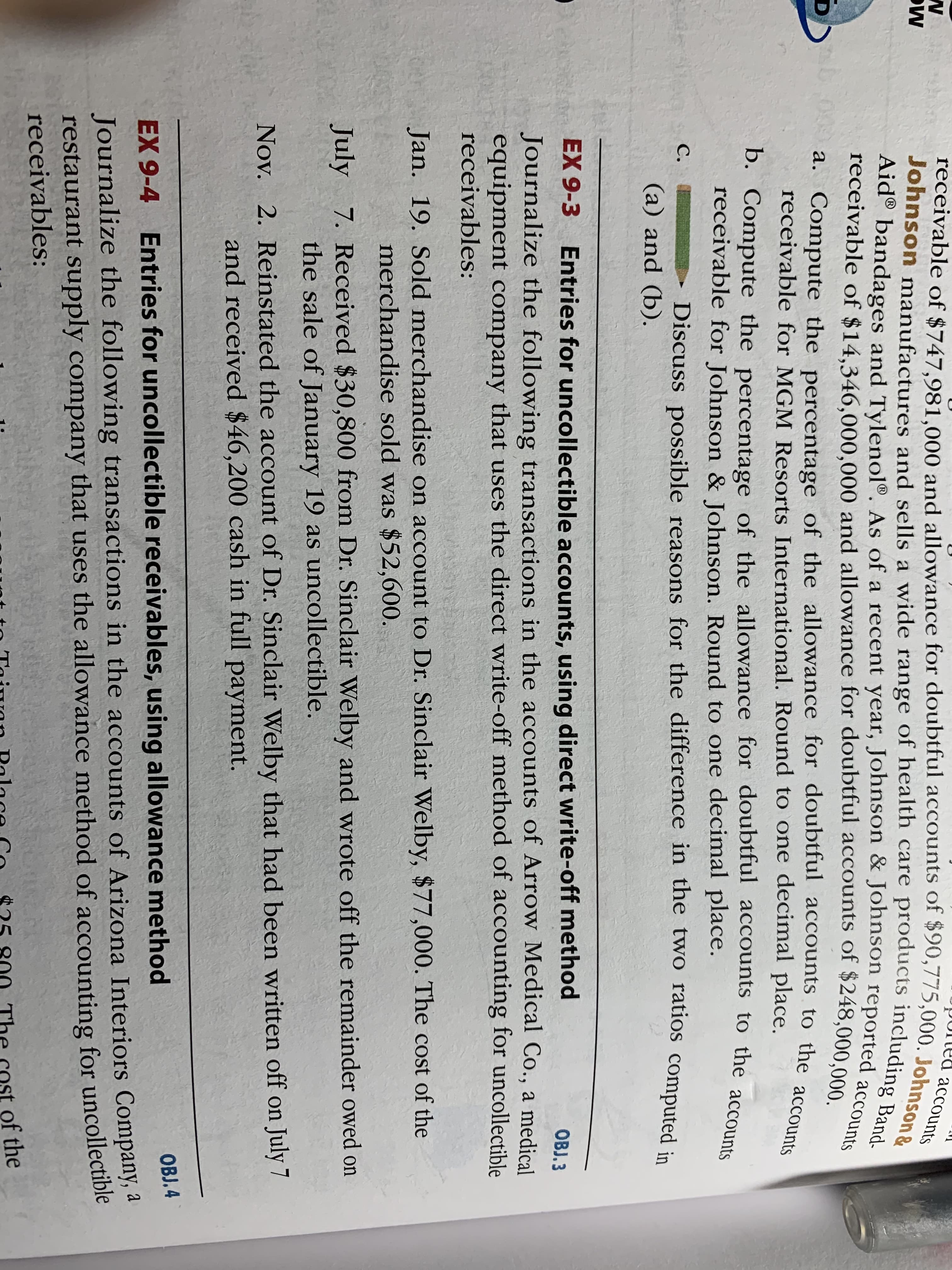

receivable of $747,981,000 and allowance for doubtful accounts of $90,775,000. Johnson & Johnson manufactures and sells a wide range of health care products including Band- Aid® bandages and Tylenol®. As of a recent year, Johnson & Johnson reported accounts a. Compute the percentage of the allowance for doubtful accounts to the accounts accounts Aid® bandages and Tylenol®. As of a recent year, Johnson & Johnson reported accond- receivable of $14,346,000,000 and allowance for doubtful accounts of $248,000.000 a. Compute the percentage of the allowance for doubtful accounts to the aces receivable for MGM Resorts International. Round to one decimal place. b. Compute the percentage of the allowance for doubtful accounts to the accous receivable for Johnson & Johnson. Round to one decimal place. C. Discuss possible reasons for the difference in the two ratios computed :- (a) and (b). EX 9-3 Entries for uncollectible accounts, using direct write-off method OBJ. 3 Journalize the following transactions in the accounts of Arrow Medical Co., a medical equipment company that uses the direct write-off method of accounting for uncollectible receivables: Jan. 19. Sold merchandise on account to Dr. Sinclair Welby, $77,000. The cost of the merchandise sold was $52,600. July 7. Received $30,800 from Dr. Sinclair Welby and wrote off the remainder owed on the sale of January 19 as uncollectible. Nov. 2. Reinstated the account of Dr. Sinclair Welby that had been written off on July 7 and received $46,200 cash in full payment. OBJ. 4 EX 9-4 Entries for uncollectible receivables, using allowance method Journalize the following transactions in the accounts of Arizona Interiors Company, a restaurant supply company that uses the allowance method of accounting for uncollectible receivables: Taiwan Polace Co *25 800 The cost of the

receivable of $747,981,000 and allowance for doubtful accounts of $90,775,000. Johnson & Johnson manufactures and sells a wide range of health care products including Band- Aid® bandages and Tylenol®. As of a recent year, Johnson & Johnson reported accounts a. Compute the percentage of the allowance for doubtful accounts to the accounts accounts Aid® bandages and Tylenol®. As of a recent year, Johnson & Johnson reported accond- receivable of $14,346,000,000 and allowance for doubtful accounts of $248,000.000 a. Compute the percentage of the allowance for doubtful accounts to the aces receivable for MGM Resorts International. Round to one decimal place. b. Compute the percentage of the allowance for doubtful accounts to the accous receivable for Johnson & Johnson. Round to one decimal place. C. Discuss possible reasons for the difference in the two ratios computed :- (a) and (b). EX 9-3 Entries for uncollectible accounts, using direct write-off method OBJ. 3 Journalize the following transactions in the accounts of Arrow Medical Co., a medical equipment company that uses the direct write-off method of accounting for uncollectible receivables: Jan. 19. Sold merchandise on account to Dr. Sinclair Welby, $77,000. The cost of the merchandise sold was $52,600. July 7. Received $30,800 from Dr. Sinclair Welby and wrote off the remainder owed on the sale of January 19 as uncollectible. Nov. 2. Reinstated the account of Dr. Sinclair Welby that had been written off on July 7 and received $46,200 cash in full payment. OBJ. 4 EX 9-4 Entries for uncollectible receivables, using allowance method Journalize the following transactions in the accounts of Arizona Interiors Company, a restaurant supply company that uses the allowance method of accounting for uncollectible receivables: Taiwan Polace Co *25 800 The cost of the

Chapter9: Accounting For Receivables

Section: Chapter Questions

Problem 10EA: Millennial Manufacturing has net credit sales for 2018 in the amount of $1,433,630, beginning...

Related questions

Question

EX 9-3

Transcribed Image Text:receivable of $747,981,000 and allowance for doubtful accounts of $90,775,000. Johnson &

Johnson manufactures and sells a wide range of health care products including Band-

Aid® bandages and Tylenol®. As of a recent year, Johnson & Johnson reported accounts

a. Compute the percentage of the allowance for doubtful accounts to the accounts

accounts

Aid® bandages and Tylenol®. As of a recent year, Johnson & Johnson reported accond-

receivable of $14,346,000,000 and allowance for doubtful accounts of $248,000.000

a. Compute the percentage of the allowance for doubtful accounts to the aces

receivable for MGM Resorts International. Round to one decimal place.

b. Compute the percentage of the allowance for doubtful accounts to the accous

receivable for Johnson & Johnson. Round to one decimal place.

C.

Discuss possible reasons for the difference in the two ratios computed :-

(a) and (b).

EX 9-3 Entries for uncollectible accounts, using direct write-off method

OBJ. 3

Journalize the following transactions in the accounts of Arrow Medical Co., a medical

equipment company that uses the direct write-off method of accounting for uncollectible

receivables:

Jan. 19. Sold merchandise on account to Dr. Sinclair Welby, $77,000. The cost of the

merchandise sold was $52,600.

July 7. Received $30,800 from Dr. Sinclair Welby and wrote off the remainder owed on

the sale of January 19 as uncollectible.

Nov. 2. Reinstated the account of Dr. Sinclair Welby that had been written off on July 7

and received $46,200 cash in full payment.

OBJ. 4

EX 9-4 Entries for uncollectible receivables, using allowance method

Journalize the following transactions in the accounts of Arizona Interiors Company, a

restaurant supply company that uses the allowance method of accounting for uncollectible

receivables:

Taiwan Polace Co

*25 800 The cost of the

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Recommended textbooks for you

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College