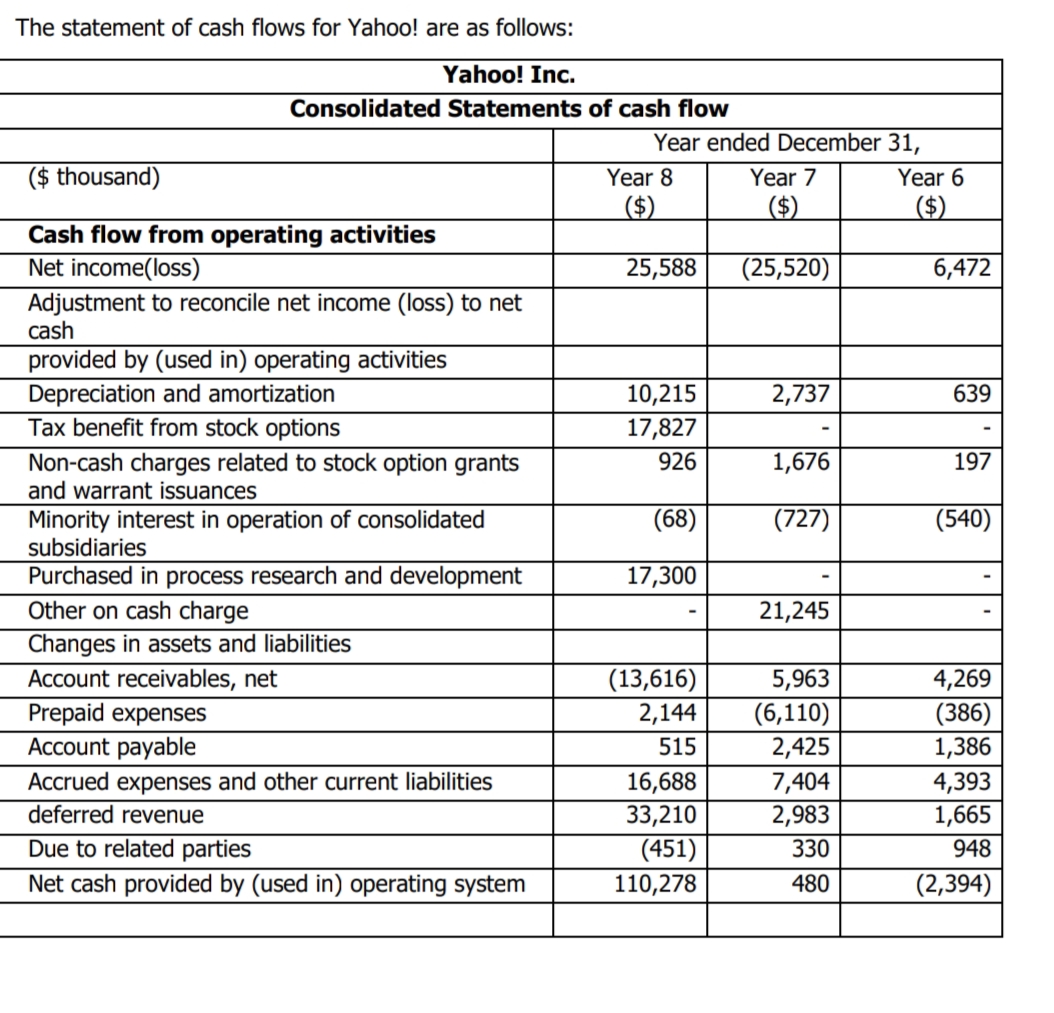

The statement of cash flows for Yahoo! are as follows: Yahoo! Inc. Consolidated Statements of cash flow Year ended December 31, ($ thousand) Year 8 Year 7 Year 6 ($) ($). ($) Cash flow from operating activities Net income(loss) 25,588 (25,520) 6,472 Adjustment to reconcile net income (loss) to net cash provided by (used in) operating activities Depreciation and amortization Tax benefit from stock options 10,215 2,737 639 17,827 Non-cash charges related to stock option grants and warrant issuances 926 1,676 197 Minority interest in operation of consolidated subsidiaries (68) (727) (540) 17,300 Purchased in process research and development Other on cash charge 21,245 Changes in assets and liabilities Account receivables, net (13,616) 2,144 5,963 4,269 Prepaid expenses Account payable (6,110) 2,425 (386) 1,386 515 Accrued expenses and other current liabilities deferred revenue 4,393 1,665 948 7,404 16,688 33,210 (451) 2,983 Due to related parties 330 Net cash provided by (used in) operating system 110,278 480 (2,394)

The statement of cash flows for Yahoo! are as follows: Yahoo! Inc. Consolidated Statements of cash flow Year ended December 31, ($ thousand) Year 8 Year 7 Year 6 ($) ($). ($) Cash flow from operating activities Net income(loss) 25,588 (25,520) 6,472 Adjustment to reconcile net income (loss) to net cash provided by (used in) operating activities Depreciation and amortization Tax benefit from stock options 10,215 2,737 639 17,827 Non-cash charges related to stock option grants and warrant issuances 926 1,676 197 Minority interest in operation of consolidated subsidiaries (68) (727) (540) 17,300 Purchased in process research and development Other on cash charge 21,245 Changes in assets and liabilities Account receivables, net (13,616) 2,144 5,963 4,269 Prepaid expenses Account payable (6,110) 2,425 (386) 1,386 515 Accrued expenses and other current liabilities deferred revenue 4,393 1,665 948 7,404 16,688 33,210 (451) 2,983 Due to related parties 330 Net cash provided by (used in) operating system 110,278 480 (2,394)

Financial Accounting: The Impact on Decision Makers

10th Edition

ISBN:9781305654174

Author:Gary A. Porter, Curtis L. Norton

Publisher:Gary A. Porter, Curtis L. Norton

Chapter12: The Statement Of Cash Flows

Section: Chapter Questions

Problem 12.20MCE

Related questions

Question

CASH FLOW ANALYSIS

a) Yahoo! Engages in purchases and sales of marketable securities. Why do you believe Yahoo! pursue this activity? EXPLAIN BRIELFY.

Yahoo! reports $33.21 million of deferred revenue. Based on your understanding of Yahoo!’s operation, what do you believe this amount represents. EXPLAIN BRIEFLY.

Transcribed Image Text:The statement of cash flows for Yahoo! are as follows:

Yahoo! Inc.

Consolidated Statements of cash flow

Year ended December 31,

($ thousand)

Year 8

Year 7

Year 6

($)

($)

($)

Cash flow from operating activities

Net income(loss)

25,588

(25,520)

6,472

Adjustment to reconcile net income (loss) to net

cash

provided by (used in) operating activities

Depreciation and amortization

Tax benefit from stock options

10,215

17,827

2,737

639

Non-cash charges related

and warrant issuances

stock option grants

926

1,676

197

(68)

Minority interest in operation of consolidated

subsidiaries

(727)

(540)

Purchased in process research and development

Other on cash charge

17,300

21,245

Changes in assets and liabilities

Account receivables, net

(13,616)

5,963

4,269

Prepaid expenses

Account payable

(6,110)

2,425

(386)

1,386

2,144

515

7,404

2,983

Accrued expenses and other current liabilities

4,393

16,688

33,210

deferred revenue

1,665

Due to related parties

(451)

330

948

Net cash provided by (used in) operating system

110,278

480

(2,394)

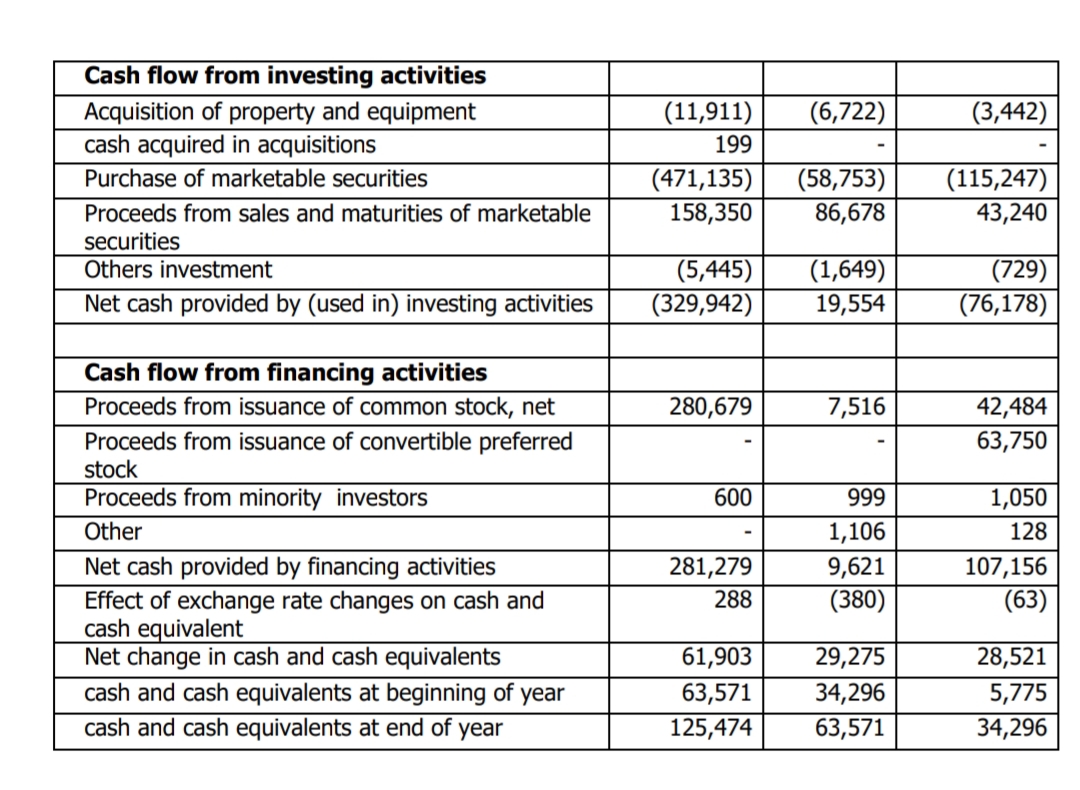

Transcribed Image Text:Cash flow from investing activities

Acquisition of property and equipment

(11,911)

199

(6,722)

(3,442)

cash acquired in acquisitions

Purchase of marketable securities

(471,135)

(115,247)

43,240

(58,753)

Proceeds from sales and maturities of marketable

158,350

86,678

securities

(1,649)

19,554

(729)

(76,178)

Others investment

(5,445)

(329,942)

Net cash provided by (used in) investing activities

Cash flow from financing activities

Proceeds from issuance of common stock, net

280,679

7,516

42,484

63,750

Proceeds from issuance of convertible preferred

stock

Proceeds from minority investors

600

999

1,050

Other

1,106

128

281,279

Net cash provided by financing activities

Effect of exchange rate changes on cash and

cash equivalent

Net change in cash and cash equivalents

cash and cash equivalents at beginning of year

cash and cash equivalents at end of year

9,621

107,156

288

(380)

(63)

61,903

29,275

28,521

63,571

34,296

5,775

125,474

63,571

34,296

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Financial And Managerial Accounting

Accounting

ISBN:

9781337902663

Author:

WARREN, Carl S.

Publisher:

Cengage Learning,