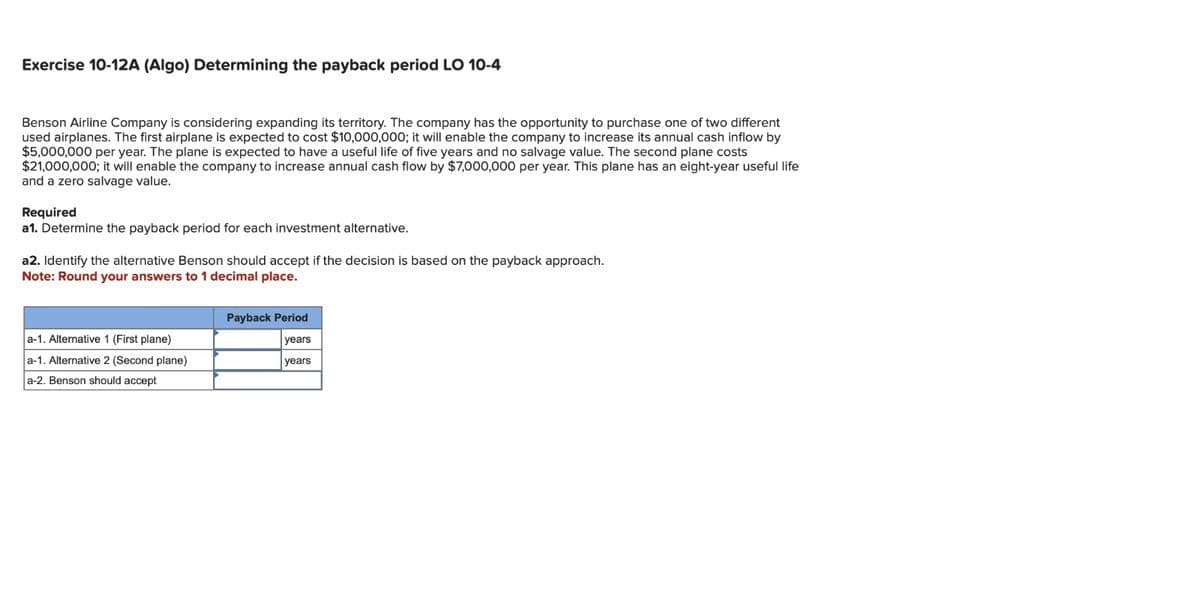

Exercise 10-12A (Algo) Determining the payback period LO 10-4 Benson Airline Company is considering expanding its territory. The company has the opportunity to purchase one of two different used airplanes. The first airplane is expected to cost $10,000,000; it will enable the company to increase its annual cash inflow by $5,000,000 per year. The plane is expected to have a useful life of five years and no salvage value. The second plane costs $21,000,000; it will enable the company to increase annual cash flow by $7,000,000 per year. This plane has an eight-year useful life and a zero salvage value. Required a1. Determine the payback period for each investment alternative. a2. Identify the alternative Benson should accept if the decision is based on the payback approach. Note: Round your answers to 1 decimal place. a-1. Alternative 1 (First plane) a-1. Alternative 2 (Second plane) a-2. Benson should accept Payback Period years years

Exercise 10-12A (Algo) Determining the payback period LO 10-4 Benson Airline Company is considering expanding its territory. The company has the opportunity to purchase one of two different used airplanes. The first airplane is expected to cost $10,000,000; it will enable the company to increase its annual cash inflow by $5,000,000 per year. The plane is expected to have a useful life of five years and no salvage value. The second plane costs $21,000,000; it will enable the company to increase annual cash flow by $7,000,000 per year. This plane has an eight-year useful life and a zero salvage value. Required a1. Determine the payback period for each investment alternative. a2. Identify the alternative Benson should accept if the decision is based on the payback approach. Note: Round your answers to 1 decimal place. a-1. Alternative 1 (First plane) a-1. Alternative 2 (Second plane) a-2. Benson should accept Payback Period years years

Fundamentals of Financial Management (MindTap Course List)

14th Edition

ISBN:9781285867977

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Eugene F. Brigham, Joel F. Houston

Chapter12: Cash Flow Estimation And Risk Analysis

Section: Chapter Questions

Problem 16P: REPLACEMENT CHAIN The Fernandez Company has an opportunity to invest in one of two mutually...

Related questions

Question

Sagar

Transcribed Image Text:Exercise 10-12A (Algo) Determining the payback period LO 10-4

Benson Airline Company is considering expanding its territory. The company has the opportunity to purchase one of two different

used airplanes. The first airplane is expected to cost $10,000,000; it will enable the company to increase its annual cash inflow by

$5,000,000 per year. The plane is expected to have a useful life of five years and no salvage value. The second plane costs

$21,000,000; it will enable the company to increase annual cash flow by $7,000,000 per year. This plane has an eight-year useful life

and a zero salvage value.

Required

a1. Determine the payback period for each investment alternative.

a2. Identify the alternative Benson should accept if the decision is based on the payback approach.

Note: Round your answers to 1 decimal place.

a-1. Alternative 1 (First plane)

a-1. Alternative 2 (Second plane)

a-2. Benson should accept

Payback Period

years

years

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Recommended textbooks for you

Fundamentals of Financial Management (MindTap Cou…

Finance

ISBN:

9781285867977

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning

Fundamentals of Financial Management (MindTap Cou…

Finance

ISBN:

9781285867977

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning