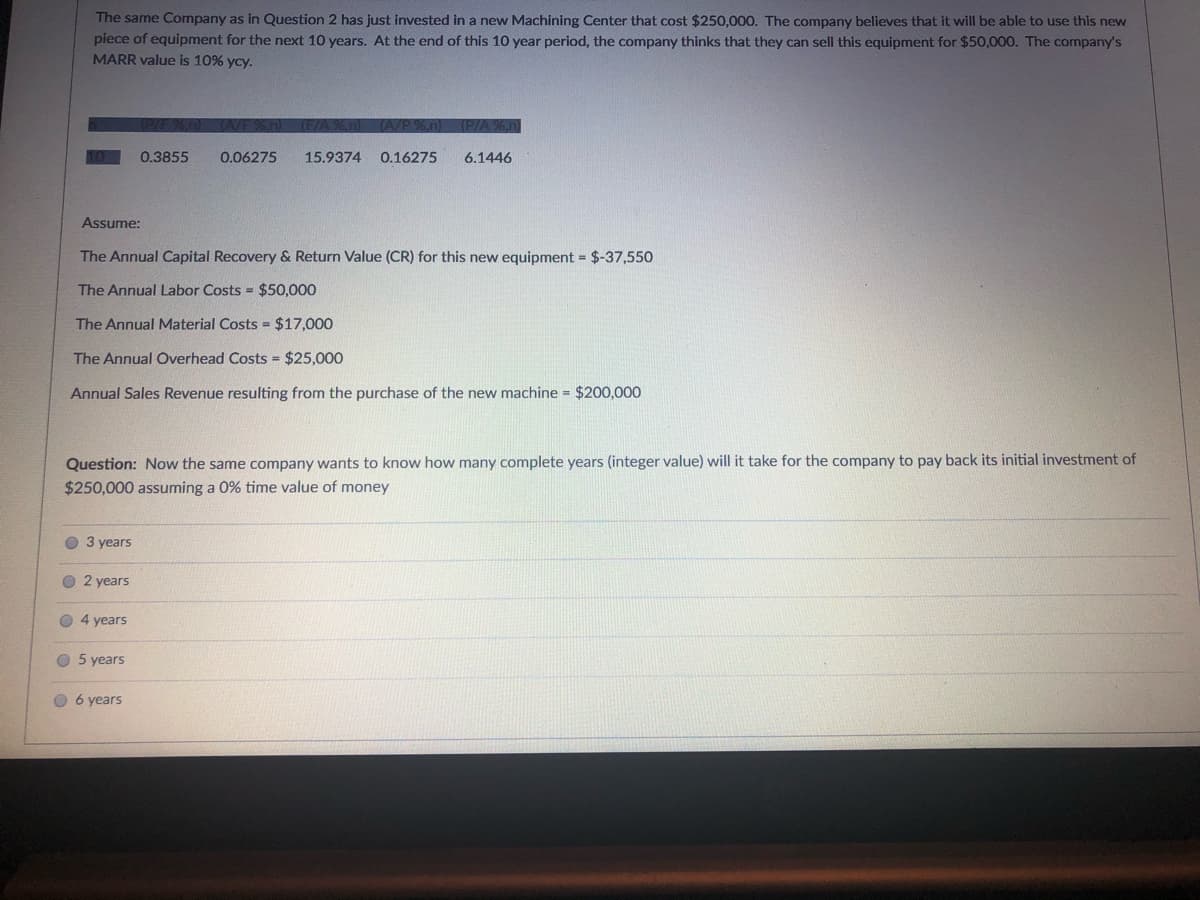

The same Company as in Question 2 has just invested in a new Machining Center that cost $250,000. The company believes that it will be able to use this new piece of equipment for the next 10 years. At the end of this 10 year period, the company thinks that they can sell this equipment for $50,000. The company's MARR value is 10% ycy. 0.3855 0.06275 15.9374 0.16275 6.1446 Assume: The Annual Capital Recovery & Return Value (CR) for this new equipment = $-37,550 The Annual Labor Costs = $50,000 The Annual Material Costs = $17,000 The Annual Overhead Costs = $25,000 Annual Sales Revenue resulting from the purchase of the new machine $200,000 Question: Now the same company wants to know how many complete years (integer value) will it take for the company to pay back its initial investment of $250,000 assuming a 0% time value of money

The same Company as in Question 2 has just invested in a new Machining Center that cost $250,000. The company believes that it will be able to use this new piece of equipment for the next 10 years. At the end of this 10 year period, the company thinks that they can sell this equipment for $50,000. The company's MARR value is 10% ycy. 0.3855 0.06275 15.9374 0.16275 6.1446 Assume: The Annual Capital Recovery & Return Value (CR) for this new equipment = $-37,550 The Annual Labor Costs = $50,000 The Annual Material Costs = $17,000 The Annual Overhead Costs = $25,000 Annual Sales Revenue resulting from the purchase of the new machine $200,000 Question: Now the same company wants to know how many complete years (integer value) will it take for the company to pay back its initial investment of $250,000 assuming a 0% time value of money

Chapter10: Capital Budgeting: Decision Criteria And Real Option

Section10.A: Mutually Exclusive Investments Having Unequal Lives

Problem 2P

Related questions

Question

Transcribed Image Text:The same Company as in Question 2 has just invested in a new Machining Center that cost $250,000. The company believes that it will be able to use this new

piece of equipment for the next 10 years. At the end of this 10 year period, the company thinks that they can sell this equipment for $50,000. The company's

MARR value is 10% ycy.

0.3855

0.06275

15.9374

0.16275

6.1446

Assume:

The Annual Capital Recovery & Return Value (CR) for this new equipment = $-37,550

The Annual Labor Costs = $50,000

The Annual Material Costs = $17,000

The Annual Overhead Costs = $25,000

Annual Sales Revenue resulting from the purchase of the new machine = $200,000

Question: Now the same company wants

know how many

years (integer value) will it take for the company to pay back its initial investment of

$250,000 assuming a 0% time value of money

O 3 years

O 2 years

4 years

O 5 years

O 6 years

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Recommended textbooks for you

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College

Fundamentals Of Financial Management, Concise Edi…

Finance

ISBN:

9781337902571

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning