The withdrawal of capital by a partner from the business of partnership will be: a. Debited to partners' capital account b. Debited to profit and loss appropriation account c. Credited to profit and loss account d. Credited to partners' capital account The amount of drawings taken by each partner will be: a. Debited to partners' current account b. Debited to profit and loss appropriation account c. Credited to partners' current account d. Credited to profit and loss account The closing balances of partners' current account will be: a. X RO 59784 (Dr), Y RO 17825 (Cr), Z RO 37622 (Dr) b. X RO 58748 (Dr), Y RO 16852 (Cr), Z RO 36620 (Dr) c. X RO 58784 (Dr), Y RO 16825 (Cr), Z RO 36622 (Dr) d. X RO 58984 (Dr), Y RO 16925 (Dr), Z RO 36626 (Dr)

The withdrawal of capital by a partner from the business of partnership will be: a. Debited to partners' capital account b. Debited to profit and loss appropriation account c. Credited to profit and loss account d. Credited to partners' capital account The amount of drawings taken by each partner will be: a. Debited to partners' current account b. Debited to profit and loss appropriation account c. Credited to partners' current account d. Credited to profit and loss account The closing balances of partners' current account will be: a. X RO 59784 (Dr), Y RO 17825 (Cr), Z RO 37622 (Dr) b. X RO 58748 (Dr), Y RO 16852 (Cr), Z RO 36620 (Dr) c. X RO 58784 (Dr), Y RO 16825 (Cr), Z RO 36622 (Dr) d. X RO 58984 (Dr), Y RO 16925 (Dr), Z RO 36626 (Dr)

SWFT Essntl Tax Individ/Bus Entities 2020

23rd Edition

ISBN:9780357391266

Author:Nellen

Publisher:Nellen

Chapter14: Partnerships And Limited Liability Entities

Section: Chapter Questions

Problem 20P

Related questions

Question

The withdrawal of capital by a partner from the business of partnership will be:

a.

Debited to partners' capital account

b.

Debited to profit and loss appropriation account

c.

Credited to profit and loss account

d.

Credited to partners' capital account

The amount of drawings taken by each partner will be:

a.

Debited to partners' current account

b.

Debited to profit and loss appropriation account

c.

Credited to partners' current account

d.

Credited to profit and loss account

The closing balances of partners' current account will be:

a.

X RO 59784 (Dr), Y RO 17825 (Cr), Z RO 37622 (Dr)

b.

X RO 58748 (Dr), Y RO 16852 (Cr), Z RO 36620 (Dr)

c.

X RO 58784 (Dr), Y RO 16825 (Cr), Z RO 36622 (Dr)

d.

X RO 58984 (Dr), Y RO 16925 (Dr), Z RO 36626 (Dr)

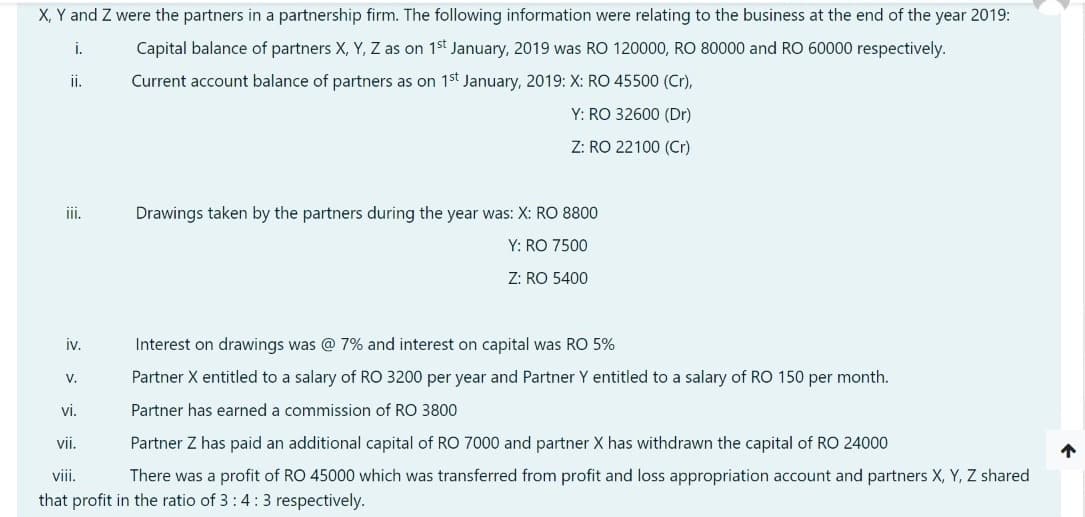

Transcribed Image Text:X, Y and Z were the partners in a partnership firm. The following information were relating to the business at the end of the year 2019:

Capital balance of partners X, Y, Z as on 1st January, 2019 was RO 120000, RO 80000 and RO 60000 respectively.

i.

Current account balance of partners as on 1st January, 2019: X: RO 45500 (Cr),

Y: RO 32600 (Dr)

Z: RO 22100 (Cr)

ii.

Drawings taken by the partners during the year was: X: RO 8800

Y: RO 7500

Z: RO 5400

iv.

Interest on drawings was @ 7% and interest on capital was RO 5%

V.

Partner X entitled to a salary of RO 3200 per year and Partner Y entitled to a salary of RO 150 per month.

vi.

Partner has earned a commission of RO 3800

vii.

Partner Z has paid an additional capital of RO 7000 and partner X has withdrawn the capital of RO 24000

vii.

There was a profit of RO 45000 which was transferred from profit and loss appropriation account and partners X, Y, Z shared

that profit in the ratio of 3:4:3 respectively.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Financial Accounting

Accounting

ISBN:

9781305088436

Author:

Carl Warren, Jim Reeve, Jonathan Duchac

Publisher:

Cengage Learning