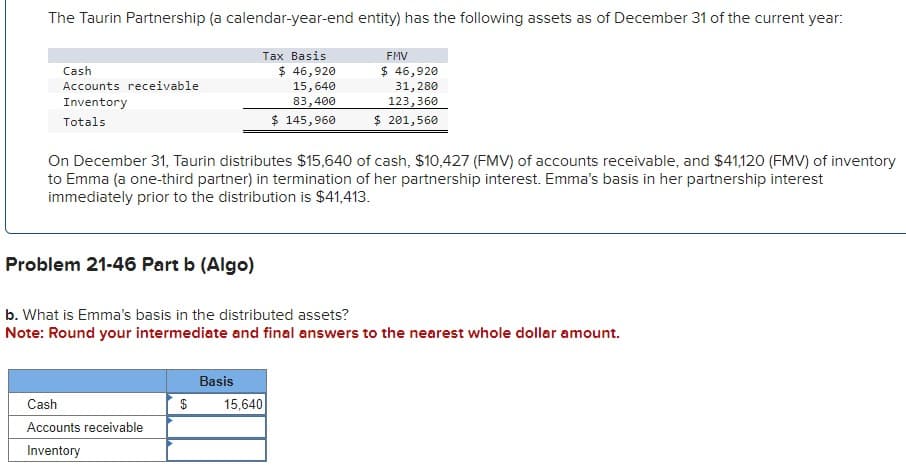

The Taurin Partnership (a calendar-year-end entity) has the following assets as of December 31 of the current year: Tax Basis FMV Cash Accounts receivable Inventory Totals $ 46,920 15,640 83,400 $ 46,920 31,280 123,360 $ 145,960 $ 201,560 On December 31, Taurin distributes $15,640 of cash, $10,427 (FMV) of accounts receivable, and $41,120 (FMV) of inventory to Emma (a one-third partner) in termination of her partnership interest. Emma's basis in her partnership interest immediately prior to the distribution is $41,413. Problem 21-46 Part b (Algo) b. What is Emma's basis in the distributed assets? Note: Round your intermediate and final answers to the nearest whole dollar amount. Cash Accounts receivable Inventory Basis $ 15,640

The Taurin Partnership (a calendar-year-end entity) has the following assets as of December 31 of the current year: Tax Basis FMV Cash Accounts receivable Inventory Totals $ 46,920 15,640 83,400 $ 46,920 31,280 123,360 $ 145,960 $ 201,560 On December 31, Taurin distributes $15,640 of cash, $10,427 (FMV) of accounts receivable, and $41,120 (FMV) of inventory to Emma (a one-third partner) in termination of her partnership interest. Emma's basis in her partnership interest immediately prior to the distribution is $41,413. Problem 21-46 Part b (Algo) b. What is Emma's basis in the distributed assets? Note: Round your intermediate and final answers to the nearest whole dollar amount. Cash Accounts receivable Inventory Basis $ 15,640

Chapter11: Partnerships: Distributions, Transfer Of Interests, And Terminations

Section: Chapter Questions

Problem 18CE

Related questions

Question

Vikarmbhai

Transcribed Image Text:The Taurin Partnership (a calendar-year-end entity) has the following assets as of December 31 of the current year:

Tax Basis

FMV

Cash

Accounts receivable

Inventory

Totals

$ 46,920

15,640

83,400

$ 46,920

31,280

123,360

$ 145,960

$ 201,560

On December 31, Taurin distributes $15,640 of cash, $10,427 (FMV) of accounts receivable, and $41,120 (FMV) of inventory

to Emma (a one-third partner) in termination of her partnership interest. Emma's basis in her partnership interest

immediately prior to the distribution is $41,413.

Problem 21-46 Part b (Algo)

b. What is Emma's basis in the distributed assets?

Note: Round your intermediate and final answers to the nearest whole dollar amount.

Cash

Accounts receivable

Inventory

Basis

$

15,640

AI-Generated Solution

Unlock instant AI solutions

Tap the button

to generate a solution

Recommended textbooks for you