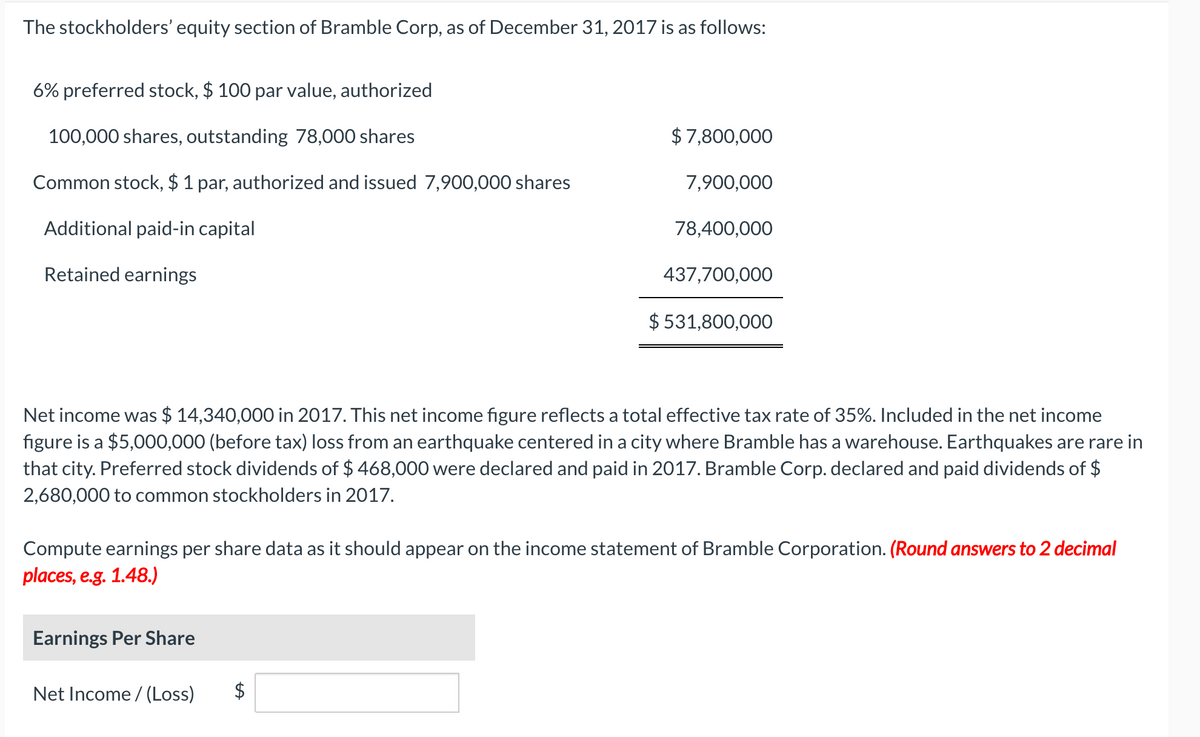

The stockholders' equity section of Bramble Corp, as of December 31, 2017 is as follows: 6% preferred stock, $ 100 par value, authorized 100,000 shares, outstanding 78,000 shares $7,800,000 Common stock, $ 1 par, authorized and issued 7,900,000 shares 7,900,000 Additional paid-in capital 78,400,000 Retained earnings 437,700,000 $ 531,800,000 Net income was $ 14,340,000 in 2017. This net income figure reflects a total effective tax rate of 35%. Included in the net income figure is a $5,000,000 (before tax) loss from an earthquake centered in a city where Bramble has a warehouse. Earthquakes are rare in that city. Preferred stock dividends of $ 468,000 were declared and paid in 2017. Bramble Corp. declared and paid dividends of $ 2,680,000 to common stockholders in 2017. Compute earnings per share data as it should appear on the income statement of Bramble Corporation. (Round answers to 2 decimal places, e.g. 1.48.) Earnings Per Share Net Income / (Loss) $

The stockholders' equity section of Bramble Corp, as of December 31, 2017 is as follows: 6% preferred stock, $ 100 par value, authorized 100,000 shares, outstanding 78,000 shares $7,800,000 Common stock, $ 1 par, authorized and issued 7,900,000 shares 7,900,000 Additional paid-in capital 78,400,000 Retained earnings 437,700,000 $ 531,800,000 Net income was $ 14,340,000 in 2017. This net income figure reflects a total effective tax rate of 35%. Included in the net income figure is a $5,000,000 (before tax) loss from an earthquake centered in a city where Bramble has a warehouse. Earthquakes are rare in that city. Preferred stock dividends of $ 468,000 were declared and paid in 2017. Bramble Corp. declared and paid dividends of $ 2,680,000 to common stockholders in 2017. Compute earnings per share data as it should appear on the income statement of Bramble Corporation. (Round answers to 2 decimal places, e.g. 1.48.) Earnings Per Share Net Income / (Loss) $

Excel Applications for Accounting Principles

4th Edition

ISBN:9781111581565

Author:Gaylord N. Smith

Publisher:Gaylord N. Smith

Chapter12: Statement Of Stockholders’ Equity (stockeq)

Section: Chapter Questions

Problem 4R: The following selected transactions and events occurred during 2013: a. Issued 200 shares of...

Related questions

Question

100%

Transcribed Image Text:The stockholders' equity section of Bramble Corp, as of December 31, 2017 is as follows:

6% preferred stock, $ 100 par value, authorized

100,000 shares, outstanding 78,000 shares

$7,800,000

Common stock, $ 1 par, authorized and issued 7,900,000 shares

7,900,000

Additional paid-in capital

78,400,000

Retained earnings

437,700,000

$ 531,800,000

Net income was $ 14,340,000 in 2017. This net income figure reflects a total effective tax rate of 35%. Included in the net income

figure is a $5,000,000 (before tax) loss from an earthquake centered in a city where Bramble has a warehouse. Earthquakes are rare in

that city. Preferred stock dividends of $ 468,000 were declared and paid in 2017. Bramble Corp. declared and paid dividends of $

2,680,000 to common stockholders in 2017.

Compute earnings per share data as it should appear on the income statement of Bramble Corporation. (Round answers to 2 decimal

places, e.g. 1.48.)

Earnings Per Share

Net Income / (Loss)

$

%24

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Recommended textbooks for you

Excel Applications for Accounting Principles

Accounting

ISBN:

9781111581565

Author:

Gaylord N. Smith

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

College Accounting, Chapters 1-27 (New in Account…

Accounting

ISBN:

9781305666160

Author:

James A. Heintz, Robert W. Parry

Publisher:

Cengage Learning

Excel Applications for Accounting Principles

Accounting

ISBN:

9781111581565

Author:

Gaylord N. Smith

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

College Accounting, Chapters 1-27 (New in Account…

Accounting

ISBN:

9781305666160

Author:

James A. Heintz, Robert W. Parry

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning