 / $108 ≈ 1.26 d = S_d / S = $80 /…

Q: Question 1 The estimated earnings yield and dividend yield of the stock market are 4% and 1.5%,…

A: “Since you have asked multiple question, we will solve the first question for you. If you want any…

Q: Tanaka Machine Shop is considering a 4-year project to improve its production efficiency. Buying a…

A: Here's how to calculate it:Calculate the annual depreciation expense using the MACRS schedule for a…

Q: Suppose NCKU company currently has NTD 10 million of five-year bonds with a coupon rate of 2%, a…

A: The modified duration of a bond portfolio refers to the sensitivity of the price of the bond…

Q: Company Express S. A. asks you to construct cash flows for following three (3) investment projects,…

A: Certainly! Let's break down the calculation of cash flows for Project 1 in detail, step by step. 1.…

Q: Evaluate the following statement:The Yield-to-Maturity (YTM) of a par bond is higher than that of a…

A: The objective of this question is to evaluate the statement that the Yield-to-Maturity (YTM) of a…

Q: Consider the following information on two stocks: P(State) Stock A Stock B Boom 20% 30% 20% Normal…

A: To calculate the weight of Asset A (Stock A) in the portfolio, we followed these steps:1. Total…

Q: Home Builder Supply, a retailer in the home improvement industry, currently operates seven retail…

A: I. Let's analyze each option for incremental earnings:a. The original purchase price of the land:…

Q: Please help with this question and work out by step cuz most responses are wrong

A: Cash Flow = Revenues − Operating Costs − Depreciation − Loan Repayment − Taxes + Salvage Value +…

Q: A put option in finance allows you to sell a share of stock at a given price in the future. There…

A: Part 2:Explanation:Step 1: Calculate the value of the portfolio without options:- For each share…

Q: Problem 21-6 MACRS Depreciation and Leasing You work for a nuclear research laboratory that is…

A: 1. **Present Value of Leasing Costs (PV_leasing):** - We calculated the present value of leasing…

Q: A company is analyzing two mutually exclusive projects, S and L, with the following cash flows: ° 1…

A: Step 1: The calculation of the IRR with a better project ABC1YearProject SProject L20 $-1,000.00…

Q: Let R be the one-year LIBOR rate with annual compounding that will be determined in 6 years from…

A: Financial derivatives are contracts between parties, the value of which depends on the price…

Q: None

A: Break-even analysis is a fundamental tool used by businesses to understand the point at which their…

Q: how start trading in share market

A: There is no denying the share market's attraction. Many are drawn to this field by the possibility…

Q: 1+ M- 9 Show Atten Current Attempt in Progress Lisa Anderson deposits $3,400 in her bank today. a. *…

A: 1. **Initial Deposit and Interest Rate**: Lisa Anderson initiates her financial endeavor by…

Q: : McGilla Golf has decided to sell a new line of golf clubs. The clubs will sell for $15 per set…

A: The problem pertains to the determination of the sensitivity of the NPV with respect to the changes…

Q: Daily Enterprises is purchasing a $10.2 million machine. It will cost $51,000 to transport and…

A: Step 1: the calculation of the net income AB1Incremental revenues $ 3,900,000 2Incremental…

Step by step

Solved in 2 steps

- Determine how much you would be willing to pay for a bond that pays $60 annual interest indefinitely and never matures (i.e., a perpetuity), assuming you require an 8 percent rate of return on this investment. a. $743 b. $1,000 c. $480 d. $750You intend to purchase a 10-year, $1,000 face value bond that pays interest of $60 every 6 months. If your nominal annual required rate of return is 10 percent with semiannual compounding, how much should you be willing to pay for this bond? a. $ 957.50 b. $826.31 c. $1,086.15 d. $1,032.20 e. $1,124.62Suppose the government decides to issue a new savings bond that is guaranteed to double in value if you hold it for 18 years. Assume you purchase a bond that costs $100. a. What is the exact rate of return you would earn if you held the bond for 18 years until it doubled in value? (Do not round intermediate calculations and enter your answer as a percent rounded to 2 decimal places, e.g., 32.16.) b. If you purchased the bond for $100 in 2020 at the then current interest rate of .22 percent year, how much would the bond be worth in 2028? (Do not round intermediate calculations and round your answer to 2 decimal places, e.g., 32.16.) c. In 2028, instead of cashing in the bond for its then current value, you decide to hold the bond until it doubles in face value in 2038. What annual rate of return will you earn over the last 10 years?

- What is the present value of a $1000 future amount received in 17 years if the appropriate discount rate is 11.7% APR? (FYI: This problem computes the value of a 17 year, $1000 zero coupon bond, although it is phrased in time value of money language, rather than bond language.) Answer to 2 decimal points.You have just made an investment for GH¢ 747.25. No payments will be made until the investment matures 5 years from now, at which time it will be redeemed for GH¢ 1,000. What interest rate will you earn on this bond? A) 4.37% B) 6.00% C) 3.559% D) 7.00% E) 4.00%Assume that you wish to purchase a 30-year bond that has a maturity value of P1,000 and a coupon interest rate of 9.5%, paid semiannually. If you require a 6.75% rate of return on this investment, what is the maximum price that you should be willing to pay for this bond? P1,352 P1,450 P675 P1,111

- Finance The practice of investing in a currency that offers the higher return on a covered basis is known as covered interest arbitrage. Currently, the six month Euro Libor rate is -0.52% per annum, and the six month TR libor rate is 18.06% per annum. If the spot rate is 8.5013TRY per Euro and the forward rates are as stated below, Forward Points EURTRY 1M FWD 1003 EURTRY 3M FWD 3411 EURTRY 6M FWD 7096 EURTRY 1Y FWD 14507 a) What is 6M Forward rate for euro? b) Do you have a covered interest arbitrage opportunity? c) If yes, how? d) How much is the arbitrage amount you can enjoy if you can borrow upto 1 million euros or its equivalent Turkish Lira?which one is correct please confirm? Q20: Which investment would show the highest rate of return: 1) a six month (180/360 days) deposit at a rate of 4.75% or 2) a six month straight discount bill at a discount rate of 4.60% (180/360) "A six month deposit is a true yield instrument, therefore the yield will be 4.75%" a six month straight discount bill at a discount rate of 4.60% cannot be determined both are sameYou submit a noncompetitive bid in Dec. 2020 to purchase a 28-day RM1,000 Treasury bill, and you find that you are buying the bond for RM999.88722. What are the: a) discount rate % b) investment rate %?

- Suppose the U.S. Treasury offers to sell you a bond for $2,000. No payments will be made until the bond matures 15 years from now, at which time it will be redeemed for $4,000. What interest rate would you earn if you bought this bond at the offer price?You will receive $100 from a savings bond in 2 years. The nominal interest rate is 8.40%. a. What is the present value of the proceeds from the bond? (Do not round intermediate calculations. Round your answer to 2 decimal places.) b. If the inflation rate over the next few years is expected to be 3.40%, what will the real value of the $100 payoff be in terms of today’s dollars? (Do not round intermediate calculations. Round your answer to 2 decimal places.) c. What is the real interest rate? (Do not round intermediate calculations. Enter your answer as a percent rounded to 2 decimal places.) d. Calculate the real payoff from the bond [from part (b)] discounted at the real interest rate [from part (c)]. (Do not round intermediate calculations. Round your answer to 2 decimal places.)What would you pay for a $205,000 debenture bond that matures in 15 years and pays $10,250 a year in interest if you wanted to earn a yield of 2%? (Round factor values to 5 decimal places, e.g. 1.25124 and final answer to 0 decimal places, e.g. 458,581.)