t the beginning of current year, Jazz Company has an The toy train division is regarded as a cash generating unit. The management measured the value in use of the toy train There is a declining interest in toy train because of the Amounts of the assets of the toy train division were: division at the current year-end at P3,600,000. The carrying operating division whose major industry is the manufacture sggressive marketing of computer-based toys. At of toy train. Building Iaventory Trademark Goodwill 2,000,000 1,500,000 1,000,000 500,000 Required: 1. Determine the amount of impairment loss. 2. Allocate the impairment loss to the assets of the cash generating unit. 3. Prepare journal entry to record the impairment loss.

t the beginning of current year, Jazz Company has an The toy train division is regarded as a cash generating unit. The management measured the value in use of the toy train There is a declining interest in toy train because of the Amounts of the assets of the toy train division were: division at the current year-end at P3,600,000. The carrying operating division whose major industry is the manufacture sggressive marketing of computer-based toys. At of toy train. Building Iaventory Trademark Goodwill 2,000,000 1,500,000 1,000,000 500,000 Required: 1. Determine the amount of impairment loss. 2. Allocate the impairment loss to the assets of the cash generating unit. 3. Prepare journal entry to record the impairment loss.

Intermediate Financial Management (MindTap Course List)

13th Edition

ISBN:9781337395083

Author:Eugene F. Brigham, Phillip R. Daves

Publisher:Eugene F. Brigham, Phillip R. Daves

Chapter21: Supply Chains And Working Capital Management

Section: Chapter Questions

Problem 12P: Strickler Technology is considering changes in its working capital policies to improve its cash flow...

Related questions

Question

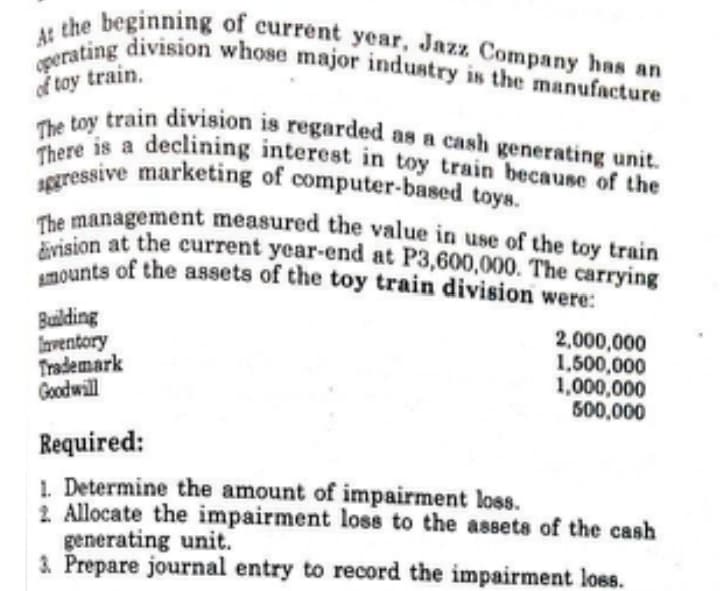

Transcribed Image Text:sggressive marketing of computer-based toys.

There is a declining interest in toy train because of the

division at the current year-end at P3,600,000. The carrying

The toy train division is regarded as a cash generating unit.

The management measured the value in use of the toy train

Amounts of the assets of the toy train division were:

operating division whose major industry is the manufacture

At the beginning of current year, Jazz Company has an

of toy train.

Building

Inventory

Trademark

Goodwill

2,000,000

1,500,000

1,000,000

500,000

Required:

1. Determine the amount of impairment loss.

2. Allocate the impairment loss to the assets of the cash

generating unit.

3. Prepare journal entry to record the impairment loss.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps with 4 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Financial Accounting

Accounting

ISBN:

9781337272124

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Financial Accounting

Accounting

ISBN:

9781337272124

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Financial Reporting, Financial Statement Analysis…

Finance

ISBN:

9781285190907

Author:

James M. Wahlen, Stephen P. Baginski, Mark Bradshaw

Publisher:

Cengage Learning

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning