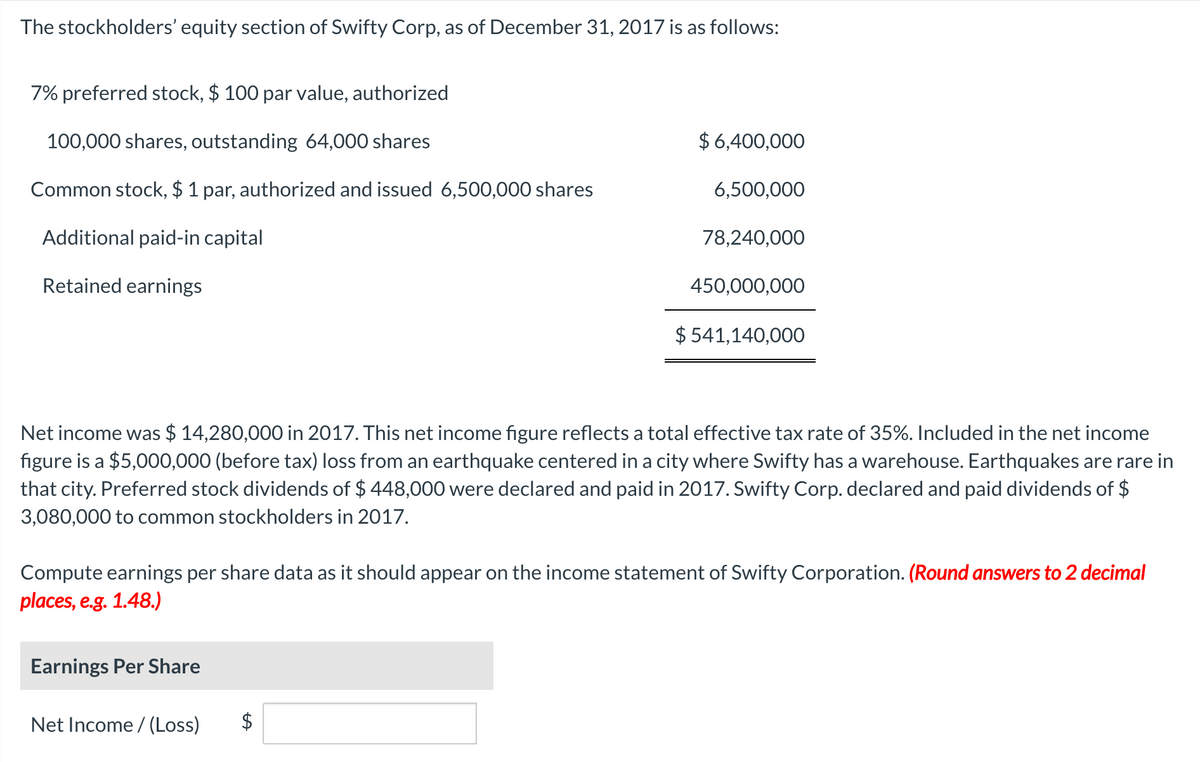

The stockholders' equity section of Swifty Corp, as of December 31, 2017 is as follows: 7% preferred stock, $ 100 par value, authorized 100,000 shares, outstanding 64,000 shares $ 6,400,000 Common stock, $ 1 par, authorized and issued 6,500,000 shares 6,500,000 Additional paid-in capital 78,240,000 Retained earnings 450,000,000 $ 541,140,000 Net income was $ 14,280,000 in 2017. This net income figure reflects a total effective tax rate of 35%. Included in the net income fig e is a $5,000,000 (before tax) loss from an earthq that city. Preferred stock dividends of $ 448,000 were declared and paid in 2017. Swifty Corp. declared and paid dividends of $ ake centered in a city where Swifty has a warehouse. Earthquakes are rare in 3,080,000 to common stockholders in 2017. Compute earnings per share data as it should appear on the income statement of Swifty Corporation. (Round answers to 2 decimal places, e.g. 1.48.) Earnings Per Share

Q: Comfort Specialists, Inc. reported the following stockholders' equity on its balance sheet at…

A: As posted multiple sub parts we are answering only first three sub parts kindly repost the…

Q: The shareholders' equity section of Nazario Freight Express, Inc. as at Dec. 31, 2018 appeared as…

A: Since there are multi sub-parts, we will solve first three for you. To get the remaining sub-parts…

Q: On January 1, 2014, Salalima Company had Common Stock of 800,000 authorizedshares with P20 par…

A: Since we answer upto three sub-parts, we shall answer first three. Please resubmit a new question…

Q: 4. The par value of the common stock $fill in the blank 4 per share 5. The average per-share…

A: Note: Since you have posted a question with multiple sub-parts, we will solve first three sub-parts…

Q: December 31, 2017, Raja Corporations's balance sheet reported the following: Stockholders' Equity…

A: Solution Concept Cost method of accounting for treasury stock While using the Cost method of…

Q: On January 1, 2017, Geffrey Corporation had the following stockholders’ equity accounts. Common…

A: The stock split leads to change in number of shares as 2 for 1 stock split will double the number of…

Q: Kohler Corporation reports the following components of stockholders’ equity on December 31, 2016:…

A: The process of recording business transactions in the books of accounts for the first time is known…

Q: The stockholders’ equity section of Sweet Corporation appears below as of December 31, 2017. 8%…

A: Earnings per Share - Earnings per share is the income earned by the company to the shareholder's of…

Q: The equity section of Atticus Group’s 2017 year-end balance sheet had 200,000 shares of $4 par value…

A: There are 2 kinds of stock splits:- 1. Forward stock split; 2. Reverse stock split

Q: Determine the dividend payout ratio for the common stock. Round the payout ratio to four decimal…

A: It has been given in the question that common shareholders have the right on the total income of…

Q: The data below are from the December 31, 2017, balance sheet of CAREBEAR CO Common stock, P10 par…

A: No. of common stock = Common stock value / Par value per share = P500,000 / P10 = 50,000 shares

Q: The stockholders' equity section of Bramble Corp, as of December 31, 2017 is as follows: 6%…

A: Earnings per share = (Net income - preferred dividend) / No. of common shares outstanding =…

Q: The stockholders’ equity accounts of Pearl Company have the following balances on December 31, 2017.…

A:

Q: Gabby Corporation has two classes of stock and the company’s balance sheet includes the following:…

A: Amount of preferred shares issued=Number of shares×Par value=10,000×$25=$250,000

Q: The stockholders’ equity section of Bridgeport Corp, as of December 31, 2017 is as follows: 9%…

A: The management evaluates the EPS value of the corporation to analyze the earnings belongs to each…

Q: On January 1, 2017, Pronghorn Corp. had these stockholders' equity accounts. Common Stock ($10 par…

A: Stockholders’ equity is the measure of assets staying in a business after the sum total of the…

Q: The stockholders’ equity accounts of Ayayai Corp. on January 1, 2017, were as follows. Preferred…

A: Stockholder holders' equity includes Preferred Stock, Common Stock, Paid in capital in excess of…

Q: The stockholders' equity section of Swifty Corp, as of December 31, 2017 is as follows: 7% preferred…

A: Earnings per share = (Net income - preferred dividend) / No. of common shares outstanding =…

Q: The stockholders’ equity accounts of Whispering Winds Corp. on January 1, 2017, were as follows.…

A: Note: Hi! Thank you for the question As per the honor code, We’ll answer the first question since…

Q: The Stockholders' Equity section of the December 31, 2017, balance sheet of Eldon Company appeared…

A: The book value of the common stock refers to the amount of balance sheet that is attributable to the…

Q: Extreme Company reported the following information about its stock on its December 31, 2016, balance…

A: Earnings Per share- It is the amount of earnings that's accrued by shareholders on each share in…

Q: The stockholders’ equity accounts of Whispering Winds Corp. on January 1, 2017, were as follows.…

A: Stockholders' equity refers to the assets remaining in a business once all liabilities have been…

Q: Preferred Stock, 50,000 shares $5,000,000 Common stock, 1,200,000 shares 2,400,000 Paid-in…

A: Stockholders equity is generally described as the wealth remaining after paying all the liabilities.…

Q: The stockholders’ equity accounts of Pearl Company have the following balances on December 31, 2017.…

A: Retained earnings = Number of shares * Market price* Stock dividend rate Retained earnings =…

Q: Divac Company has developed a statement of stockholders' equity for the year 2017 as follows:…

A: Formulas Used: Dividend payout ratio = [Cash dividend / Net Income]*100

Q: Analysis of Stockholders' Equity The Stockholders' Equity section of the December 31, 2017, balance…

A: Stockholders' equity refers to the amount that belongs to the owners and shareholders of the company…

Q: 80,000 Additional paid-in capital—Preferred 9,900 Additional paid-in capital—Common 480,000…

A: Shareholder's equity refers to the amount which company owners have invested in the business and it…

Q: Sunland Company December 31, 2017 balance sheet showed the following: 6% preferred stock, $10 par…

A: Financial Management: Financial management comprises of two words i.e. Finance and management.…

Q: The stockholders’ equity accounts of Cheyenne Corp. on January 1, 2017, were as follows.…

A: Step 1: Prepare journal entries to record the transactions:

Q: The stockholders’ equity section of the balance sheet for Mann Equipment Co. at December 31, 2018,…

A:

Q: Fechter Corporation had the following stockholders’ equity accounts on January 1, 2015: Common Stock…

A: To Determine - Journal entry of treasury stock according to cost method Cost method is one of the…

Q: Analysis of Stockholders' Equity The Stockholders' Equity section of the December 31, 2017, balance…

A:

Q: The Stockholders' Equity section of the balance sheet for Obregon, Inc. at the end of 2017 appears…

A: 1) Formula: EPS=Earnings available to common shareholdersNumber of shares

Q: Analysis of Stockholders' Equity The Stockholders' Equity section of the December 31, 2017, balance…

A: “Since you have posted a question with multiple sub-parts, we will solve the first three subparts…

Q: The stockholders' equity of Hammel Company at December 31, 2016, is shown below. 5% preferred…

A: Hence, the effect of the transactions are mentioned in the above balance sheet.

Q: The shareholders' equity section of Nazario Freight Express, Inc. as at Dec. 31, 2018 appeared as…

A: Comment- Multiple Questions Asked. Preference Shares- It refers to the shares that get precedence…

Q: Gordon Corporation reported the following equity section on its current balance sheet. The common…

A: A Stock Dividend is the payment of dividends in the forms of shares of the company. There are 2…

Q: The stockholders’ equity accounts of Ayayai Corp. on January 1, 2017, were as follows. Preferred…

A: Debit the receiver and credit the giver Debit what comes in and credit what goes out Debit expenses…

Q: The Annapolis Corporation's stockholders' equity accounts have the following balances as of January…

A: Step 1 Journal is the part of book keeping.

Q: Divac Company has developed a statement of stockholders' equity for the year 2017 as follows:…

A: Here, Balance of Preferred Stock at the end of Dec,31 is $110,000 Paid in Preferred Capital is…

Q: The stockholders’ equity accounts of Flint Corporation on January 1, 2017, were as follows.…

A: Journal entry refers to the posting of the transactions into the books of the company or entity and…

Q: The stockholders’ equity accounts of Flint Corporation on January 1, 2017, were as follows.…

A: The dividend is declared from the retained earnings of the business.

Q: The stockholders’ equity section of Porter Corporation’s balance sheet as of December 31, 2017 is as…

A: Dividend Declared=Common shares×Per share=400,000+10,000×$0.2=$82,000

Q: Divac Company has developed a statement of stockholders' equity for the year 2017 as follows:…

A: Dividend Payout Ratio = Total dividends/Net income

Q: Statement of Shareholders' Equity At the end of 2017, Jeffco Inc. had the following equity accounts…

A: As posted two sub parts only first sub part is answered kindly repost the unanswered question as a…

Q: The stockholders' equity section of Blue Spruce Corp, as of December 31, 2017 is as follows: 9%…

A: SOLUTION- EARNING PER SHARE FORMULA= (NET INCOME - PREFERENCE DIVIDEND ) / COMMON SHARE OUTSTANDING…

Q: Analysis of Stockholders' Equity The Stockholders' Equity section of the December 31, 2017, balance…

A: Hi, there, Thanks for posting the question. As per our Q&A honour code, we must answer the first…

Trending now

This is a popular solution!

Step by step

Solved in 4 steps

- Selected transactions completed by Equinox Products Inc. during the fiscal year ended December 31, 2016, were as follows: a. Issued 15,000 shares of 0 par common stock at 0, receiving cash. b. Issued 4,000 shares of 80 par preferred 5% stock at 100, receiving cash. c. Issued 500,000 of 10-year, 5% bonds at 104, with interest payable semiannually. d. Declared a quarterly dividend of 0.50 per share on common stock and 1.00 per share on preferred stock. On the date of record, 100,000 shares of common stock were outstanding, no treasury shares were held, and 20,000 shares of preferred stock were outstanding. e. Paid the cash dividends declared in (d). f. Purchased 7,500 shares of Solstice Corp. at 40 per share, plus a 150 brokerage commission. The investment is classified as an available-for-sale investment. g. Purchased 8,000 shares of treasury common stock at 33 per share. h. Purchased 40,000 shares of Pinkberry Co. stock directly from the founders for 24 per share. Pinkberry has 125,000 shares issued and outstanding. Equinox Products Inc. treated the investment as an equity method investment. i. Declared a 1.00 quarterly cash dividend per share on preferred stock. On the date of record, 20,000 shares of preferred stock had been issued. j. Paid the cash dividends to the preferred stockholders. k. Received 27,500 dividend from Pinkberry Co. investment in (h). l. Purchased 90,000 of Dream Inc. 10-year, 5% bonds, directly from the issuing company, at their face amount plus accrued interest of 375. The bonds are classified as a held- to-maturitv long-term investment. m. Sold, at 38 per share, 2,600 shares of treasury common stock purchased in (g). n. Received a dividend of 0.60 per share from the Solstice Corp. investment in (f). o. Sold 1,000 shares of Solstice Corp. at 545, including commission. p. Recorded the payment of semiannual interest on the bonds issued in (c) and the amortization of the premium for six months. The amortization is determined using the straight-line method, q. Accrued interest for three months on the Dream Inc. bonds purchased in (1). r. Pinkberry Co. recorded total earnings of 240,000. Equinox Products recorded equity earnings for its share of Pinkberry Co. net income. s. The fair value for Solstice Corp. stock was 39.02 per share on December 31, 2016. The investment is adjusted to fair value, using a valuation allowance account. Assume Valuation Allowance for Available-for-Sale Investments had a beginning balance of zero. Instructions Journalize the selected transactions. After all of the transactions for the year ended December 31, 2016, had been posted [including the transactions recorded in part (1) and all adjusting entries], the data that follows were taken from the records of Equinox Products Inc. a. Prepare a multiple-step income statement for the year ended December 31, 2016, concluding with earnings per share. In computing earnings per share, assume that the average number of common shares outstanding was 100,000 and preferred dividends were 100,000. (Round earnings per share to the nearest cent.) b. Prepare a retained earnings statement for the year ended December 31, 2016. c. Prepare a balance sheet in report form as of December 31, 2016. Income statement data: Advertising expense 150,000 Cost of merchandise sold 3,700,000 Delivery expense 30,000 Depreciation expense -office buildings and equipment 30,000 Depreciation expensestore buildings and equipment 100,000 Dividend revenue 4,500 Gain on sale of investment 4,980 Income from Pinkberry Co. investment 76,800 Income tax expense 140,500 Interest expense 21,000 Interest revenue 2,720 Miscellaneous administrative expense 7.500 Miscellaneous selling expense 14,000 Office rent expense 50,000 Office salaries expense 170,000 Office supplies expense 10,000 Sales 5,254,000 Sales commissions 185,000 Sales salaries expense 385,000 Store supplies expense 21,000 Retained earnings and balance sheet data: Accounts payable 194,300 Accounts receivable 545,000 Accumulated depreciationoffice buildings and equipment 1,580,000 Accumulated depreciationstore buildings and equipment 4,126,000 Allowance for doubtful accounts 8,450 Available for sale investments (at cost) 260,130 Bonds payable. 5%. due 2024 500,000 Cash 246,000 Common stock, 20 par (400,000 shares authorized; 100,000 shares issued. 94,600 outstanding) 2,000,000 Dividends: Cash dividends for common stock 155,120 Cash dividends for preferred stock 100,000 Goodwill 500,000 Income tax payable 44,000 Interest receivable 1,125 Investment in Pinkberry Co. stock (equity method) 1,009,300 Investment in Dream Inc. bonds (long term) 90,000 Merchandise inventory [December 31, 2016). at lower of cost (FIFO) or market 778,000 Office buildings and equipment 4.320,000 Paid-in capital from sale of treasury stock 13,000 Excess of issue price over parcommon stock 886,800 Excess of issue price over parpreferred stock 150,000 Preferred 5% stock. 80 par (30,000 shares authorized; 20,000 shares issued] 1,600,000 Premium on bonds payable 19,000 Prepaid expenses 27,400 Retained earnings, January 1, 2016 9,319,725 Store buildings and equipment 12,560,000 Treasury stock (5,400 shares of common stock at cost of 33 per share) 178,200 Unrealized gain (loss) on available for sale investments (6,500) Valuation allowance for available for sale investments (6,500)Selected transactions completed by Equinox Products Inc. during the fiscal year ended December 31, 2016, were as follows: a. Issued 15,000 shares of 20 par common stock at 30, receiving cash. b. Issued 4,000 shares of 80 par preferred 5% stock at 100, receiving cash. c. Issued 500,000 of 10-year, 5% bonds at 104, with interest payable semiannually. d. Declared a quarterly dividend of 0.50 per share on common stock and 1.00 per share on preferred stock. On the date of record, 100,000 shares of common stock were outstanding, no treasury shares were held, and 20,000 shares of preferred stock were outstanding. e. Paid the cash dividends declared in (d). f. Purchased 7,500 shares of Solstice Corp. at 40 per share, plus a 150 brokerage commission. The investment is classified as an available-for-sale investment. g. Purchased 8,000 shares of treasury common stock at 33 per share. h. Purchased 40,000 shares of Pinkberry Co. stock directly from the founders for 24 per share. Pinkberry has 125,000 shares issued and outstanding. Equinox Products Inc. treated the investment as an equity method investment. i. Declared a 1.00 quarterly cash dividend per share on preferred stock. On the date of record, 20,000 shares of preferred stock had been issued. j. Paid the cash dividends to the preferred stockholders. k. Received 27,500 dividend from Pinkberry Co. investment in (h). l. Purchased 90,000 of Dream Inc. 10-year, 5% bonds, directly from the issuing company, at their face amount plus accrued interest of 375. The bonds are classified as a heldtomaturity long-term investment. m. Sold, at 38 per share, 2,600 shares of treasury common stock purchased in (g). n. Received a dividend of 0.60 per share from the Solstice Corp. investment in (f). o. Sold 1,000 shares of Solstice Corp. at 45, including commission. p. Recorded the payment of semiannual interest on the bonds issued in (c) and the amortization of the premium for six months. The amortization is determined using the straight-line method. q. Accrued interest for three months on the Dream Inc. bonds purchased in (l). r. Pinkberry Co. recorded total earnings of 240,000. Equinox Products recorded equity earnings for its share of Pinkberry Co. net income. s. The fair value for Solstice Corp. stock was 39.02 per share on December 31, 2016. The investment is adjusted to fair value, using a valuation allowance account. Assume Valuation Allowance for Available-for-Sale Investments had a beginning balance of zero. Instructions 1. Journalize the selected transactions. 2. After all of the transactions for the year ended December 31, 2016, had been posted [including the transactions recorded in part (1) and all adjusting entries], the data that follows were taken from the records of Equinox Products Inc. a. Prepare a multiple-step income statement for the year ended December 31, 2016, concluding with earnings per share. In computing earnings per share, assume that the average number of common shares outstanding was 100,000 and preferred dividends were 100,000. (Round earnings per share to the nearest cent.) b. Prepare a retained earnings statement for the year ended December 31, 2016. c. Prepare a balance sheet in report form as of December 31, 2016.Chen Corporation began 2012 with the following stockholders equity balances: The following selected transactions and events occurred during the year: a. Issued 10,000 shares of common stock for 60,000. b. Purchased 1,200 shares of treasury stock for 4,800. c. Sold 2,000 shares of treasury stock for 11,000. d. Generated net income of 94,000. e. Declared and paid the full years dividend on preferred stock and a dividend of 1.00 per share on common stock outstanding at the end of the year. Chen Corporation maintains several paid-in capital accounts (Paid-in Capital in Excess of Par, Paid-in Capital from Treasury Stock, etc.) in its ledger, but combines them all as Additional paid-in capital when preparing financial statements. Open the file STOCKEQ from the website for this book at cengagebrain.com. Enter the formulas in the appropriate cells on the worksheet. Then fill in the columns to show the effect of each of the selected transactions and events listed earlier. Enter your name in cell A1. Save the completed worksheet as STOCKEQ2. Print the worksheet. Also print your formulas. Check figure: Total stockholders equity balance at 12/31/12 (cell G21). 398,800.

- Chen Corporation began 2012 with the following stockholders equity balances: The following selected transactions and events occurred during the year: a. Issued 10,000 shares of common stock for 60,000. b. Purchased 1,200 shares of treasury stock for 4,800. c. Sold 2,000 shares of treasury stock for 11,000. d. Generated net income of 94,000. e. Declared and paid the full years dividend on preferred stock and a dividend of 1.00 per share on common stock outstanding at the end of the year. Chen Corporation maintains several paid-in capital accounts (Paid-in Capital in Excess of Par, Paid-in Capital from Treasury Stock, etc.) in its ledger, but combines them all as Additional paid-in capital when preparing financial statements. In the space provided below, prepare the stockholders equity section of Chen Corporations balance sheet as of December 31, 2012. Use proper headings and provide full disclosure of all appropriate information. Chens corporate charter authorizes the issuance of 1,000 shares of preferred stock and 100,000 shares of common stock.Outstanding Stock Lars Corporation shows the following information in the stockholders equity section of its balance sheet: The par value of common stock is S5, and the total balance in the Common Stock account is $225,000. There are 13,000 shares of treasury stock. Required: What is the number of shares outstanding? Use the following information for Exercises 10-58 and 10-59: Stahl Company was incorporated as a new business on January 1, 2019. The company is authorized to issue 600,000 shares of $2 par value common stock and 80,000 shares of 6%, S20 par value, cumulative preferred stock. On January 1, 2019, the company issued 75,000 shares of common stock for $15 per share and 5,000 shares of preferred stock for $25 per share. Net income for the year ended December 31, 2019, was $500,000.Chen Corporation began 2012 with the following stockholders equity balances: The following selected transactions and events occurred during the year: a. Issued 10,000 shares of common stock for 60,000. b. Purchased 1,200 shares of treasury stock for 4,800. c. Sold 2,000 shares of treasury stock for 11,000. d. Generated net income of 94,000. e. Declared and paid the full years dividend on preferred stock and a dividend of 1.00 per share on common stock outstanding at the end of the year. Chen Corporation maintains several paid-in capital accounts (Paid-in Capital in Excess of Par, Paid-in Capital from Treasury Stock, etc.) in its ledger, but combines them all as Additional paid-in capital when preparing financial statements.

- The following selected transactions and events occurred during 2013: a. Issued 200 shares of preferred stock for 20,000. b. Sold 800 shares of treasury stock for 2,800. c. Declared and issued a 4% common stock dividend. The market value on the date of declaration was 5 per share. d. Generated a net loss for the year of 16,000. e. Declared and paid the full years dividend on all the preferred stock and a dividend of 15 per share on common stock outstanding at the end of the year. Enter beginning balances for 2013 on STOCKEQ2. Then erase all 2012 entries and enter the transactions for 2013. Save the results as STOCKEQ4. Print the results.Contributed Capital Adams Companys records provide the following information on December 31, 2019: Additional information: 1. Common stock has a 5 par value, 50,000 shares are authorized, 15,000 shares have been issued and are outstanding. 2. Preferred stock has a 100 par value, 3,000 shares are authorized, 800 shares have been issued and are outstanding. Two hundred shares have been subscribed at 120 per share. The stock pays an 8% dividend, is cumulative, and is callable at 130 per share. 3. Bonds payable mature on January 1, 2023. They carry a 12% annual interest rate, payable semiannually. Required: Prepare the Contributed Capital section of the December 31, 2019, balance sheet for Adams. Include appropriate parenthetical notes.Stock Dividends Crystal Corporation has the following information regarding its common stock: S10 par. with 500.000 shares authorized, 213,000 shares issued, and 183,700 shares outstanding. On August 22, 2019, Crystal declared and paid a 15% stock dividend when the market price of the common stock was $30 per share. Required: Prepare the journal entries to record declaration and payment of this stock dividend. Prepare the journal entries to record declaration and payment assuming it was a 30% stock dividend.

- Selected transactions completed by Equinox Products Inc. during the fiscal year ended December 31, 2016, were as follows: a. Issued 15,000 shares of 20 par common stock at 30, receiving cash. b. Issued 4, 000 shares of 80 par preferred 5% stock at 100, receiving cash. c. Issued 500,000 of 10-year, 5% bonds at 104, with interest payable semiannually. d. Declared a quarterly dividend of 0.50 per share on common stock and 1.00 per share on preferred stock. On the date of record, 100,000 shares of common stock were outstanding, no treasury shares were held, and 20,000 shares of preferred stock were outstanding. e. Paid the cash dividends declared in (d). f. Purchased 7,500 shares of Solstice Corp. at 40 per share, plus a 150 brokerage commission. The investment is classified as an available-for-sale investment. g. Purchased 8,000 shares of treasury common stock at 33 per share. h. Purchased 40,000 shares of Pinkberry Co. stock directly from the founders for 24 per share. Pinkberry has 125,000 shares issued and outstanding. Equinox Products Inc. treated the investment as an equity method investment. i. Declared a 1.00 quarterly cash dividend per share on preferred stock. On the date of record, 20,000 shares of preferred stock had been issued. j. Paid the cash dividends to the preferred stockholders. k. Received 27,500 dividend from Pinkberry Co. investment in (h). l. Purchased 90,000 of Dream Inc. 10-year, 5% bonds, directly from the issuing company, at their face amount plus accrued interest of 37 5. The bonds are classified as a held-to-maturity long -term investment. m. Sold, at 38 per share, 2,600 shares of treasury common stock purchased in (g). n. Received a dividend of 0 .60 per share from the Solstice Corp. investment in (f). o. Sold 1,000 shares of Solstice Corp. at 45, including commission. p. Recorded the payment of semiannual interest on the bonds issue d in (c) and the amortization of the premium for six months. The amortization is determined using the straight-line method . q. Accrued interest for three months on the Dream Inc. bonds purchased in (I). r. Pinkberry Co. recorded total earnings of 240 ,000. Equinox Products recorded equity earnings for its share of Pinkberry Co. net income. s. The fair value for Solstice Corp. stock was 39. 02 per share on December 31, 2016. The investment is adjusted to fair value , using a valuation allowance account. Assume Valuation Allowance for Available-for-Sale Investments h ad a beginning balance of zero. Instructions 1. Journalize the selected transactions. 2. After all of the transaction s for the year ended December 31, 201 6, had been poste d [including the transactions recorded in part (1) and all adjusting entries), the data that follows were taken from the records of Equinox Products Inc. a. Prepare a multiple-step in come statement for the year ended December 31, 201 6, concluding with earnings per share . In computing earnings per share, assume that the average number of common shares outstanding was 100,000 and preferred dividends were 100,000. ( Round earnings per share to the nearest cent.) b. Prepare a retained earnings statement for the year ended December 31, 20 6. c. Prepare a balance sheet in report form as of December 31, 2016.Treasury Stock, Cost Method Bush-Caine Company reported the following data on its December 31, 2018, balance sheet: The following transactions were reported by the company during 2019: 1. Reacquired 200 shares of its preferred stock at 57 per share. 2. Reacquired 500 shares of its common stock at 16 per share. 3. Sold 100 shares of preferred treasury stock at 58 per share. 4. Sold 200 shares of common treasury stock at 17 per share. 5. Sold 100 shares of common treasury stock at 9 per share. 6. Retired the shares of common stock remaining in the treasury. The company maintains separate treasury stock accounts and related additional paid-in capital accounts for each class of stock. Required: 1. Prepare the journal entries required to record the treasury stock transactions using the cost method. 2. Assuming the company earned a net income in 2019 of 30.000 and declared and paid dividends of 10,000, prepare the shareholders equity section of its balance sheet at December 31, 2019.Stockholders equity accounts and other related accounts of Gonzales Company as of January 1, 20--, the beginning of its fiscal year, are shown below. Preferred stock subscriptions receivable 50,000 Preferred stock, 10 par, 9% (200,000 shares authorized; 20,000 shares issued)200,000 Preferred stock subscribed (10,000 shares)100,000 Paid-in capital in excess of parpreferred stock40,000 Common stock, 10 par (100,000 shares authorized; 60,000 shares issued)600,000 Paid-in capital in excess of parcommon stock250,000 Retained earnings750,000 During 20--, Gonzales Company completed the following transactions affecting stockholders equity: (a) Received 20,000 for the balance due on subscriptions for 4,000 shares of preferred stock with a par value of 40,000 and issued the stock. (b) Purchased 10,000 shares of common treasury stock for 18 per share. (c) Received subscriptions for 10,000 shares of common stock at 19 per share, collecting down payments of 45,000. (d) Issued 15,000 shares of common stock in exchange for land with a fair market value of 290,000. (e) Sold 5,000 shares of common treasury stock for 100,000. (f) Issued 10,000 shares of preferred stock at 11.50 per share, receiving cash. (g) Sold 3,000 shares of common treasury stock for 17 per share. REQUIRED 1. Prepare general journal entries for the transactions, identifying each transaction by letter. 2. Post the journal entries to appropriate T accounts. The cash account has a beginning balance of 300,000. 3. Prepare the stockholders equity section of the balance sheet as of December 31, 20--. Net income for the year was 825,000 and dividends of 400,000 were paid.