The production data and other related information of ROLLY Processing Company are presented as follows: P25.00 Selling price per unit Number of units produced and sold monthly Monthly fixed cash payments 800,000 P2,640,000 For the past years, ROLLY Processing Company has experienced a variable monthly cash payment of 45% of sales. Required: Compute the following: 1. Cash contribution ratio 2. Cash contribution margin ratio 3. Cash break-even

The production data and other related information of ROLLY Processing Company are presented as follows: P25.00 Selling price per unit Number of units produced and sold monthly Monthly fixed cash payments 800,000 P2,640,000 For the past years, ROLLY Processing Company has experienced a variable monthly cash payment of 45% of sales. Required: Compute the following: 1. Cash contribution ratio 2. Cash contribution margin ratio 3. Cash break-even

Chapter18: The Management Of Accounts Receivable And Inventories

Section: Chapter Questions

Problem 5P

Related questions

Question

100%

Please answer the first picture. The second picture is the example or format. Hope you can provide picture,Thankyou !

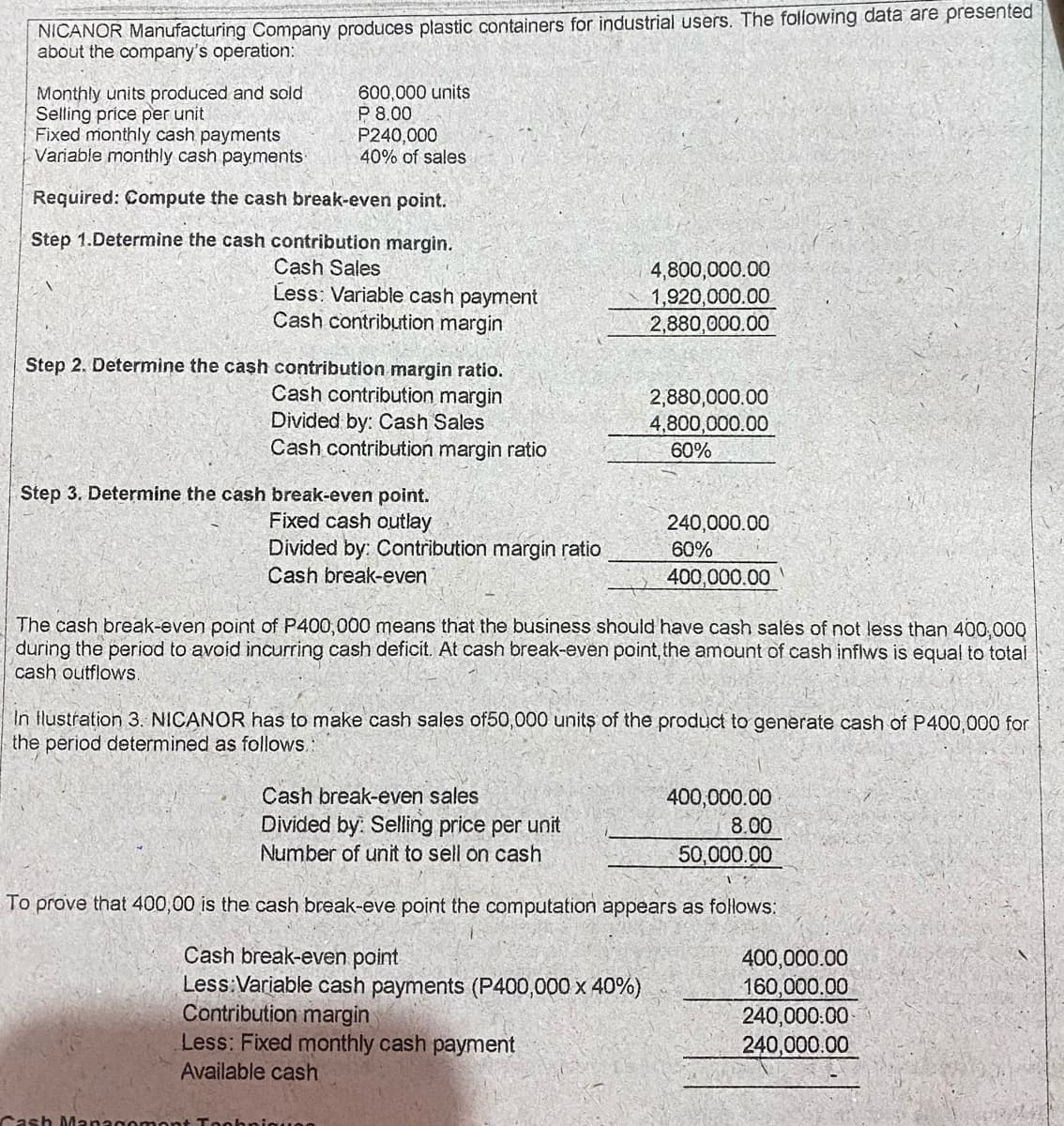

Transcribed Image Text:NICANOR Manufacturing Company produces plastic containers for industrial users. The following data are presented

about the company's operation:

Monthly units produced and sold

Selling price per unit

Fixed monthly cash payments

Variable monthly cash payments

600,000 units

P 8.00

P240,000

40% of sales

Required: Compute the cash break-even point.

Step 1.Determine the cash contribution margin.

Cash Sales

Less: Variable cash payment

Cash contribution margin

4,800,000.00

1,920,000.00

2,880,000.00

Step 2. Determine the cash contribution margin ratio.

Cash contribution margin

Divided by: Cash Sales

Cash contribution margin ratio

2,880,000.00

4,800,000.00

60%

Step 3. Determine the cash break-even point.

Fixed cash outlay

Divided by: Contribution margin ratio

240,000.00

60%

Cash break-even

400,000.00

The cash break-even point of P400,000 means that the business should have cash sales of not less than 400,000

during the period to avoid incurring cash deficit. At cash break-even point, the amount of cash inflws is equal to total

cash outflows.

In flustration 3. NICANOR has to make cash sales of50,000 units of the product to generate cash of P400,000 for

the period determined as follows.:

Cash break-even sales

400,000.00

8.00

Divided by: Selling price per unit

Number of unit to sell on cash

50,000.00

To prove that 400,00 is the cash break-eve point the computation appears as follows:

Cash break-even point

Less:Variable cash payments (P400,000 x 40%)

Contribution margin

Less: Fixed monthly cash payment

Available cash

400,000.00

160,000.00

240,000:00

240,000.00

Cash Managomi

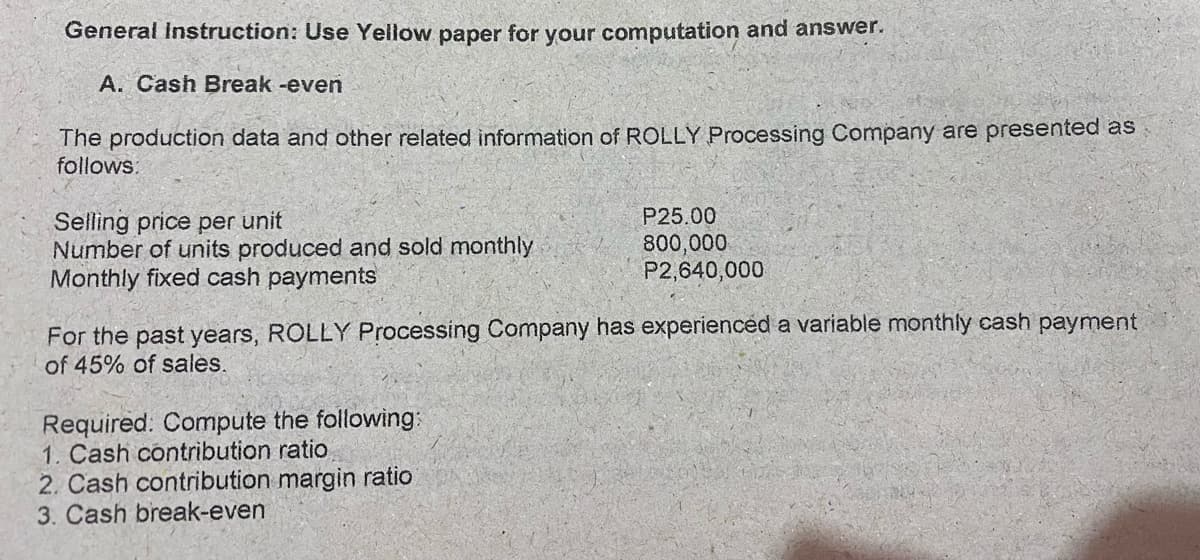

Transcribed Image Text:General Instruction: Use Yellow paper for your computation and answer.

A. Cash Break -even

The production data and other related information of ROLLY Processing Company are presented as

follows:

P25.00

Selling price per unit

Number of units produced and sold monthly

Monthly fixed cash payments

800,000

P2,640,000

For the past years, ROLLY Processing Company has experienced a variable monthly cash payment

of 45% of sales.

Required. Compute the following:

1. Cash contribution ratio

2. Cash contribution margin ratio

3. Cash break-even

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps with 3 images

Recommended textbooks for you

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning

Excel Applications for Accounting Principles

Accounting

ISBN:

9781111581565

Author:

Gaylord N. Smith

Publisher:

Cengage Learning