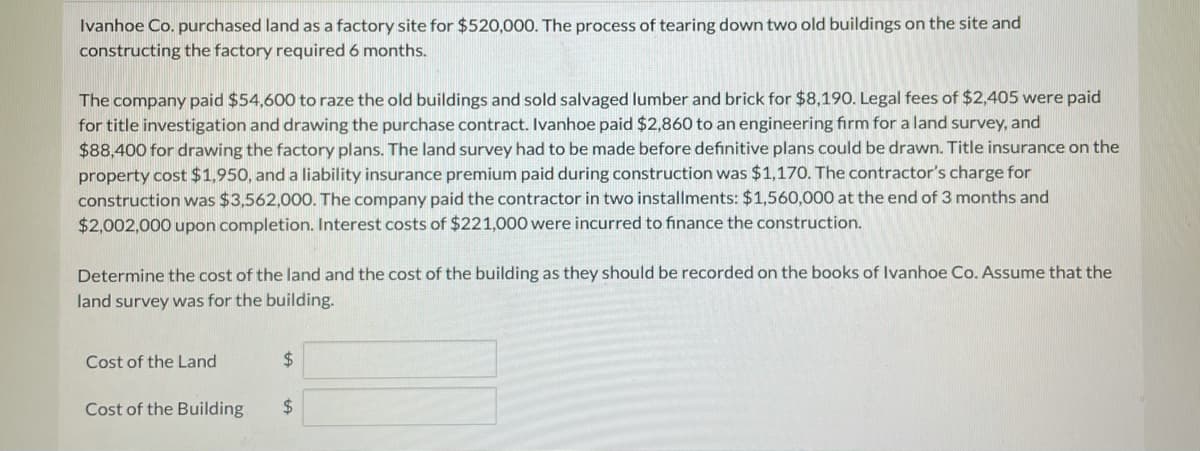

Ivanhoe Co. purchased land as a factory site for $520,000. The process of tearing down two old buildings on the site and constructing the factory required 6 months. The company paid $54,600 to raze the old buildings and sold salvaged lumber and brick for $8,190. Legal fees of $2,405 were paid for title investigation and drawing the purchase contract. Ivanhoe paid $2,860 to an engineering firm for a land survey, and $88,400 for drawing the factory plans. The land survey had to be made before definitive plans could be drawn. Title insurance on the property cost $1,950, and a liability insurance premium paid during construction was $1,170. The contractor's charge for construction was $3,562,00O. The company paid the contractor in two installments: $1,560,000 at the end of 3 months and $2,002,000 upon completion. Interest costs of $221,000 were incurred to finance the construction. Determine the cost of the land and the cost of the building as they should be recorded on the books of Ivanhoe Co. Assume that the land survey was for the building. Cost of the Land 24 Cost of the Building %24

Ivanhoe Co. purchased land as a factory site for $520,000. The process of tearing down two old buildings on the site and constructing the factory required 6 months. The company paid $54,600 to raze the old buildings and sold salvaged lumber and brick for $8,190. Legal fees of $2,405 were paid for title investigation and drawing the purchase contract. Ivanhoe paid $2,860 to an engineering firm for a land survey, and $88,400 for drawing the factory plans. The land survey had to be made before definitive plans could be drawn. Title insurance on the property cost $1,950, and a liability insurance premium paid during construction was $1,170. The contractor's charge for construction was $3,562,00O. The company paid the contractor in two installments: $1,560,000 at the end of 3 months and $2,002,000 upon completion. Interest costs of $221,000 were incurred to finance the construction. Determine the cost of the land and the cost of the building as they should be recorded on the books of Ivanhoe Co. Assume that the land survey was for the building. Cost of the Land 24 Cost of the Building %24

Cornerstones of Financial Accounting

4th Edition

ISBN:9781337690881

Author:Jay Rich, Jeff Jones

Publisher:Jay Rich, Jeff Jones

Chapter7: Operating Assets

Section: Chapter Questions

Problem 69APSA: A Cost of a Fixed Asset Mist City Car Wash purchased a new brushless car-washing machine for one of...

Related questions

Question

100%

Transcribed Image Text:Ivanhoe Co. purchased land as a factory site for $520,000. The process of tearing down two old buildings on the site and

constructing the factory required 6 months.

The company paid $54,600 to raze the old buildings and sold salvaged lumber and brick for $8,190. Legal fees of $2,405 were paid

for title investigation and drawing the purchase contract. Ivanhoe paid $2,860 to an engineering firm for a land survey, and

$88,400 for drawing the factory plans. The land survey had to be made before definitive plans could be drawn. Title insurance on the

property cost $1,950, and a liability insurance premium paid during construction was $1,170. The contractor's charge for

construction was $3,562,000. The company paid the contractor in two installments: $1,560,000 at the end of 3 months and

$2,002,000 upon completion. Interest costs of $221,000 were incurred to finance the construction.

Determine the cost of the land and the cost of the building as they should be recorded on the books of Ivanhoe Co. Assume that the

land survey was for the building.

Cost of the Land

24

Cost of the Building

24

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Business Its Legal Ethical & Global Environment

Accounting

ISBN:

9781305224414

Author:

JENNINGS

Publisher:

Cengage

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,