Country Bank has $350,000 of 6% debenture bonds outstanding. The bonds were issued at 106 in 2021 and mature in 2041. The bonds have annual interest payments. Read the requirements Requirement 1. How much cash did Country Bank receive when it issued these bonds? At the time the bortis were issued, Country Bank received cash of Requirement 2. How much cash in total will Country Bank pay the bondholders through the maturity date of the bonds? Through the maturity date of the bonds, Country Bank will pay the bondholders total cash of Requirement 3. Calculate the difference between your answers to requirements 1 and 2. This difference represents Country Bank's total interest expense over the life of the bonds. The difference between your answers to requirements 1 and 2 is

Country Bank has $350,000 of 6% debenture bonds outstanding. The bonds were issued at 106 in 2021 and mature in 2041. The bonds have annual interest payments. Read the requirements Requirement 1. How much cash did Country Bank receive when it issued these bonds? At the time the bortis were issued, Country Bank received cash of Requirement 2. How much cash in total will Country Bank pay the bondholders through the maturity date of the bonds? Through the maturity date of the bonds, Country Bank will pay the bondholders total cash of Requirement 3. Calculate the difference between your answers to requirements 1 and 2. This difference represents Country Bank's total interest expense over the life of the bonds. The difference between your answers to requirements 1 and 2 is

Chapter13: Long-term Liabilities

Section: Chapter Questions

Problem 6PA: Aggies Inc. issued bonds with a $500,000 face value, 10% interest rate, and a 4-year term on July 1,...

Related questions

Question

Subject:

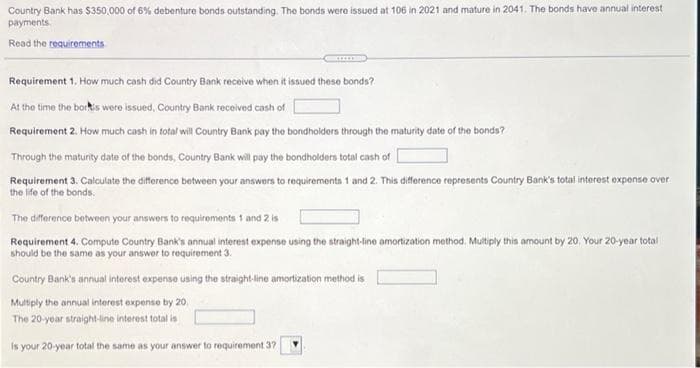

Transcribed Image Text:Country Bank has $350,000 of 6% debenture bonds outstanding. The bonds were issued at 106 in 2021 and mature in 2041. The bonds have annual interest

payments.

Read the requirements

Requirement 1, How much cash did Country Bank receive when it issued these bonds?

At the time the borks were issued, Country Bank received cash of

Requirement 2. How much cash in total will Country Bank pay the bondholders through the maturity date of the bonds?

Through the maturity date of the bonds, Country Bank will pay the bondholders total cash of

Requirement 3. Calculate the difference between your answers to requirements 1 and 2. This difference represents Country Bank's total interest expense over

the life of the bonds.

The difference between your answers to requirements 1 and 2 is

Requirement 4. Compute Country Bank's annual interest expense using the straight-line amortization method. Multiply this amount by 20. Your 20-year total

should be the same as your answer to requirement 3.

Country Bank's annual interest expense using the straight-line amortization method is

Multiply the annual interest expense by 20.

The 20-year straight-line interest total is

is your 20-year total the same as your answer to requirement 37

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Recommended textbooks for you

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Financial Accounting

Accounting

ISBN:

9781305088436

Author:

Carl Warren, Jim Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Financial Accounting

Accounting

ISBN:

9781305088436

Author:

Carl Warren, Jim Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT