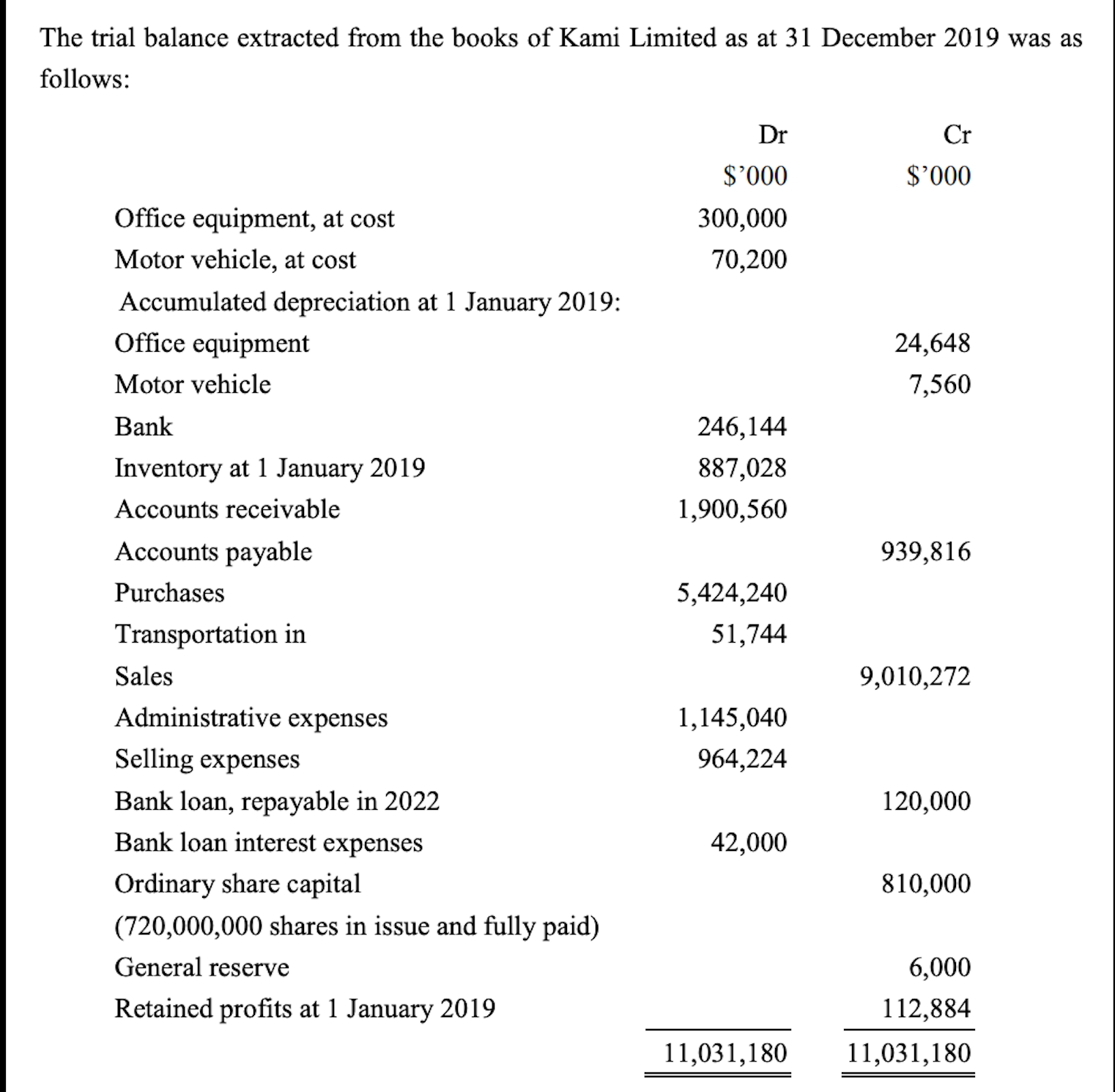

The trial balance extracted from the books of Kami Limited as at 31 December 2019 was as follows: Dr Cr $'000 000.$ Office equipment, at cost 300,000 Motor vehicle, at cost 70,200 Accumulated depreciation at 1 January 2019: Office equipment 24,648 Motor vehicle 7,560 Bank 246,144 Inventory at 1 January 2019 887,028 Accounts receivable 1,900,560 Accounts payable 939,816 Purchases 5,424,240 Transportation in 51,744 Sales 9,010,272 Administrative expenses 1,145,040 Selling expenses 964,224 Bank loan, repayable in 2022 120,000 Bank loan interest expenses 42,000 Ordinary share capital 810,000 (720,000,000 shares in issue and fully paid) General reserve 6,000 Retained profits at 1 January 2019 112,884 11,031,180 11,031,180 The following additional information is available: (i) Inventory as at 31 December 2019 was valued at $560,400,000 after inventory count. (ii) The bank statement for December 2019 showed a bank loan interest of $1,200,000 was deducted but no entries have been recorded in the book. (iii) It was discovered that a payment of $9,600,000 for purchase of office equipment on 1 January 2019 had been wrongly treated as purchase of inventory. The cash paid was correctly recorded in the bank account. No adjustment has been made. There are no other additions or disposal of fixed asset during the period. (iv) Depreciation is to be provided for the year as follows: Office equipment: straight line method with useful life of 5 years and no residual value. Motor vehicle: double declining balance method with useful life of 8 years and residual value $120,000. (v) The following year-end adjustments are to be made: $'000 Accrued administrative expenses 14,400 Prepaid selling expenses remained 6,264 Profits tax provision for 2019 88,200 (vi) The company declared a bonus issue of one for ten shares. The bonus issue is financed by transferring $72,000 out of retained earnings to share capital account during the year. These shares are not entitled to any dividends for the year of 2019. No entries have been made. (vii) The following appropriations are to be made: Transfer to general reserve: $24,000,000 Final dividends for ordinary shares: $0.8 per share

The trial balance extracted from the books of Kami Limited as at 31 December 2019 was as follows: Dr Cr $'000 000.$ Office equipment, at cost 300,000 Motor vehicle, at cost 70,200 Accumulated depreciation at 1 January 2019: Office equipment 24,648 Motor vehicle 7,560 Bank 246,144 Inventory at 1 January 2019 887,028 Accounts receivable 1,900,560 Accounts payable 939,816 Purchases 5,424,240 Transportation in 51,744 Sales 9,010,272 Administrative expenses 1,145,040 Selling expenses 964,224 Bank loan, repayable in 2022 120,000 Bank loan interest expenses 42,000 Ordinary share capital 810,000 (720,000,000 shares in issue and fully paid) General reserve 6,000 Retained profits at 1 January 2019 112,884 11,031,180 11,031,180 The following additional information is available: (i) Inventory as at 31 December 2019 was valued at $560,400,000 after inventory count. (ii) The bank statement for December 2019 showed a bank loan interest of $1,200,000 was deducted but no entries have been recorded in the book. (iii) It was discovered that a payment of $9,600,000 for purchase of office equipment on 1 January 2019 had been wrongly treated as purchase of inventory. The cash paid was correctly recorded in the bank account. No adjustment has been made. There are no other additions or disposal of fixed asset during the period. (iv) Depreciation is to be provided for the year as follows: Office equipment: straight line method with useful life of 5 years and no residual value. Motor vehicle: double declining balance method with useful life of 8 years and residual value $120,000. (v) The following year-end adjustments are to be made: $'000 Accrued administrative expenses 14,400 Prepaid selling expenses remained 6,264 Profits tax provision for 2019 88,200 (vi) The company declared a bonus issue of one for ten shares. The bonus issue is financed by transferring $72,000 out of retained earnings to share capital account during the year. These shares are not entitled to any dividends for the year of 2019. No entries have been made. (vii) The following appropriations are to be made: Transfer to general reserve: $24,000,000 Final dividends for ordinary shares: $0.8 per share

Intermediate Accounting: Reporting And Analysis

3rd Edition

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Chapter11: Depreciation, Depletion, Impairment, And Disposal

Section: Chapter Questions

Problem 7P: Dinnell Company owns the following assets: In the year of acquisition and retirement of an asset,...

Related questions

Question

Explain how accountants can improve the accuracy of their budget. Illustrate your answer with an example.

Transcribed Image Text:The trial balance extracted from the books of Kami Limited as at 31 December 2019 was as

follows:

Dr

Cr

$'000

000.$

Office equipment, at cost

300,000

Motor vehicle, at cost

70,200

Accumulated depreciation at 1 January 2019:

Office equipment

24,648

Motor vehicle

7,560

Bank

246,144

Inventory at 1 January 2019

887,028

Accounts receivable

1,900,560

Accounts payable

939,816

Purchases

5,424,240

Transportation in

51,744

Sales

9,010,272

Administrative expenses

1,145,040

Selling expenses

964,224

Bank loan, repayable in 2022

120,000

Bank loan interest expenses

42,000

Ordinary share capital

810,000

(720,000,000 shares in issue and fully paid)

General reserve

6,000

Retained profits at 1 January 2019

112,884

11,031,180

11,031,180

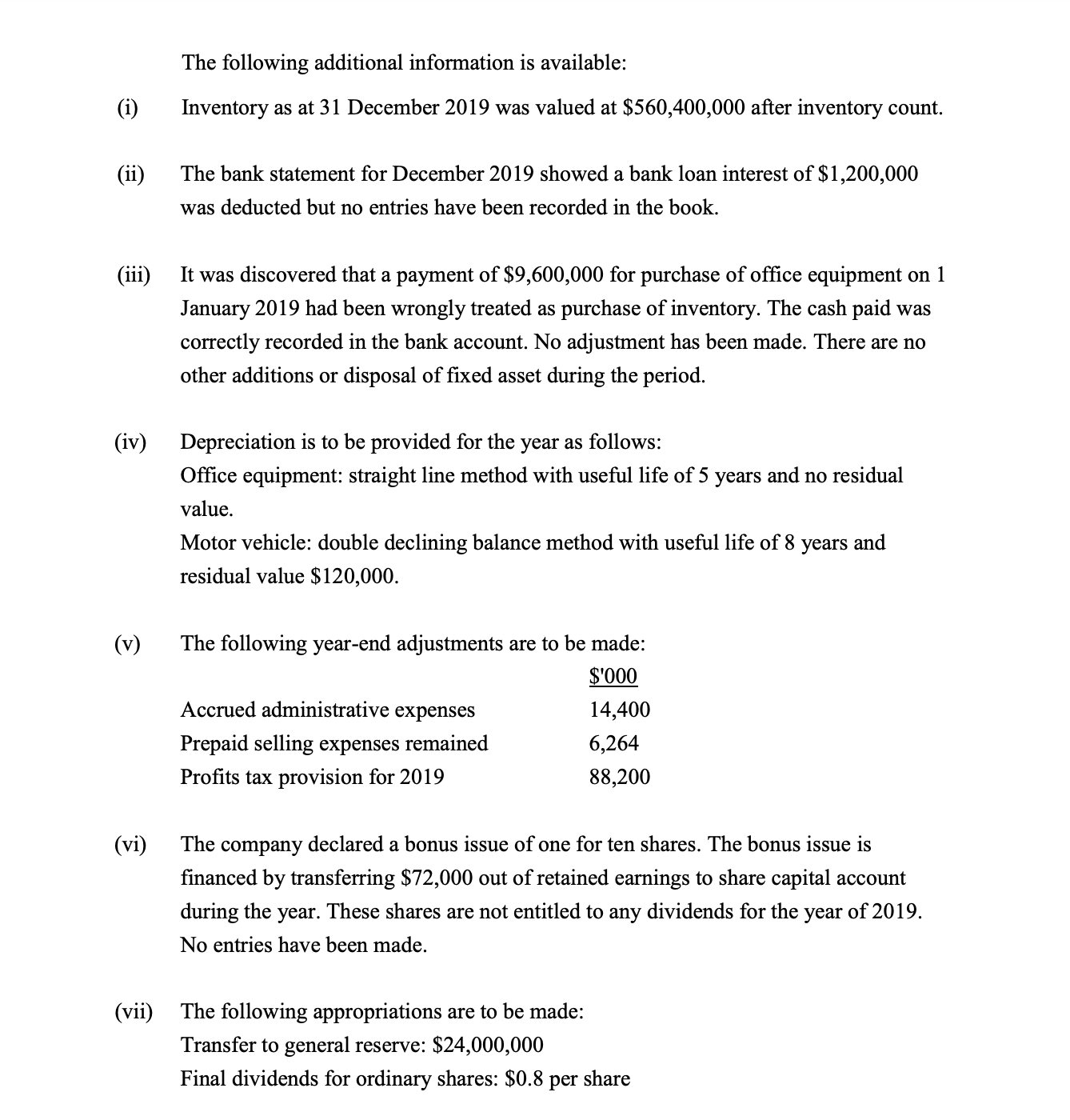

Transcribed Image Text:The following additional information is available:

(i)

Inventory as at 31 December 2019 was valued at $560,400,000 after inventory count.

(ii)

The bank statement for December 2019 showed a bank loan interest of $1,200,000

was deducted but no entries have been recorded in the book.

(iii)

It was discovered that a payment of $9,600,000 for purchase of office equipment on 1

January 2019 had been wrongly treated as purchase of inventory. The cash paid was

correctly recorded in the bank account. No adjustment has been made. There are no

other additions or disposal of fixed asset during the period.

(iv)

Depreciation is to be provided for the year as follows:

Office equipment: straight line method with useful life of 5 years and no residual

value.

Motor vehicle: double declining balance method with useful life of 8

years

and

residual value $120,000.

(v)

The following year-end adjustments are to be made:

$'000

Accrued administrative expenses

14,400

Prepaid selling expenses remained

6,264

Profits tax provision for 2019

88,200

(vi)

The company declared a bonus issue of one for ten shares. The bonus issue is

financed by transferring $72,000 out of retained earnings to share capital account

during the year. These shares are not entitled to any dividends for the year of 2019.

No entries have been made.

(vii) The following appropriations are to be made:

Transfer to general reserve: $24,000,000

Final dividends for ordinary shares: $0.8 per share

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps with 5 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning