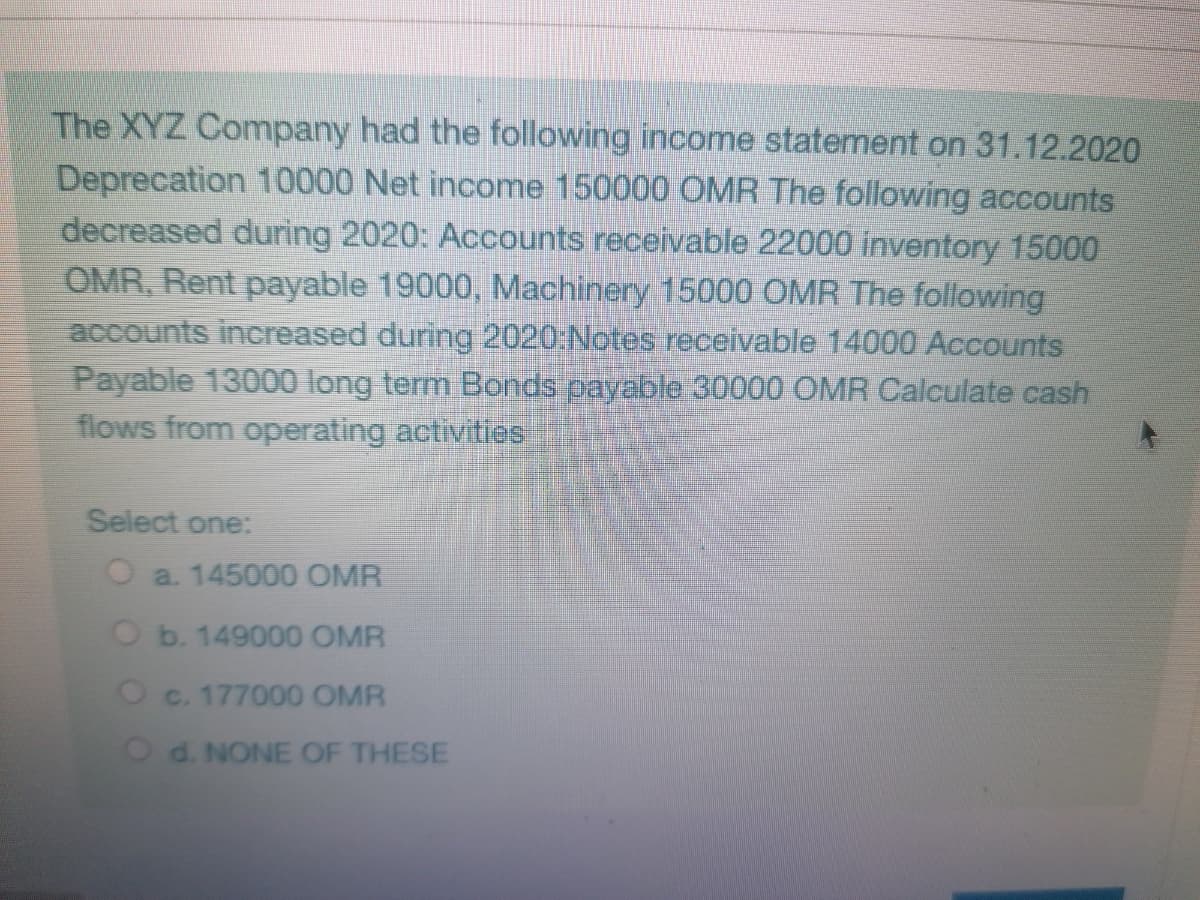

The XYZ Company had the following income statement on 31.12.2020 Deprecation 10000 Net income 150000 OMR The following accounts decreased during 2020: Accounts receivable 22000 inventory 15000 OMR, Rent payable 19000, Machinery 15000 OMR The following accounts increased during 2020:Notes receivable 14000 Accounts Payable 13000 long term Bonds payable 30000 OMR Calculate cash flows from operating activities Select one: Oa. 145000 OMR O b. 149000 OMR Oc. 177000 OMR Od. NONE OF THESE

The XYZ Company had the following income statement on 31.12.2020 Deprecation 10000 Net income 150000 OMR The following accounts decreased during 2020: Accounts receivable 22000 inventory 15000 OMR, Rent payable 19000, Machinery 15000 OMR The following accounts increased during 2020:Notes receivable 14000 Accounts Payable 13000 long term Bonds payable 30000 OMR Calculate cash flows from operating activities Select one: Oa. 145000 OMR O b. 149000 OMR Oc. 177000 OMR Od. NONE OF THESE

Cornerstones of Financial Accounting

4th Edition

ISBN:9781337690881

Author:Jay Rich, Jeff Jones

Publisher:Jay Rich, Jeff Jones

Chapter11: The Statement Of Cash Flows

Section: Chapter Questions

Problem 12MCQ: Smoltz Company reported the following information for the current year: cost of goods sold,...

Related questions

Question

Transcribed Image Text:The XYZ Company had the following income statement on 31.12.2020

Deprecation 10000 Net income 150000 OMR The following accounts

decreased during 2020: Accounts receivable 22000 inventory 15000

OMR, Rent payable 19000, Machinery 15000 OMR The following

accounts increased during 2020:Notes receivable 14000 Accounts

Payable 13000 long term Bonds payable 30000 OMR Calculate cash

flows from operating activities

Select one:

a. 145000 OMR

Ob. 149000 OMR

Oc. 177000 OMR

Od. NONE OF THESE

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Fundamentals Of Financial Management, Concise Edi…

Finance

ISBN:

9781337902571

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Fundamentals Of Financial Management, Concise Edi…

Finance

ISBN:

9781337902571

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT