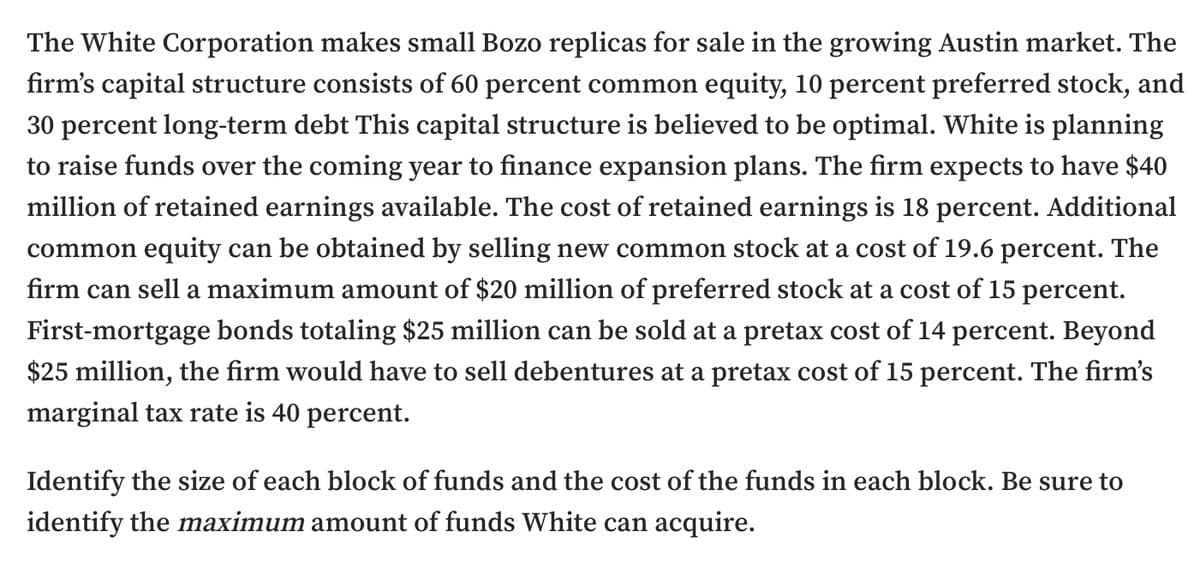

The White Corporation makes small Bozo replicas for sale in the growing Austin market. The firm's capital structure consists of 60 percent common equity, 10 percent preferred stock, and 30 percent long-term debt This capital structure is believed to be optimal. White is planning to raise funds over the coming year to finance expansion plans. The firm expects to have $40 million of retained earnings available. The cost of retained earnings is 18 percent. Additional common equity can be obtained by selling new common stock at a cost of 19.6 percent. The firm can sell a maximum amount of $20 million of preferred stock at a cost of 15 percent. First-mortgage bonds totaling $25 million can be sold at a pretax cost of 14 percent. Beyond $25 million, the firm would have to sell debentures at a pretax cost of 15 percent. The firm's marginal tax rate is 40 percent. Identify the size of each blo funds and the cost of funds each block. Be sure to identify the maximum amount of funds White can acquire.

The White Corporation makes small Bozo replicas for sale in the growing Austin market. The firm's capital structure consists of 60 percent common equity, 10 percent preferred stock, and 30 percent long-term debt This capital structure is believed to be optimal. White is planning to raise funds over the coming year to finance expansion plans. The firm expects to have $40 million of retained earnings available. The cost of retained earnings is 18 percent. Additional common equity can be obtained by selling new common stock at a cost of 19.6 percent. The firm can sell a maximum amount of $20 million of preferred stock at a cost of 15 percent. First-mortgage bonds totaling $25 million can be sold at a pretax cost of 14 percent. Beyond $25 million, the firm would have to sell debentures at a pretax cost of 15 percent. The firm's marginal tax rate is 40 percent. Identify the size of each blo funds and the cost of funds each block. Be sure to identify the maximum amount of funds White can acquire.

Chapter12: The Cost Of Capital

Section: Chapter Questions

Problem 12P

Related questions

Question

Transcribed Image Text:The White Corporation makes small Bozo replicas for sale in the growing Austin market. The

firm's capital structure consists of 60 percent common equity, 10 percent preferred stock, and

30 percent long-term debt This capital structure is believed to be optimal. White is planning

to raise funds over the coming year to finance expansion plans. The firm expects to have $40

million of retained earnings available. The cost of retained earnings is 18 percent. Additional

common equity can be obtained by selling new common stock at a cost of 19.6 percent. The

firm can sell a maximum amount of $20 million of preferred stock at a cost of 15 percent.

First-mortgage bonds totaling $25 million can be sold at a pretax cost of 14 percent. Beyond

$25 million, the firm would have to sell debentures at a pretax cost of 15 percent. The firm's

marginal tax rate is 40 percent.

Identify the size of each block of funds and the cost of the funds in each block. Be sure to

identify the maximum amount of funds White can acquire.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Recommended textbooks for you

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning