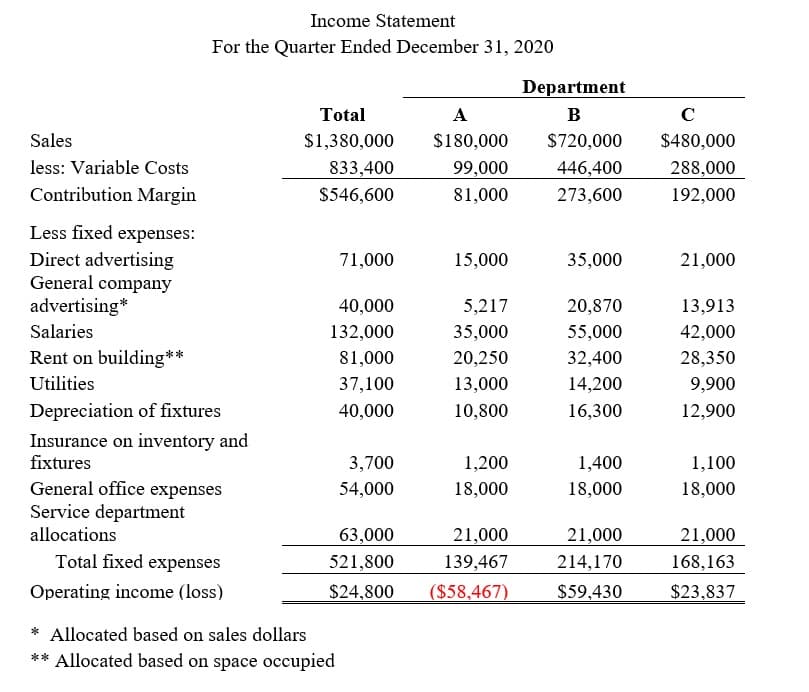

The Vice President of a telecommunications company thinks yhat Department A needs to be eliminated as it is affecting the entire organization. You have been assigned the job of determining if Department A should be eliminated or not and informing the President. The following information has been gathered to assist you in making this decision: (see the picture) The following information is also necessary to assist you in your decision. 1. One of the part-time salaried employees in Department A has been with the company for many years. If Department A is eliminated, she will be transferred to another department with a salary of $4,800 per quarter. All other employees will be laid off. 2. All departments are housed in the same building. The store leases the entire building at a fixed annual rental rate and rent expenses are allocated based on space occupied. 3. If Department A is eliminated, the utilities bill will be reduced by about $11,000 per quarter. 4. If Department A is eliminated, the fixtures in the department will be transferred to the other departments. 5. 35% of the insurance in Department A relates to the fixtures in the department, the remainder relates to the department's merchandise inventory. 6. General office expenses will not change as they relate to the head office. 7. The company has two service departments - purchasing and warehouse. If Department A is eliminated, the company can lay off one full-time and one part-time person from these departments. The combined salaries and other employee costs of these employees are $3,100 per quarter. REQUIRE: a. Assume the company has no alternative use for the space now being occupied by Department A. Prepare a schedule to show whether or not the department should be eliminated. (Assume that eliminating Department A will have not effect on the other department.) b. Assume that the space being occupied by Department A is quite valuable and could be subleased at a rental rate of $35,000 per quarter. Would you advise the company to eliminate Department A and sublease the space? c. What is one qualitative factor that should be considered with this type of decision?

The Vice President of a telecommunications company thinks yhat Department A needs to be eliminated as it is affecting the entire organization. You have been assigned the job of determining if Department A should be eliminated or not and informing the President. The following information has been gathered to assist you in making this decision: (see the picture)

The following information is also necessary to assist you in your decision.

1. One of the part-time salaried employees in Department A has been with the company for many years. If Department A is eliminated, she will be transferred to another department with a salary of $4,800 per quarter. All other employees will be laid off.

2. All departments are housed in the same building. The store leases the entire building at a fixed annual rental rate and rent expenses are allocated based on space occupied.

3. If Department A is eliminated, the utilities bill will be reduced by about $11,000 per quarter.

4. If Department A is eliminated, the fixtures in the department will be transferred to the other departments.

5. 35% of the insurance in Department A relates to the fixtures in the department, the remainder relates to the department's merchandise inventory.

6. General office expenses will not change as they relate to the head office.

7. The company has two service departments - purchasing and warehouse. If Department A is eliminated, the company can lay off one full-time and one part-time person from these departments. The combined salaries and other employee costs of these employees are $3,100 per quarter.

REQUIRE:

a. Assume the company has no alternative use for the space now being occupied by Department A. Prepare a schedule to show whether or not the department should be eliminated. (Assume that eliminating Department A will have not effect on the other department.)

b. Assume that the space being occupied by Department A is quite valuable and could be subleased at a rental rate of $35,000 per quarter. Would you advise the company to eliminate Department A and sublease the space?

c. What is one qualitative factor that should be considered with this type of decision?

Trending now

This is a popular solution!

Step by step

Solved in 3 steps