The purchase price Re cost of filling the land was RO 15,000. Cost of demolishing an old building on the land to make land suitable for ction of new factory RO 10,00O. Proceeds from salvage of the materials from the old building totalled RO 4,000. Full payment to ction contractor RO 300,000. Real estate taxes on land paid at time of purchase RO 4,500. Architect's fees on factory design plan D. Cost of the fences, parking lots and driveways RO 30,000. What is the total cost of the factory building? RO 314,000 None of the options are correct RO 310,500 RO 308 50

The purchase price Re cost of filling the land was RO 15,000. Cost of demolishing an old building on the land to make land suitable for ction of new factory RO 10,00O. Proceeds from salvage of the materials from the old building totalled RO 4,000. Full payment to ction contractor RO 300,000. Real estate taxes on land paid at time of purchase RO 4,500. Architect's fees on factory design plan D. Cost of the fences, parking lots and driveways RO 30,000. What is the total cost of the factory building? RO 314,000 None of the options are correct RO 310,500 RO 308 50

Century 21 Accounting General Journal

11th Edition

ISBN:9781337680059

Author:Gilbertson

Publisher:Gilbertson

Chapter19: Accounting For Plant Assets, Depreciation, And Intangible Assets

Section: Chapter Questions

Problem 1AFE

Related questions

Question

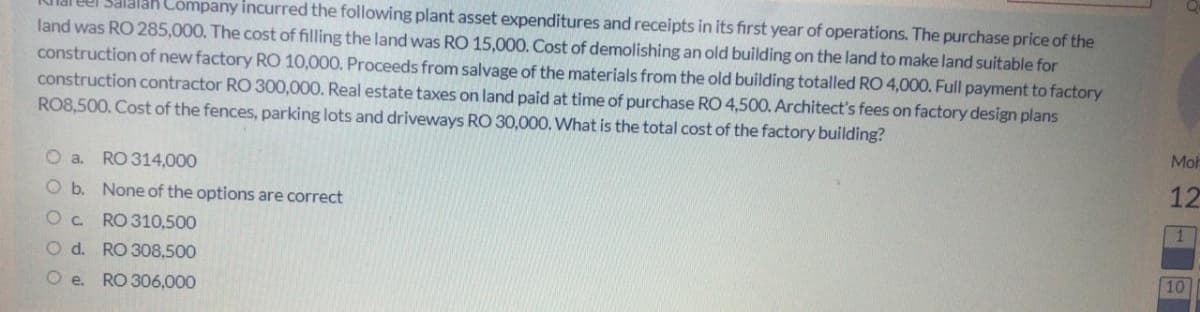

Transcribed Image Text:el Salalak Company incurred the following plant asset expenditures and receipts in its first year of operations. The purchase price of the

land was RO 285,000. The cost of filling the land was RO 15,000. Cost of demolishing an old building on the land to make land suitable for

construction of new factory RO 10,000. Proceeds from salvage of the materials from the old building totalled RO 4,000. Full payment to factory

construction contractor RO 300,000. Real estate taxes on land paid at time of purchase RO 4,500. Architect's fees on factory design plans

RO8,500. Cost of the fences, parking lots and driveways RO 30,000. What is the total cost of the factory building?

Moh

O a. RO 314,000

12

O b. None of the options are correct

Oc RO 310,500

O d. RO 308,500

10

O e. RO 306,000

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning