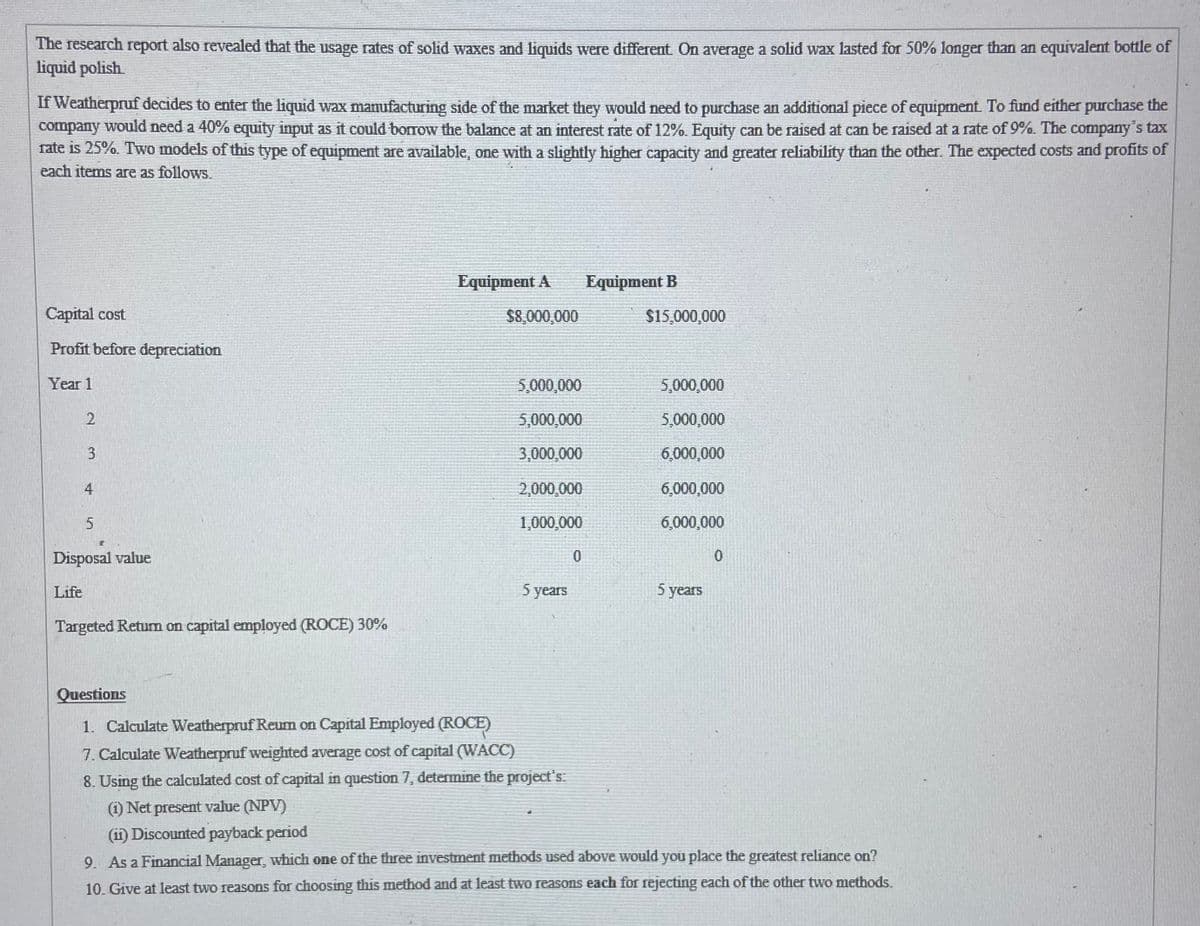

The research report also revealed that the usage rates of solid waxes and liquids were different On average a solid wax lasted for 50% longer than an equivalent bottle of liquid polish If Weatherpruf decides to enter the liquid wax manufacturing side of the market they would need to purchase an additional piece of equipment. To fund either purchase the company would need a 40% equity input as it could borrow the balance at an interest rate of 12%. Equity can be raised at can be raised at a rate of 9%. The company's tax rate is 25%. Two models of this type of equipment are available, one with a slightly higher capacity and greater reliability than the other. The expected costs and profits of each items are as follows. Equipment A Equipment B Capital cost $8,000,000 $15,000,000 Profit before depreciation Year 1 5,000,000 5,000,000 5,000,000 5,000,000 3. 3,000,000 6,000,000 4 2,000,000 6,000,000 1,000,000 6,000,000 Disposal value Life 5 years 5 years Targeted Returm on capital employed (ROCE) 30% Questions 1. Calculate Weatherpruf Reum on Capital Employed (ROCE) 7. Calculate Weatherpruf weighted average cost of capital (WACC) 8. Using the calculated cost of capital in question 7, determine the project's: (1) Net present value (NPV) (1 Discounted payback period 9. As a Financial Manager, which one of the three investment methods used above would you place the greatest reliance on? 10. Give at least two reasons for choosing this method and at least two reasons each for rejecting each of the other two methods.

The research report also revealed that the usage rates of solid waxes and liquids were different On average a solid wax lasted for 50% longer than an equivalent bottle of liquid polish If Weatherpruf decides to enter the liquid wax manufacturing side of the market they would need to purchase an additional piece of equipment. To fund either purchase the company would need a 40% equity input as it could borrow the balance at an interest rate of 12%. Equity can be raised at can be raised at a rate of 9%. The company's tax rate is 25%. Two models of this type of equipment are available, one with a slightly higher capacity and greater reliability than the other. The expected costs and profits of each items are as follows. Equipment A Equipment B Capital cost $8,000,000 $15,000,000 Profit before depreciation Year 1 5,000,000 5,000,000 5,000,000 5,000,000 3. 3,000,000 6,000,000 4 2,000,000 6,000,000 1,000,000 6,000,000 Disposal value Life 5 years 5 years Targeted Returm on capital employed (ROCE) 30% Questions 1. Calculate Weatherpruf Reum on Capital Employed (ROCE) 7. Calculate Weatherpruf weighted average cost of capital (WACC) 8. Using the calculated cost of capital in question 7, determine the project's: (1) Net present value (NPV) (1 Discounted payback period 9. As a Financial Manager, which one of the three investment methods used above would you place the greatest reliance on? 10. Give at least two reasons for choosing this method and at least two reasons each for rejecting each of the other two methods.

Managerial Accounting

15th Edition

ISBN:9781337912020

Author:Carl Warren, Ph.d. Cma William B. Tayler

Publisher:Carl Warren, Ph.d. Cma William B. Tayler

Chapter7: Variable Costing For Management

analysis

Section: Chapter Questions

Problem 2PA: The demand for solvent, one of numerous products manufactured by Logan Industries Inc., has dropped...

Related questions

Question

100%

Transcribed Image Text:The research report also revealed that the usage rates of solid waxes and liquids were different On average a solid wax lasted for 50% longer than an equivalent bottle of

liquid polish.

If Weatherpruf decides to enter the liquid wax manufacturing side of the market they would need to purchase an additional piece of equipment. To fund either purchase the

company would need a 40% equity input as it could borrow the balance at an interest rate of 12%. Equity can be raised at can be raised at a rate of 9%. The company's tax

rate is 25%. Two models of this type of equipment are available, one with a slightly higher capacity and greater reliability than the other. The expected costs and profits of

each items are as follows.

Equipment A

Equipment B

Capital cost

$8,000,000

$15,000,000

Profit before depreciation

Year 1

5,000,000

5,000,000

5,000,000

5,000,000

3

3,000,000

6,000,000

4

2,000,000

6,000,000

1,000,000

6,000,000

Disposal value

Life

5 years

5 years

Targeted Retum on capital employed (ROCE) 30%

Questions

1. Calculate Weatherpruf Reum on Capital Employed (ROCE)

7. Calculate Weatherpruf weighted average cost of capital (WACC)

8. Using the calculated cost of capital in question 7, determine the project's

(1) Net present value (NPV)

(11) Discounted payback period

9. As a Financial Manager, which one of the three investment methods used above would you place the greatest reliance on?

10. Give at least two reasons for choosing this method and at least two reasons each for rejecting each of the other two methods.

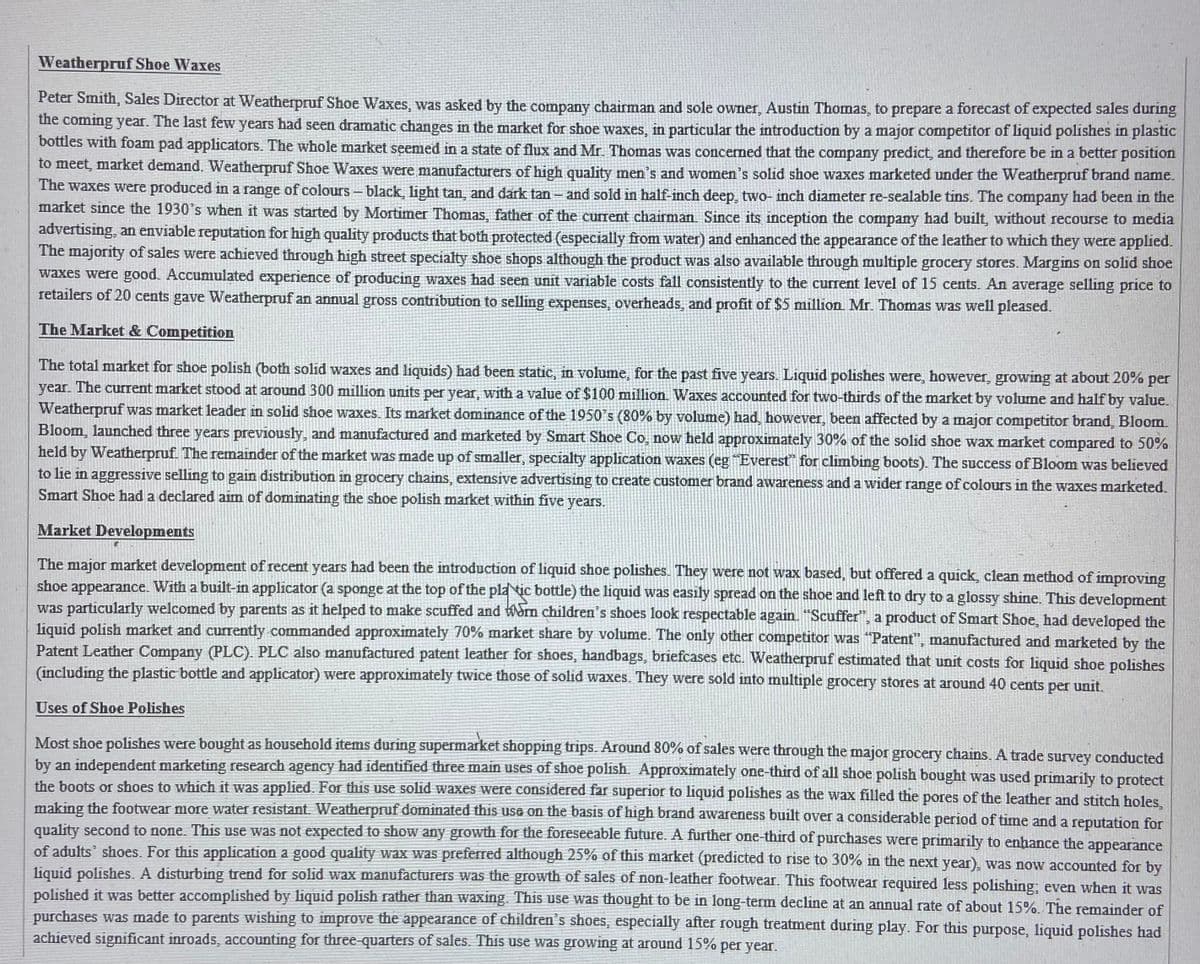

Transcribed Image Text:Weatherpruf Shoe Waxes

Peter Smith, Sales Director at Weatherpruf Shoe Waxes, was asked by the company chairman and sole owner, Austin Thomas, to prepare a forecast of expected sales during

the coming year. The last few years had seen dramatic changes in the market for shoe waxes, in particular the introduction by a major competitor of liquid polishes in plastic

bottles with foam pad applicators. The whole market seemed in a state of flux and Mr. Thomas was concened that the company predict, and therefore be in a better position

to meet, market demand. Weatherpruf Shoe Waxes were manufacturers of high quality men's and women's solid shoe waxes marketed under the Weatherpruf brand name.

The waxes were produced in a range of colours- black, light tan, and dark tan - and sold in half-inch deep, two- inch diameter re-sealable tins. The company had been in the

market since the 1930's when it was started by Mortimer Thomas, father of the current chairman Since its inception the company had built, without recourse to media

advertising, an enviable reputation for high quality products that both protected (especially from water) and enhanced the appearance of the leather to which they were applied.

The majority of sales were achieved through high street specialty shoe shops although the product was also available through multiple grocery stores. Margins on solid shoe

waxes were good. Accumulated experience of producing waxes had seen unit variable costs fall consistently to the current level of 15 cents. An average selling price to

retailers of 20 cents gave Weatherpruf an annual gross contribution to selling expenses, overheads, and profit of $5 million. Mr. Thomas was well pleased.

The Market & Competition

The total market for shoe polish (both solid waxes and liquids) had been static, in volume, for the past five years. Liquid polishes were, however, growing at about 20% per

year. The curent market stood at around300 million units per year, with a value of $100 million. Waxes accounted for two-thirds of the market by volume and half by value.

Weatherpruf was market leader in solid shoe waxes. Its market dominance of the 1950's (80% by volume) had, however, been affected by a major competitor brand, Bloom.

Bloom, launched three years previously, and manufactured and marketed by Smart Shoe Co, now held approximately 30% of the solid shoe wax market compared to 50%

held by Weatherpruf. The remainder of the market was made up of smaller, specialty application waxes (eg Everest" for climbing boots). The success of Bloom was believed

to lie in aggressive selling to gain distribution in grocery chains, extensive advertising to create customer brand awareness anda wider range of colours in the waxes marketed.

Smart Shoe had a declared aim of dominating the shoe polish market within five years.

Market Developments

The major market development of recent years had been the introduction of liquid shoe polishes. They were not wax based, but offered a quick, clean method of improving

shoe appearance. With a built-in applicator (a sponge at the top of the pla tic bottle) the liquid was easily spread on the shoe and left to dry to a glossy shine. This development

was particularly welcomed by parents as it helped to make scuffed and Wom children's shoes look respectable again. "Scuffer", a product of Smart Shoe, had developed the

liquid polish market and currently commanded approximately 70% market share by volume. The only other competitor was "Patent", manufactured and marketed by the

Patent Leather Company (PLC). PLC also manufactured patent leather for shoes, handbags, briefcases etc. Weatherpruf estimated that unit costs for liquid shoe polishes

(including the plastic bottle and applicator) were approximately twice those of solid waxes. They were sold into multiple grocery stores at around 40 cents per unit.

Uses of Shoe Polishes

Most shoe polishes were bought as household items during supermarket shopping trips. Around 80% of sales were through the major grocery chains. A trade survey conducted

by an independent marketing research agency had identified three main uses of shoe polish. Approximately one-third of all shoe polish bought was used primarily to protect

the boots or shoes to which it was applied. For this use solid waxes were considered far superior to liquid polishes as the wax filled the pores of the leather and stitch holes.

making the footwear more water resistant. Weatherpruf dominated this use on the basis of high brand awareness built over a considerable period of time and a reputation for

quality second to none. This use was not expected to shoW any growth for the foreseeable future. A further one-third of purchases were primarily to enhance the appearance

of adults' shoes. For this application a good quality wax was preferred although 25% of this market (predicted to rise to 30% in the next year), was now accounted for by

liquid polishes. A disturbing trend for solid wax manufacturers was the growth of sales of non-leather footwear. This footwear required less polishing; even when it was

polished it was better accomplished by liquid polish rather than waxing. This use was thought to be in long-term decline at an annual rate of about 15%. The remainder of

purchases was made to parents wishing to improve the appearance of children's shoes, especially after rough treatment during play. For this purpose, liquid polishes had

achieved significant inroads, accounting for three-quarters of sales. This use was growing at around 15% per year.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 4 steps with 5 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Recommended textbooks for you

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning

Essentials of Business Analytics (MindTap Course …

Statistics

ISBN:

9781305627734

Author:

Jeffrey D. Camm, James J. Cochran, Michael J. Fry, Jeffrey W. Ohlmann, David R. Anderson

Publisher:

Cengage Learning