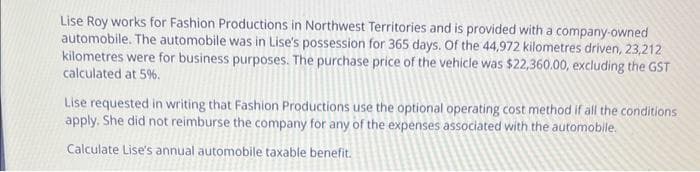

Calculate Lise's annual automobile taxable benefit.

Q: On 1 January 2015, Telupid Bhd acquired a fabric design from a well-known fashion designer at…

A: Acquisition is an transaction between two companies where one company purchases all the assets and…

Q: Thornton Painting Company is considering whether to purchase a new spray paint machine that costs…

A: Unadjusted rate of return is computed by dividing the increase average income with the initial cost…

Q: A company owns machinery with a book value of P2,200,000. It is estimated that the machinery will…

A: Impairment loss can be calculated with the help of its book value, where the book value of the…

Q: Mrs. Ewachniuk had a son and two daughters. In 2006 at the age of 90 she died leaving a $2 million…

A: The fundamental section for establishing a genuine understanding is that social affairs consent…

Q: Martinez Company’s relevant range of production is 7,500 units to 12,500 units. When it produces and…

A: The incremental cost is also known as marginal cost. It is an additional cost incurred due to an…

Q: Machinery Purchased for $ 800000 Accumulated depreciation value is $ 600000 Sold for $400000…

A: The depreciation expense is charged on fixed assets as reduced value of the fixed asset with usage…

Q: Sky Company is unable to reconcile the bayk balance at January 31. Sky's reconciliation is as…

A: Bank reconciliation: It is a statement drawn up by the business to verify the cash book balance with…

Q: what is Paul's taxable income for 2013? A). $90,000 B). $210,000 C). $315,000 D).…

A: The taxable income of the taxpayer is the income on which the tax is paid. the taxable income is the…

Q: Cullumber Limited competes in the fast food industry with Bramble Limited. Cullumber underwent a…

A: The ratio analysis helps to analyze the financial statements with different elements of financial…

Q: 1 2 3 4. 5. 6. 7. 8. 9. 10. Lacson invested P100,000 cash in the business Paid P5,000 for office…

A: Rule of debit credit is they are known as the Golden Rules of accountancy: 1)Debit what comes in,…

Q: 1 The sum of P35,000 invested on April 16, 2009 amounts to P58,300 on July 16, 2013. At what rate…

A: Present Value Or Principal Amount :— It is the value of Amount today Or Amount invested in present…

Q: Belle Company reports the following information for the current year. All beginning inventory…

A: Introduction: Absorption costing is a method of calculating inventory costs. It includes variable…

Q: 2. Change all of the numbers in the data area of your worksheet so that it looks like this: A…

A: Pre-determined overhead rate refers to the rate of allocation which is used for applying the…

Q: Explain four (4) emerging issues in the auditing profession and the work of an auditor in general.

A: Answer:- Auditing meaning:- Auditing can be defined as the systematic examination of the books of…

Q: a. Production schedule by product. Note: Use a negative sign in your schedule to indicate that an…

A: Budgeting is a process by which a business entity make its financial plans and set targets. Budgets…

Q: If JoBlo Inc., has a retained earnings opening balance of $50,000 at the beginning of the year, and…

A: Introduction: Retained Earnings: Retained Earnings are shareholder funds. Profit is retained with…

Q: 4. A certain sum of money is invested at 2 years at 12% compounded quarterly. If the sum is P43,000,…

A: Future Value = Future Value means Value of Amount in Future. Compound Interest :— It means…

Q: NTJ Distributors Ltd has has an annual demand for an airport metal detector of 1400 units. The cost…

A: Lets understand the basics. Economic order quantity is a quantity at which carrying cost and…

Q: 9 15 Purchased supplies on account for $1,100 from Digital Shot Company. Received $3,500 cash…

A: Introduction: Journals: All the business transactions are to be recorded in Journals. Journals are…

Q: GMA Corp. received a charter authorizing 120,000 ordinary shares at ₱15 par value per share. During…

A: Share Premium = Total Issue Price of Shares - Total Par Value of Shares Issued

Q: The following wages costs were incurred for the manufacturing of Espresso pods at Nespresso: Labor…

A: Under high-low method the lowest and highest activities are used to compute variable cost per unit…

Q: Find the compound amount and interest on P360,000 for 8 years and 6 months at 10% compounded…

A: Compound interest is the interest on interest received and this will increase with increase in…

Q: Marcus purchased a equipment which was an depreciable asset for P38,000 on January 1, 2017. The…

A: Depreciation was used to record value of various machineries after its wear and tear where sum of…

Q: Ian bought some goods in May for $600 and sold them in the following August for $950.For the…

A: The expenditures that are incurred in the process of running a firm are referred to as expenses and…

Q: Instructions: Identify each of the following accounts as an asset, Liability or Equity. DESCRIPTION…

A: Introduction: Balance sheet: All the assets and liabilities are to be shown in Balance sheet. It…

Q: BFAR Corp. was authorized to issue 500,000 ordinary shares with a par value of P10. One of its…

A: Delinquent shares is a share which has not been paid by the subscriber and therefore such shares are…

Q: Cahuilla Corporation predicts the following sales in units for the coming four months: April May…

A: The number of units of product that must be manufactured is defined by the production budget, which…

Q: A fundamental analyst uses the discounted cashflow method to value firms, and has a short-term…

A: Fundamental Analysis is a technique to value firms on the basis of their fundamentals i.e. their…

Q: Assume a manufacturer of automobiles. How would the cost of steel used in the manufacture of the…

A: Prime cost - These costs are those costs that are directly incurred to create a product or service…

Q: he partner equity balances are Jack, Capital 30000,Current 9000; Bob, Capital 35000, Current 12000;…

A: Capital balance of partner is the amount of money that the partners have invested in the partnership…

Q: BFAR Corp. has the following information in its shareholders' equity: . Preference Share Capital,…

A: Legal capital is the sum of par values of all shares issued by a company.

Q: Winds Inc. originally has four branches. The North Branch was already sold due to downsizing reasons…

A: Price to Book Value Ratio (P/B Ratio) :— It is the Ratio between Market Price & Book value of…

Q: Required information Ramos Co. provides the following sales forecast and production budget for the…

A: The Direct materials purchase budget becomes the base for the purpose of determining the materials…

Q: Gail Trevino expects to receive a $500,000 cash benefit when she retires five years from today. Ms.…

A: This question relates to the application of time value of money. We will compute the present value…

Q: Belle Company reports the following information for the current year. All beginning inventory…

A: Units of Finished Goods Inventory = Units Produced - Units Sold Cost of Finished Goods Inventory =…

Q: Problem #2 Adjusting Entries and Accounting Policy The following are some of the transactions made…

A: Adjusting Entry – The inputs that make the accrual principle operate for the organization are known…

Q: BFAR Corp. has 500,000 shares authorized and has the following information at the end of its first…

A: Shares are a type of securities, the holders of which get rights to participate in the profits of…

Q: Required: 1. Compute (a) the CM ratio and the break-even point in skateboards, and (b) the degree of…

A: Introduction:- Break-even point point means, where no profit or loss At Break-even point point,…

Q: . Which of the following business units has the highest beta factor?

A: Banks or any other business has one the feature or we can say a disadvantage which is the risk which…

Q: GMA Corp. was authorized to issue 500,000 ordinary shares with a par value of ₱10. One of its…

A: That is in case of subscriber fails to pay his unpaid money on shares upon several notices his…

Q: [The following information applies to the questions displayed below.] Shown here are condensed…

A: In order to determine the net income earned during the year, the business entities prepare the…

Q: Timeless Toys hopes to raise as much long-term capital as possible for corporate expansion. However,…

A: The best way for a company to raise long-term capital while maintaining corporate control is to…

Q: . Determine budgeted cost of merchandise purchased for quarters 1, 2, and 3. . Determine budgeted…

A: The question is related to the budgeting costing. The budgeted cost of merchandise purchased can be…

Q: On January 1 of its first month of business, Bags Bunny, Inc., paid $74,000 for six months rent…

A: Introduction: Income statement: All revenues and expenses are to be shown in Income statement. It…

Q: Sharp Motor Company has two operating divisions-an Auto Division and a Truck Division. The company…

A: Cost Charged :- Cost include all type of variable Cost ( DM, DL, Variable manufacturing Cost,…

Q: The 2020 income statement of Blossom Corporation showed net income of $1,271,000, which included a…

A: Net Income- Net income is the remaining amount after expenses and cost of goods sold have been…

Q: ndicate whether the following items would appear on the income statement, balance sheet, or retained…

A: Balance sheet provides for the statement of position of a business at a specific date. Income…

Q: 1. If Chemical Boost, Inc. had used FIFO instead of LIFO to value its inventory, what value would…

A: Introduction: LIFO: The last in, first out (LIFO) approach of inventory accounting is utilized.…

Q: freight Terms Determine the amount to be paid in full settlement of each of two invoices, (a) and…

A: IF the term is FOB shipping point then freight is added to the total cost but if the term is FOB…

Q: the month of sale, 55% in the first month after sale, 22% in the second month after sale, and 3% is…

A: Introduction: The cash collection cycle is the number of days it takes to recover accounts…

Step by step

Solved in 4 steps

- Kate is an executive for the Cozy Furniture Manufacturing Company. She purchased furniture from the company for $9,500, the price Cozy ordinarily would charge a wholesaler for the same items. The retail price of the furniture was $12,500, and Cozy’s cost was $9,000. The company also paid for Kate’s parking space in a garage near the office. The parking fee was $600 for the year. All employees are allowed to buy furniture at a discounted price comparable to that charged to Kate. However, the company does not pay other employees’ parking fees. Kate’s gross income from the above is: answer choices: $3,500. $4,100. $-0-. $900 $600.Joe purchased a delivery van for his business through an online auction. His winning bid for the van was $24,500. In addition, Jose incurred the following expenses before using the van: shipping cost of $650; paint to match the other fleet vehicles at a cost of $1,000; registration costs of $3,200. Which included $3,000 of sales tax and an annual registration fee of $200; wash and detailing for $50; and an engine tune-up for $250. What is Jose’s cost basis for the delivery van?To support herself while attending school, Daun Deloch sold stereo systems to other students. During the first year of operations, Daun purchased the stereo systems for $260,000 and sold them for $370,000 cash. She provided her customers with a one-year warranty against defects in parts and labor. Based on industry standards, she estimated that warranty claims would amount to 2 percent of sales. During the year, she paid $4,020 cash to replace a defective tuner. Requireda. Prepare an income statement and statement of cash flows for Daun’s first year of operation. b. Based on the information given, what is Daun’s total warranties liability at the end of the accounting period?

- Thabitha works for Lobatse Clayworks Limited, a company that specializes in manufacturing ceramic products as well as special heat resistant face bricks used mainly in industrial processes. During the financial year ended 31 December 2022, she received amounts as shown below: A company vehicle for private use with a value of P480,000 with annual running costs of P18,000 paid by the company Tickets and booking to the value of P15,000 to go on her annual holiday as part of her condition of employment. Received free meals for P7,500 during the year from the company canteen Refund of P5,000 for medical expenses from Pula Medical Aid Society, her medical aid provider Dividends of P12,550 for shares held in a local company. Won a Jackpot of P50,500 from Cumberland Casino Share option offer from employer of 10,800 shares in the company at a price of P1.80 each, the current market price of the shares is P2.30 each Received a subsidy of P125,000 from government programme for Horticultural…To support herself while attending school, Daun Deloch sold stereo systems to other students. During the first year of operations, Deloch purchased the stereo systems for $138,000 and sold them for $258,000 cash. She provided her customers with a one-year warranty against defects in parts and labor. Based on industry standards, she estimated that warranty claims would amount to 6 percent of sales. During the year, she paid $1,480 cash to replace a defective tuner. Required a-1. Prepare an income statement for Deloch’s first year of operation. a-2. Prepare a statement of cash flows for Deloch’s first year of operation.An air-conditioning contractor is installing a heat pump system in a privatehome. He has agreed to do the job for the cost of parts and labor plus acontractor’s fee of 9% of the total. The heat pump costs $1,495, the electricalsupplies $53, the ducting $81, and the other supplies $39. Three men work16 hours each to install the system. They are paid $14 per hour. Sales tax is6% of the subtotal of the cost for parts, labor, and contractor’s fee.a. What is the total cost for parts and labor?

- During 2022, BLC Corporation leased a car for its employee Carmen, at a monthly cost of $983, including all taxes. BLC paid $7043 for the operating costs of the car during 2022. Carmen used the car for 11 months during the year and during the months of non-use, it was returned to BLC's premises. During the year, he drove the car a total of 26031 kilometers of which 16716 kilometers were for personal travel and the remainder was for employment-related use. Calculate Carmen's total taxable benefit arising from the use of the car in 2022.Allan’s employer purchased a car in March 2019 at a cost of $44,000 GST inclusive and provided the car to Allan on 1 July 2019. Allan garages the car at his home each night from 1 July 2019 to 31 March 2020, excluding the month of December 2019. Allan travelled 40,000 kilometres in the car during the year, and the odometer and logbook records show that 20,000 kilometres were for business purposes and 20,000 kilometres were for private purposes. The operating costs of the car (not including deemed depreciation and deemed interest) were $9,000 (GST inclusive). Allan did not make any contribution but provided all the necessary documents for his employer to calculate his FBT liability. Question Assuming the employer elects to use the operating cost basis, explain and calculate the taxable value of the car fringe benefit and the FBT consequences for Allan’s employer.Jos is a Sales Manager. He uses his own car to travel to various locations. He acquired the car on 1 October 2021 for $60,000. The acquisition cost was funded entirely by a loan at an interest rate of 15%. He has determined that the depreciation deduction on the car would be $2,300 for the year. In addition, Jos incurred the following expenses during the year: Registration and insurance = $2,000; Repairs and maintenance = $1,000; and Oil and fuel costs = $1,500. For the period 1 October 2021 to 30 June 2022, Jos estimates that the car travelled 15,000 kilometres, 12,000 of which were for business purposes. You may assume that Jos has maintained all necessary records and a logbook. Required: Calculate Jos's deduction for car expenses under the two methods (cent per kilometre rate 0.72 and logbook) in Div 28 of Income Tax Assessment Act 1997. Assume that depreciation has been adjusted for part-year use and the impact of the car limit

- Mica is the chief chemist of V Medical Hospital Inc. As reward for good performance, she was sent by her employer to the United States to attend a 3-day convention of International Association of Medical technologists. She was booked on a first class ticket that cost the company US $2,000 ($1=P50) for a round trip ticket. Economy ticket costs only $1,200. She was likewise given an allowance to bw used for her meals and local transportation at a rate of US $100 daily which is subject to liquidation. The amount of fringe benefit-tax is---Thomson Printing Company is a buyer and seller of used machinery. On April 10, the president of the company, James Thomson, went to the surplus machinery department of B.F. Goodrich Company in Akron, Ohio, to examine some used equipment that was for sale. Thomson discussed the sale, including a price of $9,000, with Ingram Meyers, a Goodrich employee and agent. Four days later, on April 14, Thomson sent a purchase order to confirm the oral contract for purchase of the machinery and a partial payment of $1,000 to Goodrich in Akron. The purchase order contained Thomson Printing’s name, address, and telephone number, as well as certain information about the purchase, but did not specifically mention Meyers or the surplus equipment department. Goodrich sent copies of the documents to a number of its divisions, but Meyers never learned of the confirmation until weeks later, by which time the equipment had been sold to another party. Thomson Printing brought suit against Goodrich for breach…On July 1, 2018, Brent purchases a new automobile for $40,000. He uses the car 80% for business and drives the car for business purposes as follows: 8,000 miles in 2018, 19,000 miles in 2019, 20,000 miles in 2020, and 15,000 miles in 2021. Brent uses the actual cost method. [Assume that no § 179 expensing is claimed and that 200% declining-balance cost recovery with the half-year convention is used. The recovery limitation for an auto placed in service in 2018 is as follows: $10,000 (first year), $16,000 (second year), $9,600 (third year), and $5,760 (fourth year).] a. Compute his depreciation deductions for the years 2018, 2019, 2020, and 2021. What is Brent's adjusted basis in the auto on January 1, 2022?