The year-end balance sheet of Manor, Inc., includes the following stockholders' equity section (with certain details omitted): Stockholders' equity: 10% cumulative preferred stock, $100 par value, authorized 100,000 shares.. $ 400,000 ....... Common stock, $2 par value, authorized 2,000,000 shares... Additional paid-in capital: common stock Donated capital Retained earnings Total stockholders' equity 3,400,000 6,800,000 400,000 3,160,000 $18,160,000

The year-end balance sheet of Manor, Inc., includes the following stockholders' equity section (with certain details omitted): Stockholders' equity: 10% cumulative preferred stock, $100 par value, authorized 100,000 shares.. $ 400,000 ....... Common stock, $2 par value, authorized 2,000,000 shares... Additional paid-in capital: common stock Donated capital Retained earnings Total stockholders' equity 3,400,000 6,800,000 400,000 3,160,000 $18,160,000

College Accounting, Chapters 1-27

23rd Edition

ISBN:9781337794756

Author:HEINTZ, James A.

Publisher:HEINTZ, James A.

Chapter20: Corporations: Organization And Capital Stock

Section: Chapter Questions

Problem 1MP: Stockholders equity accounts and other related accounts of Gonzales Company as of January 1, 20--,...

Related questions

Question

100%

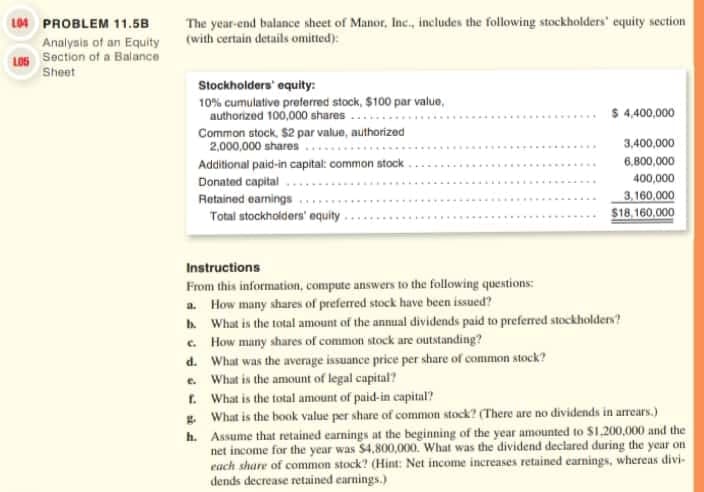

Transcribed Image Text:The year-end balance sheet of Manor, Inc., includes the following stockholders' equity section

(with certain details omitted):

LO4 PROBLEM 11.58

Analysis of an Equity

LO6 Section of a Balance

Sheet

Stockholders' equity:

10% cumulative preferred stock, $100 par value,

authorized 100,000 shares.

Common stock, $2 par value, authorized

2,000,000 shares ..

Additional paid-in capital: common stock

$ 4,400,000

3,400,000

6,800,000

Donated capital

400,000

3.160.000

$18.160,000

Retained earnings .

Total stockholders' equity.

Instructions

From this information, compute answers to the following questions:

a. How many shares of preferred stock have been issued?

h What is the total amount of the annual dividends paid to preferred stockholders?

c. How many shares of common stock are outstanding?

d. What was the average issuance price per share of common stock?

e. What is the amount of legal capital?

t. What is the total amount of paid-in capital?

g What is the book value per share of common stock? (There are no dividends in arrears.)

h. Assume that retained earnings at the beginning of the year amounted to $1,200,000 and the

net income for the year was $4.800,000. What was the dividend declared during the year on

each share of common stock? (Hint: Net income increases retained earnings, whereas divi-

dends decrease retained earnings.)

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 4 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,

College Accounting, Chapters 1-27 (New in Account…

Accounting

ISBN:

9781305666160

Author:

James A. Heintz, Robert W. Parry

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,

College Accounting, Chapters 1-27 (New in Account…

Accounting

ISBN:

9781305666160

Author:

James A. Heintz, Robert W. Parry

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning