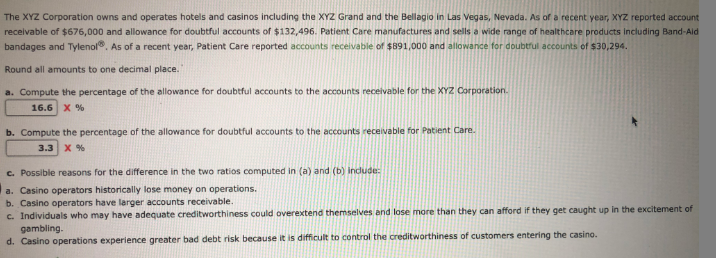

The XYZ Corporation owns and operates hotels and casinos including the XYZ Grand and the Bellagio in Las Vegas, Nevada. As of a recent year, XYZ reported account receivable of $676,000 and allowance for doubtful accounts of $132,496. Patient Care manufactures and sells a wide range of healthcare products including Band-Ald bandages and Tylenol. As of a recent year, Patient Care reported accounts receivable of $891,000 and allowance for doubtrul accounts of $30,294. Round all amounts to one decimal place. a. Compute the percentage of the allowance for doubtful accounts to the accounts receivable for the XYZ Corporation. 16.6 X % b. Compute the percentage of the allowance for doubtful accounts to the accounts receivable for Patient Care. 3.3 x % c. Possible reasons for the difference in the two ratios computed in (a) and (b) indude: a. Casino operators historically lose money on operations. b. Casino operators have larger accounts receivable. c. Individuals who may have adequate creditworthiness could overextend themselves and lose more than they can afford if they get caught up in the excitement of gambling. d. Casino operations experience greater bad debt risk because it is difficult to control the creditworthiness of customers entering the casino.

The XYZ Corporation owns and operates hotels and casinos including the XYZ Grand and the Bellagio in Las Vegas, Nevada. As of a recent year, XYZ reported account receivable of $676,000 and allowance for doubtful accounts of $132,496. Patient Care manufactures and sells a wide range of healthcare products including Band-Ald bandages and Tylenol. As of a recent year, Patient Care reported accounts receivable of $891,000 and allowance for doubtrul accounts of $30,294. Round all amounts to one decimal place. a. Compute the percentage of the allowance for doubtful accounts to the accounts receivable for the XYZ Corporation. 16.6 X % b. Compute the percentage of the allowance for doubtful accounts to the accounts receivable for Patient Care. 3.3 x % c. Possible reasons for the difference in the two ratios computed in (a) and (b) indude: a. Casino operators historically lose money on operations. b. Casino operators have larger accounts receivable. c. Individuals who may have adequate creditworthiness could overextend themselves and lose more than they can afford if they get caught up in the excitement of gambling. d. Casino operations experience greater bad debt risk because it is difficult to control the creditworthiness of customers entering the casino.

Financial Accounting

14th Edition

ISBN:9781305088436

Author:Carl Warren, Jim Reeve, Jonathan Duchac

Publisher:Carl Warren, Jim Reeve, Jonathan Duchac

Chapter9: Receivables

Section: Chapter Questions

Problem 27E

Related questions

Question

Transcribed Image Text:The XYZ Corporation owns and operates hotels and casinos including the XYZ Grand and the Bellagio in Las Vegas, Nevada. As of a recent year, XYZ reported account

receivable of $676,000 and allowance for doubtful accounts of $132,496. Patient Care manufactures and sells a wide range of healthcare products including Band-Ald

bandages and Tylenol. As of a recent year, Patient Care reported accounts receivable of $891,000 and allowance for doubtrul accounts of $30,294.

Round all amounts to one decimal place.

a. Compute the percentage of the allowance for doubtful accounts to the accounts receivable for the XYZ Corporation.

16.6 X %

b. Compute the percentage of the allowance for doubtful accounts to the accounts receivable for Patient Care.

3.3 x %

c. Possible reasons for the difference in the two ratios computed in (a) and (b) indude:

a. Casino operators historically lose money on operations.

b. Casino operators have larger accounts receivable.

c. Individuals who may have adequate creditworthiness could overextend themselves and lose more than they can afford if they get caught up in the excitement of

gambling.

d. Casino operations experience greater bad debt risk because it is difficult to control the creditworthiness of customers entering the casino.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Recommended textbooks for you

Financial Accounting

Accounting

ISBN:

9781305088436

Author:

Carl Warren, Jim Reeve, Jonathan Duchac

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Financial Accounting

Accounting

ISBN:

9781305088436

Author:

Carl Warren, Jim Reeve, Jonathan Duchac

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT