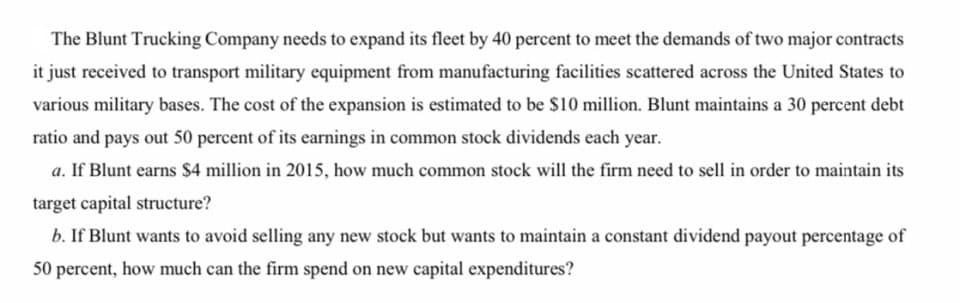

The Blunt Trucking Company needs to expand its fleet by 40 percent to meet the demands of two major contracts it just received to transport military equipment from manufacturing facilities scattered across the United States to various military bases. The cost of the expansion is estimated to be $10 million. Blunt maintains a 30 percent debt ratio and pays out 50 percent of its earnings in common stock dividends each year. a. If Blunt earns $4 million in 2015, how much common stock will the firm need to sell in order to maintain its target capital structure? b. If Blunt wants to avoid selling any new stock but wants to maintain a constant dividend payout percentage of 50 percent, how much can the firm spend on new capital expenditures?

The Blunt Trucking Company needs to expand its fleet by 40 percent to meet the demands of two major contracts it just received to transport military equipment from manufacturing facilities scattered across the United States to various military bases. The cost of the expansion is estimated to be $10 million. Blunt maintains a 30 percent debt ratio and pays out 50 percent of its earnings in common stock dividends each year. a. If Blunt earns $4 million in 2015, how much common stock will the firm need to sell in order to maintain its target capital structure? b. If Blunt wants to avoid selling any new stock but wants to maintain a constant dividend payout percentage of 50 percent, how much can the firm spend on new capital expenditures?

Chapter12: The Cost Of Capital

Section: Chapter Questions

Problem 12P

Related questions

Question

please be accurate

Transcribed Image Text:The Blunt Trucking Company needs to expand its fleet by 40 percent to meet the demands of two major contracts

it just received to transport military equipment from manufacturing facilities scattered across the United States to

various military bases. The cost of the expansion is estimated to be $10 million. Blunt maintains a 30 percent debt

ratio and pays out 50 percent of its earnings in common stock dividends each year.

a. If Blunt earns S4 million in 2015, how much common stock will the firm need to sell in order to maintain its

target capital structure?

b. If Blunt wants to avoid selling any new stock but wants to maintain a constant dividend payout percentage of

50 percent, how much can the firm spend on new capital expenditures?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Recommended textbooks for you

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning