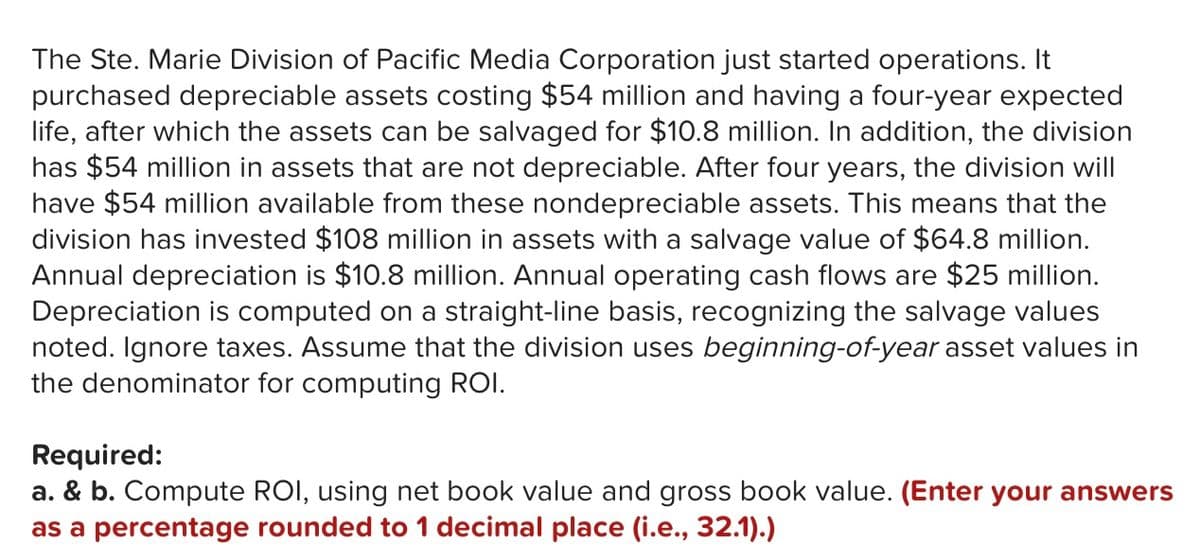

The Ste. Marie Division of Pacific Media Corporation just started operations. It purchased depreciable assets costing $54 million and having a four-year expected life, after which the assets can be salvaged for $10.8 million. In addition, the division has $54 million in assets that are not depreciable. After four years, the division will have $54 million available from these nondepreciable assets. This means that the division has invested $108 million in assets with a salvage value of $64.8 million. Annual depreciation is $10.8 million. Annual operating cash flows are $25 million. Depreciation is computed on a straight-line basis, recognizing the salvage values noted. Ignore taxes. Assume that the division uses beginning-of-year asset values in the denominator for computing ROI. Required: a. & b. Compute ROI, using net book value and gross book value. (Enter your answers as a percentage rounded to 1 decimal place (i.e., 32.1).)

The Ste. Marie Division of Pacific Media Corporation just started operations. It purchased depreciable assets costing $54 million and having a four-year expected life, after which the assets can be salvaged for $10.8 million. In addition, the division has $54 million in assets that are not depreciable. After four years, the division will have $54 million available from these nondepreciable assets. This means that the division has invested $108 million in assets with a salvage value of $64.8 million. Annual depreciation is $10.8 million. Annual operating cash flows are $25 million. Depreciation is computed on a straight-line basis, recognizing the salvage values noted. Ignore taxes. Assume that the division uses beginning-of-year asset values in the denominator for computing ROI. Required: a. & b. Compute ROI, using net book value and gross book value. (Enter your answers as a percentage rounded to 1 decimal place (i.e., 32.1).)

Chapter25: Taxation Of International Transact Ions

Section: Chapter Questions

Problem 25P

Related questions

Question

Transcribed Image Text:The Ste. Marie Division of Pacific Media Corporation just started operations. It

purchased depreciable assets costing $54 million and having a four-year expected

life, after which the assets can be salvaged for $10.8 million. In addition, the division

has $54 million in assets that are not depreciable. After four years, the division will

have $54 million available from these nondepreciable assets. This means that the

division has invested $108 million in assets with a salvage value of $64.8 million.

Annual depreciation is $10.8 million. Annual operating cash flows are $25 million.

Depreciation is computed on a straight-line basis, recognizing the salvage values

noted. Ignore taxes. Assume that the division uses beginning-of-year asset values in

the denominator for computing ROI.

Required:

a. & b. Compute ROI, using net book value and gross book value. (Enter your answers

as a percentage rounded to 1 decimal place (i.e., 32.1).)

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning