The Stenback Company is in the process of preparing its manufacturing overhead budget for the upcoming year. Sales are projected to be 48,000 units. Information about the various manufacturing overhead costs follows: (Click the icon to view the manufacturing overhead cost information.) Requirement Prepare the manufacturing overhead budget for the Stenback Company for the upcoming year. Prepare the manufacturing overhead budget by first calculating the total variable manufacturing overhead, then calculate the total fixed manufacturing overhead and total manufacturing overhead. The Stenback Company Manufacturing Overhead Budget For the Upcoming Year Projected Sales (Units) Variable manufacturing overhead costs: Indirect materials Supplies Indirect labor Plant utilities Repairs and maintenance Total variable manufacturing overhead Data table Indirect materials. Supplies.... Indirect labor... Plant utilities. Repairs and maintenance. Depreciation on plant and equipment.. Insurance on plant and equipment.... Plant supervision...... Variable rate per unit $ Total fixed costs 0.90 0.70 0.40 $ 0.10 $ 0.50 $ $ $ $ 64,000 34,000 10,000 45,000 20,000 68,000 X

The Stenback Company is in the process of preparing its manufacturing overhead budget for the upcoming year. Sales are projected to be 48,000 units. Information about the various manufacturing overhead costs follows: (Click the icon to view the manufacturing overhead cost information.) Requirement Prepare the manufacturing overhead budget for the Stenback Company for the upcoming year. Prepare the manufacturing overhead budget by first calculating the total variable manufacturing overhead, then calculate the total fixed manufacturing overhead and total manufacturing overhead. The Stenback Company Manufacturing Overhead Budget For the Upcoming Year Projected Sales (Units) Variable manufacturing overhead costs: Indirect materials Supplies Indirect labor Plant utilities Repairs and maintenance Total variable manufacturing overhead Data table Indirect materials. Supplies.... Indirect labor... Plant utilities. Repairs and maintenance. Depreciation on plant and equipment.. Insurance on plant and equipment.... Plant supervision...... Variable rate per unit $ Total fixed costs 0.90 0.70 0.40 $ 0.10 $ 0.50 $ $ $ $ 64,000 34,000 10,000 45,000 20,000 68,000 X

Managerial Accounting

15th Edition

ISBN:9781337912020

Author:Carl Warren, Ph.d. Cma William B. Tayler

Publisher:Carl Warren, Ph.d. Cma William B. Tayler

Chapter9: Evaluating Variances From Standard Costs

Section: Chapter Questions

Problem 3E: Salisbury Bottle Company manufactures plastic two-liter bottles for the beverage industry. The cost...

Related questions

Question

qestion 6 attahed in ss below

thanksxn ahelp

appareiapcted it

ipt15ypi15jypimg1pi5gm1pg15

g15pigm15gippizc

1p4t14imtp1

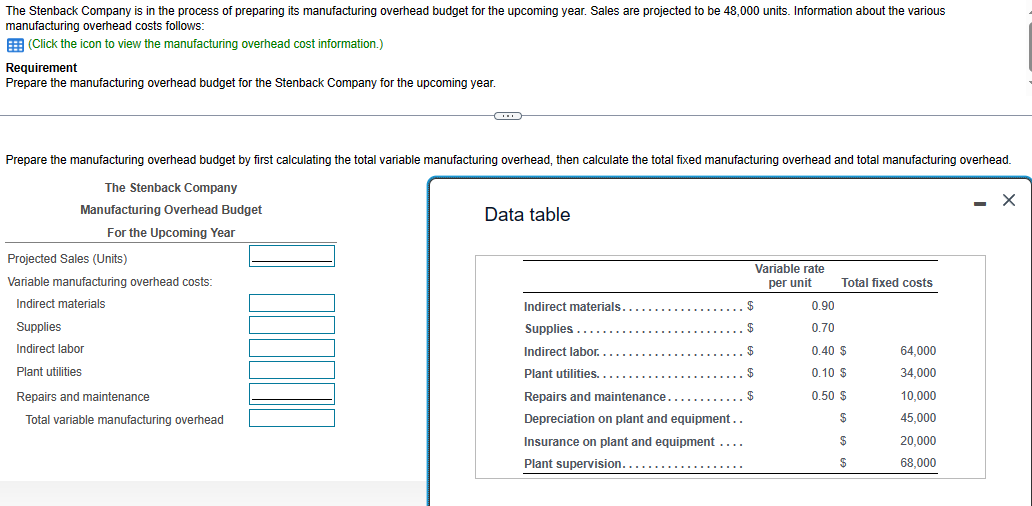

Transcribed Image Text:The Stenback Company is in the process of preparing its manufacturing overhead budget for the upcoming year. Sales are projected to be 48,000 units. Information about the various

manufacturing overhead costs follows:

(Click the icon to view the manufacturing overhead cost information.)

Requirement

Prepare the manufacturing overhead budget for the Stenback Company for the upcoming year.

Prepare the manufacturing overhead budget by first calculating the total variable manufacturing overhead, then calculate the total fixed manufacturing overhead and total manufacturing overhead.

The Stenback Company

Manufacturing Overhead Budget

For the Upcoming Year

Projected Sales (Units)

Variable manufacturing overhead costs:

Indirect materials

Supplies

Indirect labor

Plant utilities

Repairs and maintenance

Total variable manufacturing overhead

Data table

Indirect materials..

Supplies.....

Indirect labor.

Plant utilities....

Repairs and maintenance...

Depreciation on plant and equipment..

Insurance on plant and equipment ....

Plant supervision.....

Variable rate

per unit

$

$

$

$

.$

0.90

0.70

Total fixed costs

0.40 $

0.10 $

0.50 $

$

$

$

64,000

34,000

10,000

45,000

20,000

68,000

-

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps with 1 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Financial And Managerial Accounting

Accounting

ISBN:

9781337902663

Author:

WARREN, Carl S.

Publisher:

Cengage Learning,

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Financial And Managerial Accounting

Accounting

ISBN:

9781337902663

Author:

WARREN, Carl S.

Publisher:

Cengage Learning,

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning

Excel Applications for Accounting Principles

Accounting

ISBN:

9781111581565

Author:

Gaylord N. Smith

Publisher:

Cengage Learning