Excel Applications for Accounting Principles

4th Edition

ISBN: 9781111581565

Author: Gaylord N. Smith

Publisher: Cengage Learning

expand_more

expand_more

format_list_bulleted

Concept explainers

Textbook Question

Chapter 21, Problem 5R

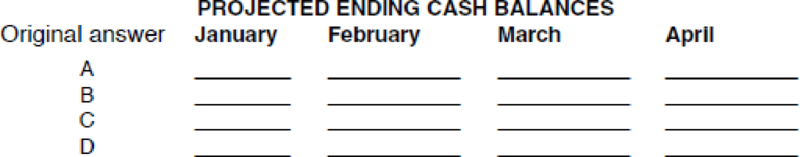

The following four suggestions have been made to improve the company’s cash position. Evaluate the effect on cash flow for each of the four suggestions. After evaluating each suggestion, enter the projected cash balances in the spaces provided. Consider each suggestion separately. Reset cells to their initial values after each new suggestion.

- a. Seek agreement with suppliers to extend the credit period to 30 days. This would mean that all current monthly purchases would be paid for in the following month.

- b. Raise the unit price from $28 to $30. A price increase will reduce unit sales by 10% each month. Unit purchases will also be reduced by 10%.

- c. Put the company’s two salespeople on straight commission. This would reduce fixed marketing and administrative costs to $1,500 per month and raise variable marketing and administrative costs to $7 per unit.

- d. Increase the cash discount from 5% to 10%. It is anticipated that this would increase the percentage of customers paying within the discount period to 85%, and those paying the month after the discount period would drop to 8%. Five percent would pay in the following month and 2% would still be uncollectible.

What are your recommendations for Sweet Pleasures, Inc.? Consider potential impact on profits as well as cash balances.

Expert Solution & Answer

Want to see the full answer?

Check out a sample textbook solution

Students have asked these similar questions

Consider the following selected financial data for the Skyway Retailer and Calculate (A) the operating and (B) cash conversion cycles.

(check the attached picture)

Choose the bullet with the correct answer.

(A) 47.6 days and (B) 10 days

(A) 57.6 days and (B) 12 days

(A) 67.6 days and (B) 22 days

(A) 77.6 days and (B) 32 days

(A) 87.6 days and (B) 42 days

Inmoo Company's average age of accounts receivable is 89 days, the average age of accounts payable is 40 days, and the average age of inventory is 48 days. Assuming a 365-day year, what is the length of its cash conversion cycle?

Please explain process and show calculations.

You have to test cash and PP&E of your client. Both accounts have the same balance at the end of the year: $25 million. In a typical company, which account will you spend more time testing AND WHY?

Chapter 21 Solutions

Excel Applications for Accounting Principles

Ch. 21 - On January 1, Sweet Pleasures, Inc., begins...Ch. 21 - Open the file CASHBUD from the website for this...Ch. 21 - Can the 10,000 note be repaid on May 1? Explain.Ch. 21 - Prob. 4RCh. 21 - The following four suggestions have been made to...Ch. 21 - Reset cells to their initial values. Sweet...Ch. 21 - Prob. 7R

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- The management of MNGO Corporation is currently evaluating if they will need to borrow funds for their fourth quarter operation. Below are the different forecasted cash inflows and outflows of MNGO Corporation for the fourth quarter of the year Forecasted sales for October, November and December are $100,000, $150,000, and $ 180,000 respectively. Based on experience 40% is on cash sales, 40% is collected the following month and the remaining 20% is collected after 2 months when sales was made. It is expected that the company will be receiving $10,000 from its investments on Marketable securities on December. A scrap value of $3,000 is expected to be received by the company on November for the sales of depreciated assets. Monthly cash purchases on inventory is estimated to be 35% of monthly sales. Payment of accounts payable is done monthly which is 10% of the previous months sales. Monthly salary and wages are paid in cash amounting to $20,000 Monthly estimated utilities expense is…arrow_forwardCass & Company has the following data. What is the firm's cash conversion cycle? Inventory Conversion Period = 40 days Receivables Collection Period = 17 days Payables Deferral Period = 25 days Question options: 35 days 31 days 25 days 32 days 33 daysarrow_forwardThe financial manager of a firm wants to determine the amount of cash outlays to be spent for the next period. He asked the help of the accountant and the latter provided a cash budget for the next year. According to the computations, the company would be incurring cash expenses of P6,612,500 per month. The financial manager has estimated a cost of P40 per transaction in case non-cash asset is converted to cash. The firm’s opportunity cost ratio is 12%. The optimum cash balance is? The average cash balance is? the number of conversion made during the year is? The total cash cost is?arrow_forward

- The financial manager of Sarap Corporation wants to determine the amount of cash outlays to be spent for the next period. He asked the help of the accountant and the latter provided a cash budget for the next year. According to the computations, the company would be incurring cash expenses of P6,612,500 per month. The financial manager has estimated a cost of P40 per transaction in case non-cash asset is converted to cash. The firm's opportunity cost ratio is 12%. a. The optimum cash balance is?arrow_forwardRomano Inc. has the following data. What is the firm's cash conversion cycle? Inventory Conversion Period = 59 days Receivables Collection Period = 19 days Payables Deferral Period = 41 days Please explain process and show calculations.arrow_forwardThe financial manager of Sarap Corporation wants to determine the amount of cash atlays to be spent for the next period. He asked the help of the accountant and the lattes provided a cash budget for the next year According to the computation, the company would be incurring cash expenses of P6,612,500 per month. The financial manager has estimated a cost of P40 per transaction in case non-cash asset is converted to cash. The firm's opportunity cost ratio is 12% a) the optimum cash tufence is? b) The average cash balance is? c) the number of conversion made during the year? d) The total cash cost is? Please help me with these. Thank youuuu!arrow_forward

- You have recently been hired to improve the performance of Multiplex Corporation, which has been experiencing a severe cash shortage. As one part of your analysis, you want to determine the firm’s cash conversion cycle. Using the following information and a 365-day year,(a) what is your estimate of the firm’s current cash conversion cycle? Current inventory = $241,000.00 • Annual sales = $1,200,000.00 • Accounts receivable = $300,000.00 • Accounts payable = $245,000.00 • Total annual purchases = $600,000.00 • Purchases credit terms: net 30 days. • Receivables credit terms: net 50 days.arrow_forwardBrothers Breads has the following data. What is the firm's cash conversion cycle? Inventory conversion period = 50 days Average collection period = 17 days Payables deferral period = 25 days a. 46 days b. 31 days c. 42 days d. 38 days e. 34 daysarrow_forwardParadise Retailers, Inc. (PRI) determined that $1,500,000 is needed for cash transactions made during the next year. Each time PRI deposits money in its checking account, a charge of $12.95 is assessed to cover clerical costs. If PRI can hold marketable securities that yield 4.5%, and then convert these securities to cash at a cost of only the $12.95 deposit charge, what is the optimal cash amount C* to transfer from marketable securities to the checking account according to the Baumol Model?arrow_forward

- Directions: Read and analyze the problem below then do the following requirements. Assuming, you owned a sari-sari store and had a beginning cash amounting of P50, 000 and the following transactions occurred during the month. Purchase of goods. Paid in cash. 100, 000 Sales of goods. Received cash. 150,000 Paid utilities 30,000 Paid rent 10,000 Sold equipment for cash 100, 000 Owner withdraws investment 10, 000 Required: Compute for your net cash flow generated/used in operating activities. Compute for your net cash flow generated/used in investing activities. Compute for your net cash flow used in financing activities. Prepare a cash flows statement using direct method.arrow_forwardABC Inc. has the following data. What is the firm's cash (conversion) cycle? Inventory Conversion Period = 38 days Receivables Collection Period = 19 days Payables Deferral Period = 26 daysarrow_forwardThe financial manager of Sarap Corporation wants to determine the amount of cash outlays to be spent for the nextperiod. He asked the help of the accountant and the latter provided a cash budget for the next year. According tothe computations, the company would be incurring cash expenses of P6,612,500 per month. The financial managerhas estimated a cost of P40 per transaction in case non-cash asset is converted to cash. The firm’s opportunity costratio is 12%.a. The optimum cash balance is?b. The average cash balance is?c. the number of conversion made during the year is?d. The total cash cost is?arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Excel Applications for Accounting PrinciplesAccountingISBN:9781111581565Author:Gaylord N. SmithPublisher:Cengage Learning

Excel Applications for Accounting PrinciplesAccountingISBN:9781111581565Author:Gaylord N. SmithPublisher:Cengage Learning EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT

EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT

Excel Applications for Accounting Principles

Accounting

ISBN:9781111581565

Author:Gaylord N. Smith

Publisher:Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:9781337514835

Author:MOYER

Publisher:CENGAGE LEARNING - CONSIGNMENT

Responsibility Accounting| Responsibility Centers and Segments| US CMA Part 1| US CMA course; Master Budget and Responsibility Accounting-Intro to Managerial Accounting- Su. 2013-Prof. Gershberg; Author: Mera Skill; Rutgers Accounting Web;https://www.youtube.com/watch?v=SYQ4u1BP24g;License: Standard YouTube License, CC-BY