Six years ago the Templeton Company issued 25-year bonds with a 15% annual coupon rate at their $1,000 par value. The bonds had a 9% call premium, with 5 years of call protection. Today Templeton called the bonds. Compute the realized rate of return for an investor who purchased the bonds when they were issued and held them until they were called. Round your answer to two decimal places. % Why should or should not the investor be happy that Templeton called them? I. Investors should not be happy. Since the bonds have been called, interest rates must have fallen sufficiently such that the YTC is less than the YTM. If investors wish to reinvest their interest receipts, they must do so at lower interest rates. II. Investors should be happy. Since the bonds have been called, interest rates must have risen sufficiently such that the YTC is greater than the YTM. If investors wish to reinvest their interest receipts, they can now do so at higher interest rates. III. Investors should be happy. Since the bonds have been called, investors will receive a call premium and can declare a capital gain on their tax returns. IV. Investors should be happy. Since the bonds have been called, investors will no longer need to consider reinvestment rate risk. -Select- v *

Six years ago the Templeton Company issued 25-year bonds with a 15% annual coupon rate at their $1,000 par value. The bonds had a 9% call premium, with 5 years of call protection. Today Templeton called the bonds. Compute the realized rate of return for an investor who purchased the bonds when they were issued and held them until they were called. Round your answer to two decimal places. % Why should or should not the investor be happy that Templeton called them? I. Investors should not be happy. Since the bonds have been called, interest rates must have fallen sufficiently such that the YTC is less than the YTM. If investors wish to reinvest their interest receipts, they must do so at lower interest rates. II. Investors should be happy. Since the bonds have been called, interest rates must have risen sufficiently such that the YTC is greater than the YTM. If investors wish to reinvest their interest receipts, they can now do so at higher interest rates. III. Investors should be happy. Since the bonds have been called, investors will receive a call premium and can declare a capital gain on their tax returns. IV. Investors should be happy. Since the bonds have been called, investors will no longer need to consider reinvestment rate risk. -Select- v *

Chapter2: The Domestic And International Financial Marketplace

Section: Chapter Questions

Problem 3P

Related questions

Question

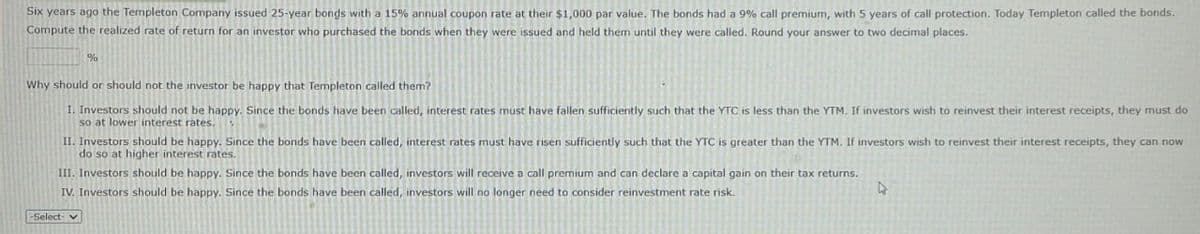

Transcribed Image Text:Six years ago the Templeton Company issued 25-year bonds with a 15% annual coupon rate at their $1,000 par value. The bonds had a 9% call premium, with 5 years of call protection. Today Templeton called the bonds.

Compute the realized rate of return for an investor who purchased the bonds when they were issued and held them until they were called. Round your answer to two decimal places.

%

Why should or should not the investor be happy that Templeton called them?

I. Investors should not be happy. Since the bonds have been called, interest rates must have fallen sufficiently such that the YTC is less than the YTM. If investors wish to reinvest their interest receipts, they must do

so at lower interest rates.

II. Investors should be happy. Since the bonds have been called, interest rates must have risen sufficiently such that the YTC is greater than the YTM. If investors wish to reinvest their interest receipts, they can now

do so at higher interest rates.

III. Investors should be happy. Since the bonds have been called, investors will receive a call premium and can declare a capital gain on their tax returns.

IV. Investors should be happy. Since the bonds have been called, investors will no longer need to consider reinvestment rate risk.

-Select- v

*

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Recommended textbooks for you

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College