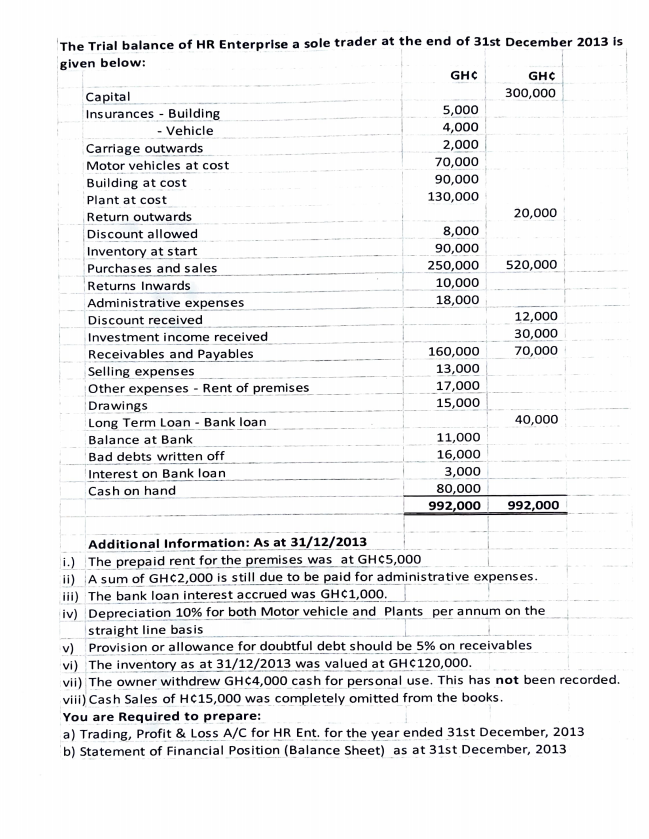

The Trial balance of HR Enterprise a sole trader at the end of 31st December 2013 is given below: GHC GHC Capital 300,000 5,000 Insurances - Building - Vehicle 4,000 Carriage outwards 2,000 Motor vehicles at cost 70,000 90,000 Building at cost Plant at cost Return outwards 130,000 20,000 Discount allowed 8,000 Inventory at start 90,000 Purchases and sales 250,000 520,000 Returns Inwards 10,000 Administrative expenses 18,000 13.000

The Trial balance of HR Enterprise a sole trader at the end of 31st December 2013 is given below: GHC GHC Capital 300,000 5,000 Insurances - Building - Vehicle 4,000 Carriage outwards 2,000 Motor vehicles at cost 70,000 90,000 Building at cost Plant at cost Return outwards 130,000 20,000 Discount allowed 8,000 Inventory at start 90,000 Purchases and sales 250,000 520,000 Returns Inwards 10,000 Administrative expenses 18,000 13.000

Chapter1: Financial Statements And Business Decisions

Section: Chapter Questions

Problem 1Q

Related questions

Question

Transcribed Image Text:The Trial balance of HR Enterprise a sole trader at the end of 31st December 2013 is

given below:

GH¢

GH¢

Capital

300,000

Insurances - Building

5,000

- Vehicle

4,000

Carriage outwards

2,000

Motor vehicles at cost

70,000

90,000

Building at cost

Plant at cost

Return outwards

130,000

20,000

Discount allowed

8,000

Inventory at start

90,000

Purchases and sales

250,000

520,000

Returns Inwards

10,000

Administrative expenses

18,000

Discount received

12,000

Investment income received

30,000

Receivables and Payables

160,000

70,000

Selling expenses

13,000

Other expenses - Rent of premises

17,000

Drawings

15,000

Long Term Loan - Bank loan

40,000

Balance at Bank

11,000

Bad debts written off

16,000

3,000

Interest on Bank loan

Cash on hand

80,000

992,000 992,000

Additional Information: As at 31/12/2013

i.) The prepaid rent for the premises was at GHC5,000

ii) A sum of GHC2,000 is still due to be paid for administrative expenses.

iii) The bank loan interest accrued was GH¢1,000.

iv) Depreciation 10% for both Motor vehicle and Plants per annum on the

straight line basis

v) Provision or allowance for doubtful debt should be 5% on receivables

vi) The inventory as at 31/12/2013 was valued at GH C120,000.

vii) The owner withdrew GH¢4,000 cash for personal use. This has not been recorded.

viii) Cash Sales of H¢15,000 was completely omitted from the books.

You are Required to prepare:

a) Trading, Profit & Loss A/C for HR Ent. for the year ended 31st December, 2013

b) Statement of Financial Position (Balance Sheet) as at 31st December, 2013

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Accounting

Accounting

ISBN:

9781337272094

Author:

WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:

Cengage Learning,

Accounting Information Systems

Accounting

ISBN:

9781337619202

Author:

Hall, James A.

Publisher:

Cengage Learning,

Accounting

Accounting

ISBN:

9781337272094

Author:

WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:

Cengage Learning,

Accounting Information Systems

Accounting

ISBN:

9781337619202

Author:

Hall, James A.

Publisher:

Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis…

Accounting

ISBN:

9780134475585

Author:

Srikant M. Datar, Madhav V. Rajan

Publisher:

PEARSON

Intermediate Accounting

Accounting

ISBN:

9781259722660

Author:

J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:

McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:

9781259726705

Author:

John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:

McGraw-Hill Education