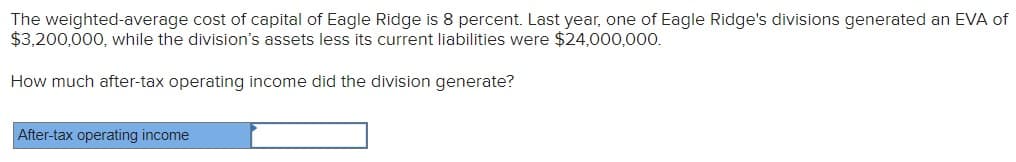

The weighted-average cost of capital of Eagle Ridge is 8 percent. Last year, one of Eagle Ridge's divisions generated an EVA of $3,200,000, while the division's assets less its current liabilities were $24,000,000. How much after-tax operating income did the division generate? After-tax operating income

Q: machine costs $30,500. The incremental annual net cash inflows provided by the new machine would be…

A: The differential analysis is performed to compare the different alternatives available with the…

Q: Cost of Units Completed and in Process The charges to Work in Process-Assembly Department for a…

A: The equivalent units are calculated on the basis of the percentage of the work completed during the…

Q: A buyer for home furnishings orders merchandise from a North Carolina vendor totaling 2,800. The…

A: The objective of this question is to determine which of the two options provided by the vendor would…

Q: Mohave Corporation is considering outsourcing production of the umbrella tote bag included with some…

A: Differential cost refers to the difference between different cost alternatives. Differential costs…

Q: The following selected transactions relate to investment activities of Ornamental Insulation…

A: Investment means an asset purchased in expectation of earning a return on such investment in future…

Q: In Bali, Daniel changed $110 Australian to 924 000 Rupiah, with no commission included. How many…

A: The objective of the question is to find out how many Rupiah Daniel would get if he changed 12…

Q: The following unit data were assembled for the assembly process of Super Co. for the month of April.…

A: Under the FIFO method of calculating equivalent units produced, beginning units are considered and…

Q: Builder Products, Incorporated, uses the weighted-average method in its process costing system. It…

A: A process costing system is a method typically used within certain sectors of the manufacturing…

Q: In Bali, Daniel changed $110 Australian to 924 000 Rupiah, with no commission included. How many…

A:

Q: Coronado Corporation is a regional company which is an SEC registrant. The corporation's securities…

A: Debentures are long-term debt instruments that governments and businesses issue to raise money. By…

Q: Alsup Consulting sometimes performs services for which it receives payment at the conclusion of the…

A: The amount of income tax that a business anticipates paying in the future as a result of transient…

Q: Prepare income statements using FIFO and LIFO.

A: An income statement shows all the revenue and expenses of the business at the end of the period.…

Q: Greenstream Painting Company incurs the following transactions for September. 1. September 3 Paint…

A: The journal entries are prepared to record the transactions on a regular basis. The T-accounts are…

Q: Required: a. Prepare closing entries for the year-end, using separate entries for each net asset…

A: Required journal entries : DateAccount title & ExplanationDebit ($)Credit ($)Reclassification…

Q: A company has the following information: Net credit sales = $400,000 Net income = $100,000 Average…

A: The ratio is the technique used by the prospective investor or an individual or strategist to read…

Q: Mersey Chemicals manufactures polypropylene that it ships to its customers via tank car. Currently,…

A: Incremental cash flows are those that are acquired by a company in case of attending new projects. A…

Q: Advertising expense Depreciation expense-Office equipment Depreciation expense-Selling equipment…

A: The cost of goods manufactured includes the cost of goods that are finished during the period. The…

Q: Prepare a tabular summary to record the following transactions on Sheridan Company's books using a…

A: The accounting equation states that assets are equal to the sum of the liabilities and equity. The…

Q: A company expected its annual overhead costs to be $781100 and machine hours to equal 107000 hours.…

A: Lets understand the basics.If applied overhead is more than the actual overhead then overhead is…

Q: Ben is a single taxpayer with no dependents and is 32 years old. What is the minimum amount of…

A: The question is asking for the minimum amount of income that a single taxpayer with no dependents,…

Q: Ivan's, Incorporated, paid $500 in dividends and $595 in interest this past year. Common stock…

A: Stockholders' equity: The net assets that remain accessible to shareholders after all obligations…

Q: Alaskan Fisheries, Inc., processes salmon for various distributors and it uses the weighted-average…

A: WEIGHTED AVERAGE METHOD :— Under this method, equivalent units are calculated by adding equivalent…

Q: is a financial product that allows an individual to lend their money to a bank A and be paid an…

A: A savings account is a financial product that allows an individual to lend their money to a bank and…

Q: b. What amount of gross profit would Casey's General Stores have reported if the FIFO method had…

A: Inventory Valuation is a method of calculating the value of stock at the end of an accounting…

Q: Sweeney originally contributed $258,000 in cash for a one-fourth interest in the Gilbert LLC. During…

A: A company, firm, or individual invests money in the company and purchases some shares of the…

Q: A company has the following financial information regarding its inventory: Item Cost Retail…

A: Conventional retail inventory is one of the method used for calculation and estimation of inventory.…

Q: Nicanor made the following donations to his children in 2021: To Jose - Agricultural land in Nueva…

A: In Philippine Donor’s tax for each calendar year shall be six percent (6%) computed on the basis of…

Q: ChimneySweep provides cleaning services for residential chimneys and fireplaces. The cleaning…

A: Variable cost is the cost that changes with change in the activity of cost driver used. The variable…

Q: Wirefree Corporation began 2021 with retained earnings of $290 million. Revenues during the year…

A: The net income is calculated as the difference between the revenue and expenses. The retained…

Q: Sheridan, Inc. had outstanding $6,060,000 of 11% bonds (interest payable July 31 and January 31) due…

A: Journal entries are made to record the transactions as the first process in the books of accounts…

Q: Knowledge Check 01 On January 1, Year 1, Sterling Corporation issued stock options for 260,000…

A: Stock option means where the shares are issued to company employee or executives at less than the…

Q: Requirements: a) Explainifaprovisionshouldbemadefor: (i) the decommissioning of the mine and (ii)…

A: Decommissioning and restoration costs are the costs associated with the process of restoring a site…

Q: The company's expenses during the above period were: depreciation = 1500, exhibition expenses =…

A: The objective of the question is to calculate the total administrative costs from the given list of…

Q: Required A Required B Assume that only one product is being sold in each of the four following case…

A: The contribution margin is calculated as the difference between the sales and variable costs. The…

Q: During the year, Tempo Inc. has monthly cash expenses of $132,978. On December 31, its cash balance…

A: Lets understand the basics.Calculate the ratio of cash to monthly cash expenses as follows:Ratio of…

Q: At year-end, the perpetual inventory records of Concord Corporation showed merchandise inventory of…

A: Under periodic inventory system, day to day in and out of inventory is not recorded. Closing…

Q: Swifty Corporation borrowed $660000 from Liber Bank on January 1, 2019 in order to expand its mining…

A: Bonds is a long-term debts issued by the government and companies to raise funds for their…

Q: Heidi Software Corporation provides a variety of share-based compensation plans to its employees.…

A: Journal Entry is the primary step in recording the transactions in the books of accounts.The…

Q: Your friend Binna has a money market mutual fund account, automatic deposit of her paycheck into…

A: The objective of the question is to understand the benefits of using multiple financial institutions…

Q: Small Business and Self-Employed Retirement Plans (LO 5.4) Eligio is a 45-year-old self-employed…

A: According to SEP-IRA plan, a self-employed person can contribute towards a retirement scheme or an…

Q: Mr. Kelly owns stock in VP and in BL, both of which are S corporations. This year, he had the…

A: Passive income is defined as profits earned from activities in which the individual or company is…

Q: What is the depletion and depreciation, respectively, for 2013

A: Depletion is used to allocate the cost of natural resources based on the natural resources extracted…

Q: aa.4

A: The objective of the question is to calculate the MXP/AUD cross rate using the given exchange rates.

Q: Grouper Company buys merchandise on account from Metlock, Inc.. The selling price of the goods is…

A: Journal entries are made to record the transactions as the first process in the books of accounts…

Q: Journalize the following transactions for the firm that began operations on 1/1/of 23. Create the…

A: Journal Entry is the primary step in recording the transactions in the books of accounts.The…

Q: Required information [The following information applies to the questions displayed below.]…

A: Inventory valuation is based on the flow-off issue used by the organization. It can be the first in…

Q: On Jan. 1, 2015, Scarlet issued $20 million of 5% convertible bonds due in 20 years at 103. These…

A: Journal entries are required to be prepared by the companies to record the transactions of the…

Q: For the month of July, Jacobs Company incurs a direct materials cost of $6,000 for 6,000 gallons of…

A: The conversion costs include the indirect costs incurred for the production. The conversion cost per…

Q: Southwestern Wear Inc. has the following balance sheet: $1,875,000 Accounts payable 1,875,000 Notes…

A: General creditors refer to the creditors who lend money to the borrower but they don't have an…

Q: cholfield Enterprises makes a variety of products that it sells to other businesses. The company's…

A: Manufacturing Overhead includes all th indirect costs incurred in connection with production the…

Step by step

Solved in 3 steps

- During the current year, Sokowski Manufacturing earned income of $350,000 from total sales of $5,500,000 and average capital assets of $12,000, 000. What is the sales margin?Forchen, Inc., provided the following information for two of its divisions for last year: Required: 1. For the Small Appliances Division, calculate: a. Average operating assets b. Margin c. Turnover d. Return on investment (ROI) 2. For the Cleaning Products Division, calculate: a. Average operating assets b. Margin c. Turnover d. Return on investment (ROI) 3. What if operating income for the Small Appliances Division was 2,000,000? How would that affect average operating assets? Margin? Turnover? ROI? Calculate any changed ratios (round to four significant digits).During the current year. Plainfield Manufacturing earned income of $845,000 from total sales of $9,350,000 and average capital assets of $13,500,000. What is the sales margin?

- Spartans Inc. has the following information for its two divisions: North and South North South Sales $6,000,000 $6,000,000 Expenses $3,800,000 $3,800,000 Oper. Income $2,200,000 $2,200,000 Taxes $660,000 $770,000 Taxable Inc. $1,540,000 $1,430,000 Invested Assets $13,000,000 $15,000,000 Spartans Inc. has a 10% hurdle rate. Calculate the following for each division: Return on Investment (ROI) North Division ________________ South…Blaser Division had $1,040,000 in invested assets, sales of $1,271,000, income from operations of $205,000, and a minimum acceptable return of 13%. The return on investment for Blaser Division is (round the percentage to one decimal place.)The AAA Division has permanent current assets of P50,000 and operating non-current assets of 350,000. It provides annual operating income after tax of P100,000. Its cost of capital is 15% but the minimum required rate of return by the entity is 16%. 1. How much is its current return on investment? 2. How much is its economic value added? 3. How much is its residual income? 4. Assume that the Senna Division is presented by the head office to manage a P60,000 investment option yielding a 20% return on its investment. Should the Division agree to manage this investment opportunity? A. Yes, because the ROI will increase. B. Yes, because the RI and EVA will increase. C. No, because the ROI will decrease. D. No, because the RI and EVA will decrease.

- Blaser Corporation had $1,090,000 in invested assets, sales of $1,277,000, operating income amounting to $236,000 , and a desired minimum return on investment of 13%. The return on investment for Blaser Corporation isLast year, Stewart-Stern Inc. reported $11,250 of sales, $4,500 of operating costs other than depreciation, and $1,250 of depreciation. The company had $2,500 of bonds outstanding that carry a 7.00% interest rate, and its federal-plus-state income tax rate was 25.00%. During last year, the firm had expenditures on fixed assets and net operating working capital that totaled $1,600. These expenditures were necessary for it to sustain operations and generate future sales and cash flows. This year's data are expected to remain unchanged except for one item, depreciation, which is expected to increase by $900. By how much will the depreciation change cause (1) the firm's net income and (2) its free cash flow to change? Note that the company uses the same depreciation for tax and stockholder reporting purposes. Do not round the intermediate calculationsThe XYZ Division of ABC Corp. generated a residual income of $400,000 and a return on investment of 34% with average annual assets of $4,000,000. What was the target rate of return the company used to calculate the XYZ Division's residual income?

- ABC Company has established a target rate of return of 12% for all of its divisions. In 2021, Division A generated sales of $16,000,000 and expenses of $14,000,000. Total assets at the beginning of the year were $10,000,000, and total assets at the end of the year were $8,000,000. For 2021, what was Division A's return on investment (rounded to the nearest whole percent)?NUBD Division reported a residual income of P200,000 for the year just ended. The division had P8,000,000 of invested capital and P1,500,000 of income. On the basis of this information, the required rate of return was: (round-off to 2 decimal places)Mason Corporation had $1,096,000 in invested assets, sales of $1,217,000, operating income amounting to $231,000, and a desired minimum return on investment of 13%. The profit margin (rounded to one decimal place) for Mason Corporation is