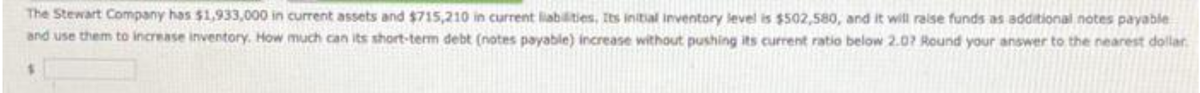

The Stewart Company has $1,933,000 in current assets and $715,210 in current liabilities. Its initial inventory level is $502,580, and it will raise funds as additional notes payable and use them to increase inventory. How much can its short-term debt (notes payable) increase without pushing its current ratio below 2.07 Round your answer to the nearest dolla

Q: If the monthly labor cost for security staff is $33,000, and 50 security workers are each working 40…

A: It is a case of calculating hourly payment done per worker. It is done on the basis of the monthly…

Q: Loaded-Up Fund charges a 12b-1 fee of 1% and maintains an expense ratio of 0.65%. Economy Fund…

A: Data given: Loaded-Up Fund 12b-1 fee =1% Expense ratio = 0.65% Economy Fund Front-end load = 2%,…

Q: Calculate the annual interest that you will receive on the described bond. A $500 Treasury bond with…

A: A treasury bond is a kind of debt security issued by the government and private companies for…

Q: Suppose the spot and three-month forward rates for the yen are ¥79.70 and ¥79.04, respectively. b.…

A: Data given: Spot rate=¥ 79.90 3 months forward rate=¥ 79.04

Q: If a business unit generated $3,600,000 in BEFORE TAX PROFIT and had invested capital of $18,000,000…

A: An indicator of the financial success of ongoing initiatives, Economic Value Added (EVA), also…

Q: Imagine that a friend tells you that you should not rush to pay off your mortgage early because you…

A: Introduction: Mortgage: It is a type of amortized loan by which the debt is repaid in regular…

Q: Using the expectations hypothesis theory for the term structure of interest rates, determine the…

A: Expected return refers to the minimum rate of return to be earned by the investors over a period…

Q: Give typing answer with explanation and conclusion you want to borrow $71,400 from your local bank…

A: The idea of the time value of money (TVM) holds that a quantity of currency is valuable currently…

Q: You have $50,000 in your retirement fund that is earning 5.5 percent per year, compounded quarterly.…

A: Amount present in fund = $50,000 Interest rate = 5.5% compounded quarterly

Q: Bramble Corporation had net credit sales of $14100000 and cost of goods sold of $9370000 for the…

A: Here, Net Credit Sales is $14100000 Cost of Goods Sold is $9370000 Average Inventory is $1171250

Q: How would you explain Valuation Principles and Law of One Price in simple language to someone…

A: Valuation principles and the law of one price are fundamental concepts in economics and finance that…

Q: Give only typing answer with explanation and conclusion Consider an eight-month European put option…

A: An option is a type of financial instrument that is based on the value of underlying securities,…

Q: You wish to buy a $20,000 car. The dealer offers you a 6-year loan with a 7.2 percent APR. What are…

A: The borrower can pay interest at regular intervals or at the time of making payment. The payment…

Q: An investor purchased a fixed-coupon bond at a time when the bond's yield to maturity was 6.9%. The…

A: A bond is a fixed income instrument that pays certain percentage of coupon interest on face value of…

Q: In Q1, suppose the company gives up the cash dividend plan because of shareholder opposition.…

A: Introduction: MM model- A company can finance their operations or fuel their growth and expansion…

Q: Yoyo, Inc. is considering the purchase of a new machine that will reduce manufacturing costs by…

A: Machine Cost = P 60,000 Working Capital Reduction = P 15,000 Net cash outflow = Machine cost -…

Q: You make a $500 deposit today in a savings account that pays 5% interest APY compounded quarterly.…

A: Compound = n = Quarterly = 4 Present Value = pv = $500 Interest Rate = r = 5% Time = t = 2 years

Q: Tech analysis—why? Explain why technicians use it and how it may assist evaluate investment timing.

A: Introduction: Technical analysis-It is a method of analyzing the movement of stock price based on…

Q: Suppose you own a mutual fund that has 10,311,515 shares outstanding. If its total assets are…

A: NAV = (Total Assets - Total liabilities) / No of units Total Assets = $36,600,019 Total liabilities…

Q: uppose a U.S. investor wishes to invest in a British firm currently selling for £40 per share. The…

A: A rate through which individuals or companies convert their domestic currency with the other…

Q: The common stock of Royal Ranch House is selling for $19.70. The firm pays dividends that are…

A: Data given: Price of stock (P)=$19.70 Growth rate (g)=4.10% N= 8 years Required: Estimated price…

Q: The stockholders required rate of return is 6.0% and the stock has a beta of -60. The risk-free rate…

A: Required rate of return =6.0% Beta=-60 Risk-free rate=8% Required: Market Return=?

Q: You would like to be holding a protective put position on the stock of XYZ Co. to lock in a…

A: Put option is one of the options which gives the holder the right to sell the assets underlying the…

Q: Country Bank has $350,000 of 6% debenture bonds outstanding. The bonds were issued at 106 in 2021…

A: Debenture issued at premium of 106 Total amount = $350000 Interest rate = 6% Maturity = 20 years

Q: On January 1, 2018, Tonge Industries had outstanding 800,000 common shares ($1 par) that originally…

A: Data given: Jan1, 2019: No. of outstanding common shares=800,000 Oct.1, 2018: No. of additional…

Q: Compare the monthly payments and total loan costs for the following pairs of loan options. Assume…

A: Monthly Payment on Loan: This monthly payment is computed from the interest charged on the loan and…

Q: Required 1 Required 2 Required 3 Required 4 Determine the break-even time for this investment. Note:…

A: Net present value is the modern method of capital budgeting that is used to determine the present…

Q: CVM Inc bought a machine for $22,000. Its estimated life is 4 years with a residual value of $1,000.…

A: Book Value = P - ( P - S)/Lt * t P = Initial Value S = Salvage value Lt = Lifetime of Asset t =…

Q: A fixed income analyst has made the following assessments: The risk-free rate is expected to remain…

A: Risk-free rate (r) = 2.5% Inflation: 3% this year (I1) 4% next year (I2) 5% a year thereafter (I3)…

Q: Compare the monthly payments and total loan costs for the following pairs of loan options. Assume…

A: Monthly Payment on Loan: This monthly payment is computed from the interest charged on the loan and…

Q: Your stockbroker, John Smith, calls you with a hot stock tip to buy SMITH Inc. The stock is…

A: The dividend discount model (DDM), a mathematical technique for predicting the price of a company's…

Q: Consider the Following 10-year project: Year Cash Flow 0 -30000 1 2500…

A: Net present value (NPV):The net present value is a technique used for making the investment…

Q: A $1500 treasury bond with a coupon rate of 3.1% that has a market value of $1350. What is the…

A: Data given: Face value=$1500 Coupon rate=3.1% Current market value=$ 1350 Required: Current yield…

Q: Using either logarithms or a graphing calculator, fnd the time required for each initial amount to…

A: Principal = $4500 Annual interest rate = 3.6% = 0.036 Number of compounding periods per year =12…

Q: The business is considering a project and is not sure which of these two projects to embark on. The…

A: Net present value is the modern method of capital budgeting that is used to determine the present…

Q: What is the purpose of a budget in financial management?

A: Financial management refers to the process of planning, organizing, directing, and controlling the…

Q: Suppose today is January 1, 2024 and you are given two options: a. an annuity that pays you 1000…

A: An annuity refers to a payment series that provides periodic payment in exchange for a lump sum…

Q: Paper plates are shipped in boxes. Each box has 10 bags of plates. Each bag has 10 plates. Draw…

A: Each box having 10 bags and every bags having 10 plates. We required 180 paper plates so Each box…

Q: You have just inherited $530,000. You plan to save this money and continue to live off the money…

A: Present value = pv = $530,000 Interest rate = r = 5.30% Future value = fv = $1,000,000 Time = t =…

Q: Problem (6): You work for the 3T company, which expects to earn at least 18 percent on its…

A: The variation between the current value of cash inflows and withdrawals over a period of time is…

Q: Sub : Finance Pls answer very fast.I ll upvote correct answer . Thank You ( dont use CHATGPT ) A…

A: A company is planning to introduce a new product in near future , in order to have sufficient money…

Q: [The following information applies to the questions displayed below] Nick's Novelties, Incorporated,…

A: Payback period is the capital budgeting technique used for making investment decisions. Payback…

Q: Carson Trucking is considering whether to expand its regional service center in Mohab, UT. The…

A: The net present value(NPV) of a project is calculated using following equation NPV = -CF0 +…

Q: The maturity value of a $44000, 9%, 60-day note receivable dated July 3 is O $44000. O $51920. O…

A: Maturity value = Present value/issued price + interest accrued for 60 days

Q: A sailboat costs $22,765. You pay 15% down and amortize the rest with equal monthly payments over a…

A: EMI is also known as monthly payment. It includes the Interest amount & principal amount which…

Q: Consider the following loan. Complete parts (a)-(c) below. An individual borrowed $65,000 at an APR…

A: Borrowed Amount = $65000 APR = 5% Monthly Payment (PMT) = $442 No. of years = 19 Compounding =…

Q: The Stewart Pharmaceuticals corporation is considering investing in developing a drug that cures MS.…

A: The project viability can be calculated by using NPV. IF the NPV of the project is positive then the…

Q: A TV programme maker, called Ace Production, is considering a new show with 10 episodes per series…

A: Net present value (NPV):The net present value is a technique used for making the investment…

Q: Use the formula for the present value of an ordinary annuity or the amortization formula to solve…

A: Present Value (PV) = $16,000 Interest Rate (i) = 0.03 Payment (PMT) = $600 The formula for the…

A 164.

Subject:- finance

Step by step

Solved in 3 steps

- Vigo Vacations has $200 million in total assets, $5 million in notes payable, and $25 million in long-term debt. What is the debt ratio?Long-Term Financing Needed At year-end 2018, Wallace Landscapings total assets were 2.17 million, and its accounts payable were 560,000. Sales, which in 2018 were 3.5 million, are expected to increase by 35% in 2019. Total assets and accounts payable are proportional to sales, and that relationship will be maintained. Wallace typically uses no current liabilities other than accounts payable. Common stock amounted to 625,000 in 2018, and retained earnings were 395,000. Wallace has arranged to sell 195,000 of new common stock in 2019 to meet some of its financing needs. The remainder of its financing needs will be met by issuing new long-term debt at the end of 2019. (Because the debt is added at the end of the year, there will be no additional interest expense due to the new debt.) Its net profit margin on sales is 5%, and 45% of earnings will be paid out as dividends. a. What were Wallaces total long-term debt and total liabilities in 2018? b. How much new long-term debt financing will be needed in 2019? [Hint: AFN New stock = New long-term debt.)LONG-TERM FINANCING NEEDED At year-end 2019, total assets for Arrington Inc. were 1.8 million and accounts payable were 450,000. Sales, which in 2019 were 3.0 million, are expected to increase by 25% in 2020. Total assets and accounts payable are proportional to sales, and that relationship will be maintained; that is, they will grow at the same rate as sales. Arrington typically uses no current liabilities other than accounts payable. Common stock amounted to 500,000 in 2019, and retained earnings were 475,000. Arrington plans to sell new common stock in the amount of 130,000. The firms profit margin on sates is 5%; 35% of earnings will be retained. a. What were Arringtons total liabilities in 2019? b. How much new long-term debt financing will be needed in 2020? (Hint: AFN - New stock = New long-term debt.)

- Chasse Building Supply Inc. reported net cash provided by operating activities of $243,000, capital expenditures of $112,900, cash dividends of $35,800, and average maturities of long-term debt over the next 5 years of $122,300. What is Chasses free cash flow and cash flow adequacy ratio? a. $94,300 and 0.77, respectively c. $130,100 and 1.06, respectively b. $94,300 and 0.82, respectively d. $165,900 and 1.36, respectivelyFinancing Deficit Stevens Textile Corporation’s 2018 financial statements are shown here: Balance Sheet as of December 31, 2018 (Thousands of Dollars) Income Statement for December 31, 2018 (Thousands of Dollars) Suppose 2019 sales are projected to increase by 15% over 2018 sales. Use the forecasted financial statement method to forecast a balance sheet and income statement for December 31, 2019. The interest rate on all debt is 10%, and cash earns no interest income. Assume that all additional debt in the form of a line of credit is added at the end of the year, which means that you should base the forecasted interest expense on the balance of debt at the beginning of the year. Use the forecasted income statement to determine the addition to retained earnings. Assume that the company was operating at full capacity in 2018, that it cannot sell off any of its fixed assets, and that any required financing will be borrowed as notes payable. Also, assume that assets, spontaneous liabilities, and operating costs are expected to increase by the same percentage as sales. Determine the additional funds needed. What is the resulting total forecasted amount of the line of credit? In your answers to parts a and b, you should not have charged any interest on the additional debt added during 2019 because it was assumed that the new debt was added at the end of the year. But now suppose that the new debt is added throughout the year. Don’t do any calculations, but how would this change the answers to parts a and b?Income, Cash Flow, and Future Losses On January L 2017, Cermack National Bank loaned 55,000,000 under a 2-year, zero coupon note to a real estate developer. The bank recognized interest revenue on this note of approximately $400,000 per year. Due to an economic downturn, the developer was unable to pay the $5,800,000 maturity amount on December 31, 2018. The bank convinced the developer to pay $800,000 on December 31, 2018, and agreed to extend $5,000,000 credit to the developer despite the gloomy economic outlook for the next several years. Thus, on December 31, 2018, the bank issued a new 2-year, zero coupon note to the developer to mature on December 31, 2020, for $6,000,000. The bank recognized interest revenue on this note of approximately $500,000 per year. The banks external auditor insisted that the riskiness of the new loan be recognized by increasing the allowance for uncollectible notes by $1,500,000 on December 31, 2018, and $2,000,000 on December 31, 2019. On December 31, 20201 the bank received $1,200,000 from the developer and learned that the developer was in bankruptcy and that no additional amounts would be recovered. Required: Prepare a schedule showing the effect of the notes on net income in each of the 4 years.

- Income, Cash Flow, and Future Losses On January L 2017, Cermack National Bank loaned 55,000,000 under a 2-year, zero coupon note to a real estate developer. The bank recognized interest revenue on this note of approximately $400,000 per year. Due to an economic downturn, the developer was unable to pay the $5,800,000 maturity amount on December 31, 2018. The bank convinced the developer to pay $800,000 on December 31, 2018, and agreed to extend $5,000,000 credit to the developer despite the gloomy economic outlook for the next several years. Thus, on December 31, 2018, the bank issued a new 2-year, zero coupon note to the developer to mature on December 31, 2020, for $6,000,000. The bank recognized interest revenue on this note of approximately $500,000 per year. The banks external auditor insisted that the riskiness of the new loan be recognized by increasing the allowance for uncollectible notes by $1,500,000 on December 31, 2018, and $2,000,000 on December 31, 2019. On December 31, 20201 the bank received $1,200,000 from the developer and learned that the developer was in bankruptcy and that no additional amounts would be recovered. Required: 1. Prepare a schedule showing annual cash flows fur the two notes in each of the 4 years.Income, Cash Flow, and Future Losses On January L 2017, Cermack National Bank loaned 55,000,000 under a 2-year, zero coupon note to a real estate developer. The bank recognized interest revenue on this note of approximately $400,000 per year. Due to an economic downturn, the developer was unable to pay the $5,800,000 maturity amount on December 31, 2018. The bank convinced the developer to pay $800,000 on December 31, 2018, and agreed to extend $5,000,000 credit to the developer despite the gloomy economic outlook for the next several years. Thus, on December 31, 2018, the bank issued a new 2-year, zero coupon note to the developer to mature on December 31, 2020, for $6,000,000. The bank recognized interest revenue on this note of approximately $500,000 per year. The banks external auditor insisted that the riskiness of the new loan be recognized by increasing the allowance for uncollectible notes by $1,500,000 on December 31, 2018, and $2,000,000 on December 31, 2019. On December 31, 20201 the bank received $1,200,000 from the developer and learned that the developer was in bankruptcy and that no additional amounts would be recovered. Required: Which figure, net income or net cash flow, does the better job of telling the banks stock-holders about the effect of these notes on the bank? Explain by reference to the schedules prepared in Requirements 1 and 2.Dortmund Stockyard reports $896,000 in credit sales for 2018 and $802,670 in 2019. It has a $675,000 accounts receivable balance at the end of 2018, and $682,000 at the end of 2019. Dortmund uses the balance sheet method to record bad debt estimation at 8% during 2018. To manage earnings more favorably, Dortmund changes bad debt estimation to the income statement method at 6% during 2019. A. Determine the bad debt estimation for 2018. B. Determine the bad debt estimation for 2019. C. Describe a benefit to Dortmund Stockyard in 2019 as a result of its earnings management.

- The Stewart Company has $1,068,000 in current assets and $384,480 in current liabilities. Its initial inventory level is $234,960, and it will raise funds as additional notes payable and use them to increase inventory. How much can its short-term debt (notes payable) increase without pushing its current ratio below 2.0? Round your answer to the nearest dollar.The Nelson Company has $1,400,000 in current assets and $500,000 in current liabilities. Its initial inventory level is $330,000, and it will raise funds as additional notes payable and use them to increase inventory. How much can Nelson's short-term debt (notes payable) increase without pushing its current ratio below 1.8? Do not round intermediate calculations. Round your answer to the nearest dollar.Hansen's Auto Supply has $1,021,000 in current assets and $420,000 in current liabilities. Its initial inventory level is $390,000, and it will raise funds as additional notes payable and use them to increase inventory. How much can its short-term debt (notes payable) increase without pushing its current ratio below 2.3? a. $145,652 b. $55,000 c. $23,913 d. $42,308 e. $257,692