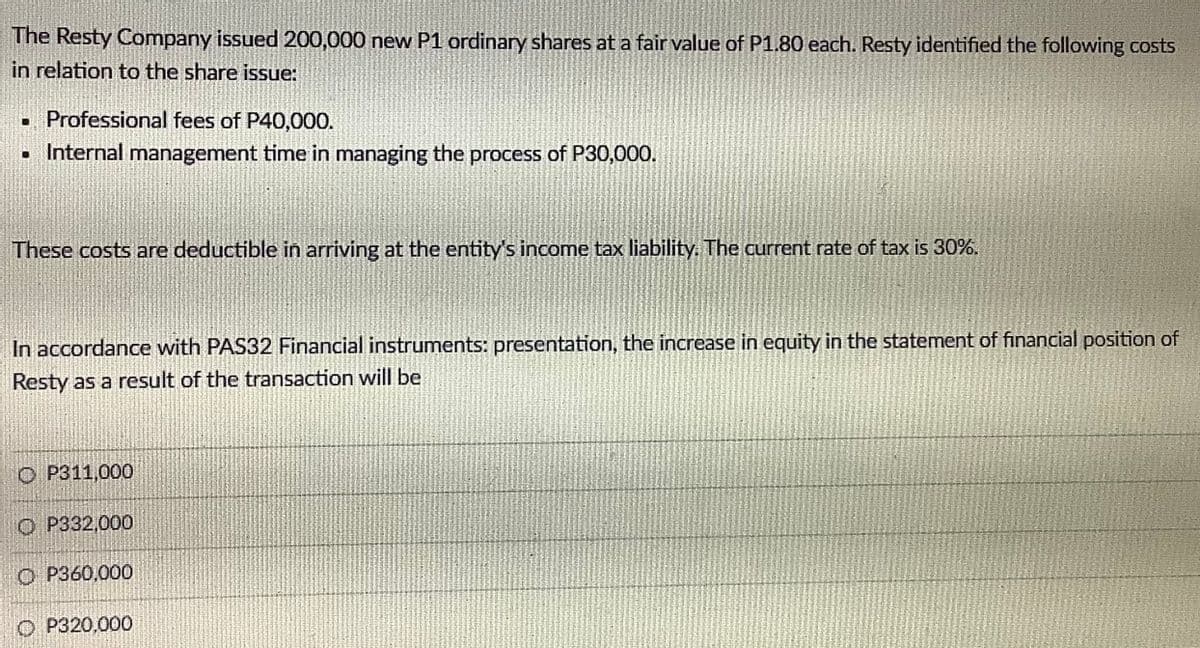

The Resty Company issued 200,000 new P1 ordinary shares at a fair value of P1.80 each. Resty identified the following costs in relation to the share issue: • Professional fees of P40,000. • Internal management time in managing the process of P30,000. These costs are deductible in arriving at the entity's income tax liability. The current rate of tax is 30%. In accordance with PAS32 Financial instruments: presentation, the increase in equity in the statement of financial position of Resty as a result of the transaction will be O P311,000 O P332,000 O P360,000 O P320,000

The Resty Company issued 200,000 new P1 ordinary shares at a fair value of P1.80 each. Resty identified the following costs in relation to the share issue: • Professional fees of P40,000. • Internal management time in managing the process of P30,000. These costs are deductible in arriving at the entity's income tax liability. The current rate of tax is 30%. In accordance with PAS32 Financial instruments: presentation, the increase in equity in the statement of financial position of Resty as a result of the transaction will be O P311,000 O P332,000 O P360,000 O P320,000

Chapter19: Corporations: Distributions Not In Complete Liquidation

Section: Chapter Questions

Problem 1BCRQ

Related questions

Question

100%

19

Transcribed Image Text:The Resty Company issued 200,000 new P1 ordinary shares at a fair value of P1.80 each. Resty identified the following costs

in relation to the share issue:

• Professional fees of P40,000.

• Internal management time in managing the process of P30,000.

These costs are deductible in arriving at the entity's income tax liability. The current rate of tax is 30%.

In accordance with PAS32 Financial instruments: presentation, the increase in equity in the statement of financial position of

Resty as a result of the transaction will be

O P311,000

O P332,000

O P360,000

O P320,000

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning