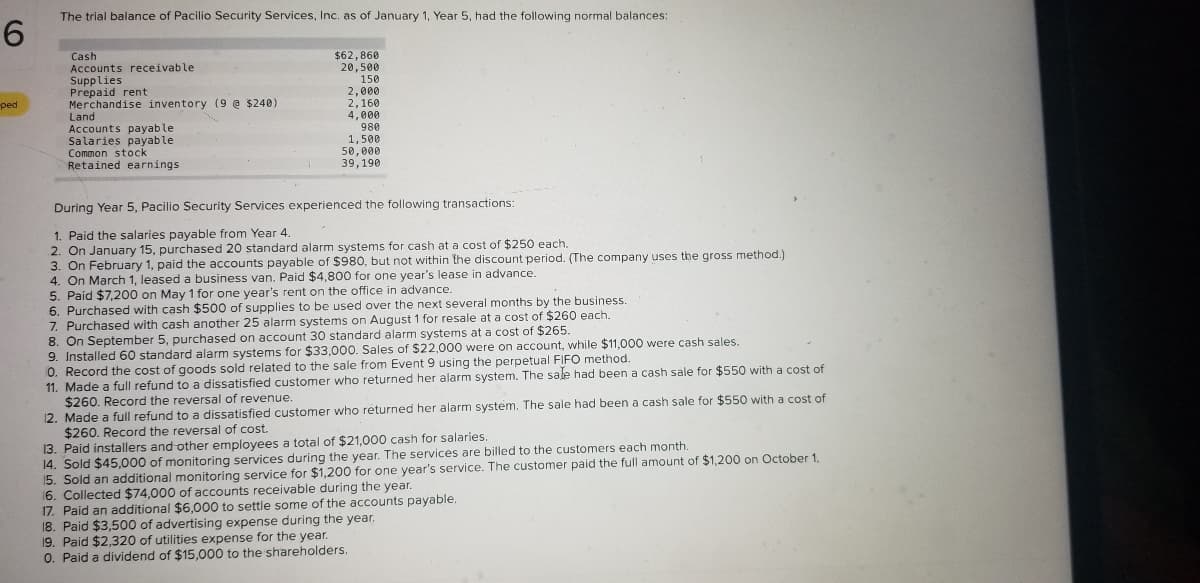

The trial balance of Pacilio Security Services, Inc. as of January 1, Year 5, had the following normal balances: 6. $62,860 20,500 150 Cash Accounts receivable Supplies Prepaid rent Merchandise inventory (9 @ $240) Land Accounts payable Salaries payable Common stock Retained earnings 2,000 2,160 4,000 980 1,500 50,000 39,190 ped During Year 5, Pacilio Security Services experienced the following transactions: 1. Paid the salaries payable from Year 4. 2. On January 15, purchased 20 standard alarm systems for cash at a cost of $250 each. 3. On February 1, paid the accounts payable of $980, but not within the discount period. (The company uses the gr 4. On March 1, leased a business van. Paid $4,800 for one year's lease in advance. 5. Paid $7,200 on May 1 for one year's rent on the office in advance. 6. Purchased with cash $500 of supplies to be used over the next several months by the business. 7. Purchased with cash another 25 alarm systems on August 1 for resale at a cost of $260 each. 8. On September 5, purchased on account 30 standard alarm systems at a cost of $265. on account while $11000 were cash s

The trial balance of Pacilio Security Services, Inc. as of January 1, Year 5, had the following normal balances: 6. $62,860 20,500 150 Cash Accounts receivable Supplies Prepaid rent Merchandise inventory (9 @ $240) Land Accounts payable Salaries payable Common stock Retained earnings 2,000 2,160 4,000 980 1,500 50,000 39,190 ped During Year 5, Pacilio Security Services experienced the following transactions: 1. Paid the salaries payable from Year 4. 2. On January 15, purchased 20 standard alarm systems for cash at a cost of $250 each. 3. On February 1, paid the accounts payable of $980, but not within the discount period. (The company uses the gr 4. On March 1, leased a business van. Paid $4,800 for one year's lease in advance. 5. Paid $7,200 on May 1 for one year's rent on the office in advance. 6. Purchased with cash $500 of supplies to be used over the next several months by the business. 7. Purchased with cash another 25 alarm systems on August 1 for resale at a cost of $260 each. 8. On September 5, purchased on account 30 standard alarm systems at a cost of $265. on account while $11000 were cash s

Survey of Accounting (Accounting I)

8th Edition

ISBN:9781305961883

Author:Carl Warren

Publisher:Carl Warren

Chapter3: Basic Accounting Systems: Accrual Basis

Section: Chapter Questions

Problem 3.6.1P: Adjustment process and financial statements Adjustment data for Ms. Ellen’s Laundry Inc. for the...

Related questions

Question

Answer full question.

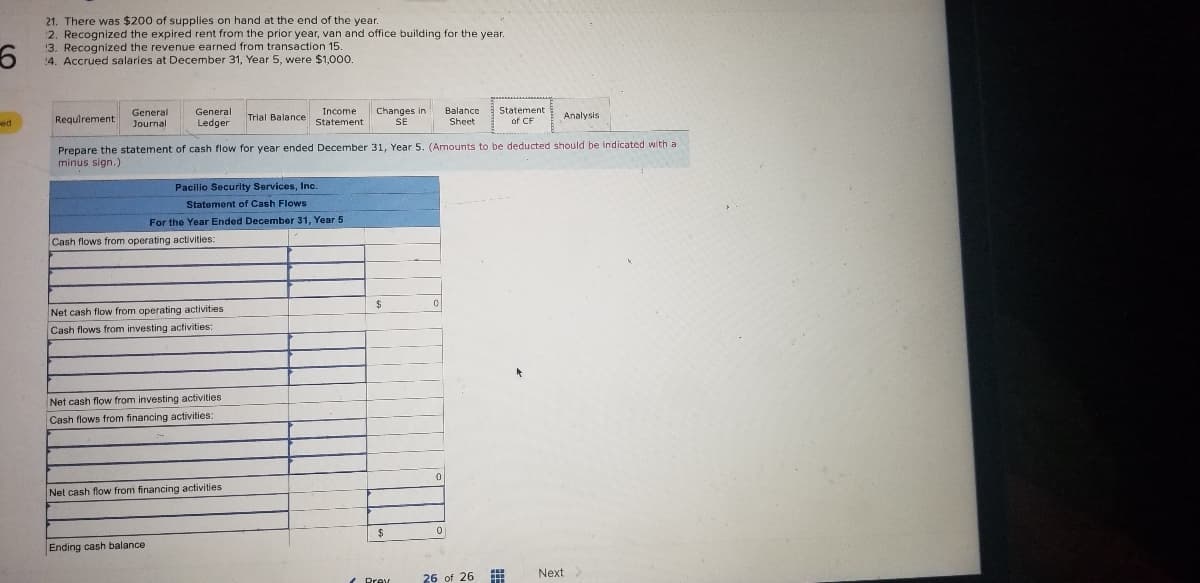

Transcribed Image Text:21. There was $200 of supplies on hand at the end of the year.

2. Recognized the expired rent from the prior year, van and office building for the year.

13. Recognized the revenue earned from transaction 15.

4. Accrued salaries at December 31, Year 5, were $1,000

Income

Trial Balance Statement

Changes in

SE

Balance

Sheet

General

General

Statement

Analysis

Requirement:

of CF

Journal

Ledger

Prepare the statement of cash flow for year ended December 31, Year 5. (Amounts to be deducted should be indicated with a

minus sign.)

Pacilio Security Services, Inc.

Statement of Cash Flows

For the Year Ended December 31, Year 5

Cash flows from operating activities:

Net cash flow from operating activities

Cash flows from investing activities:

Net cash flow from investing activities

Cash flows from financing activities:

Net cash flow from financing activities

Ending cash balance

26 of 26 E

Next

Transcribed Image Text:The trial balance of Pacilio Security Services, Inc. as of January 1, Year 5, had the following normal balances:

6.

Cash

Accounts receivable

Supplies

Prepaid rent

Merchandise inventory (9 @ $240)

Land

Accounts payable

Salaries payable

Common stock

Retained earnings

$62,860

20,500

150

2,000

2,160

4,000

980

1,500

50,000

39,190

ped

During Year 5, Pacilio Security Services experienced the following transactions:

1. Paid the salaries payable from Year 4.

2. On January 15, purchased 20 standard alarm systems for cash at a cost of $250 each.

3. On February 1, paid the accounts payable of $980, but not within the discount period. (The company uses the gross method.)

4. On March 1, leased a business van. Paid $4,800 for one year's lease in advance.

5. Paid $7,200 on May 1 for one year's rent on the office in advance.

6. Purchased with cash $500 of supplies to be used over the next several months by the business.

7. Purchased with cash another 25 alarm systems on August 1 for resale at a cost of $260 each.

8. On September 5, purchased on account 30 standard alarm systems at a cost of $265.

9. Installed 60 standard alarm systems for $33,000. Sales of $22,000 were on account, while $11,000 were cash sales.

0. Record the cost of goods sold related to the sale from Event 9 using the perpetual FIFO method.

11. Made a full refund to a dissatisfied customer who returned her alarm system. The sale had been a cash sale for $550 with a cost of

$260. Record the reversal of revenue.

12. Made a full refund to a dissatisfied customer who returned her alarm system. The sale had been a cash sale for $550 with a cost of

$260. Record the reversal of cost.

13. Paid installers and other employees a total of $21,000 cash for salaries.

14. Sold $45,000 of monitoring services during the year. The services are billed to the customers each month.

15. Sold an additional monitoring service for $1,200 for one year's service. The customer paid the full amount of $1,200 on October 1.

16. Collected $74,000 of accounts receivable during the year.

17. Paid an additional $6,000 to settle some of the accounts payable.

18. Paid $3,500 of advertising expense during the year.

19. Paid $2,320 of utilities expense for the year.

0. Paid a dividend of $15,000 to the shareholders.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

College Accounting (Book Only): A Career Approach

Accounting

ISBN:

9781305084087

Author:

Cathy J. Scott

Publisher:

Cengage Learning

College Accounting (Book Only): A Career Approach

Accounting

ISBN:

9781337280570

Author:

Scott, Cathy J.

Publisher:

South-Western College Pub

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

College Accounting (Book Only): A Career Approach

Accounting

ISBN:

9781305084087

Author:

Cathy J. Scott

Publisher:

Cengage Learning

College Accounting (Book Only): A Career Approach

Accounting

ISBN:

9781337280570

Author:

Scott, Cathy J.

Publisher:

South-Western College Pub

Century 21 Accounting Multicolumn Journal

Accounting

ISBN:

9781337679503

Author:

Gilbertson

Publisher:

Cengage

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College