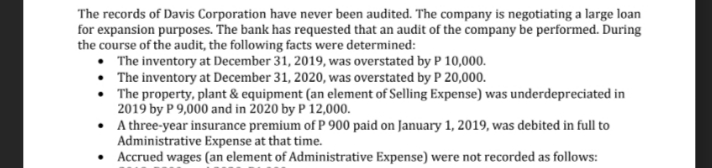

The records of Davis Corporation have never been audited. The company is negotiating a large loan for expansion purposes. The bank has requested that an audit of the company be performed. During the course of the audit, the following facts were determined: • The inventory at December 31, 2019, was overstated by P 10,000. • The inventory at December 31, 2020, was overstated by P 20,000. • The property, plant & equipment (an element of Selling Expense) was underdepreciated in 2019 by P 9,000 and in 2020 by P 12,000. • A three-year insurance premium of P 900 paid on January 1, 2019, was debited in full to Administrative Expense at that time.

The records of Davis Corporation have never been audited. The company is negotiating a large loan for expansion purposes. The bank has requested that an audit of the company be performed. During the course of the audit, the following facts were determined: • The inventory at December 31, 2019, was overstated by P 10,000. • The inventory at December 31, 2020, was overstated by P 20,000. • The property, plant & equipment (an element of Selling Expense) was underdepreciated in 2019 by P 9,000 and in 2020 by P 12,000. • A three-year insurance premium of P 900 paid on January 1, 2019, was debited in full to Administrative Expense at that time.

Auditing: A Risk Based-Approach (MindTap Course List)

11th Edition

ISBN:9781337619455

Author:Karla M Johnstone, Audrey A. Gramling, Larry E. Rittenberg

Publisher:Karla M Johnstone, Audrey A. Gramling, Larry E. Rittenberg

Chapter13: Auditing Debt, Equity, And Long-term Liabilities Requiring Management Estimates

Section: Chapter Questions

Problem 28RQSC

Related questions

Question

Prepare correcting entries.

Transcribed Image Text:The records of Davis Corporation have never been audited. The company is negotiating a large loan

for expansion purposes. The bank has requested that an audit of the company be performed. During

the course of the audit, the following facts were determined:

• The inventory at December 31, 2019, was overstated by P 10,000.

• The inventory at December 31, 2020, was overstated by P 20,000.

• The property, plant & equipment (an element of Selling Expense) was underdepreciated in

2019 by P 9,000 and in 2020 by P 12,000.

• Athree-year insurance premium of P 900 paid on January 1, 2019, was debited in full to

Administrative Expense at that time.

• Accrued wages (an element of Administrative Expense) were not recorded as follows:

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Auditing: A Risk Based-Approach (MindTap Course L…

Accounting

ISBN:

9781337619455

Author:

Karla M Johnstone, Audrey A. Gramling, Larry E. Rittenberg

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Auditing: A Risk Based-Approach to Conducting a Q…

Accounting

ISBN:

9781305080577

Author:

Karla M Johnstone, Audrey A. Gramling, Larry E. Rittenberg

Publisher:

South-Western College Pub

Auditing: A Risk Based-Approach (MindTap Course L…

Accounting

ISBN:

9781337619455

Author:

Karla M Johnstone, Audrey A. Gramling, Larry E. Rittenberg

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Auditing: A Risk Based-Approach to Conducting a Q…

Accounting

ISBN:

9781305080577

Author:

Karla M Johnstone, Audrey A. Gramling, Larry E. Rittenberg

Publisher:

South-Western College Pub