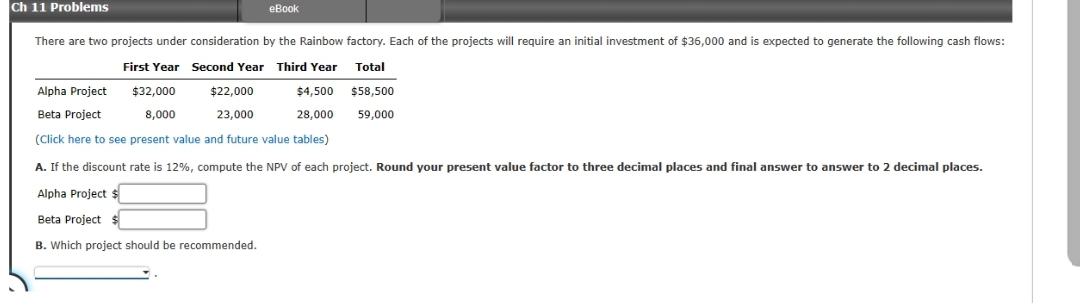

There are two projects under consideration by the Rainbow factory. Each of the projects will require an initial investment of $36,000 and is expected to generate the following cash flows: Second Year Third Year Total First Year $32,000 $4,500 $58,500 8,000 28,000 59,000 $22,000 23,000 Alpha Project Beta Project (Click here to see present value and future value tables) A. If the discount rate is 12%, compute the NPV of each project. Round your present value factor to three decimal places and final answer to answer to 2 decimal places. Alpha Project $ Beta Project $ B. Which project should be recommended.

There are two projects under consideration by the Rainbow factory. Each of the projects will require an initial investment of $36,000 and is expected to generate the following cash flows: Second Year Third Year Total First Year $32,000 $4,500 $58,500 8,000 28,000 59,000 $22,000 23,000 Alpha Project Beta Project (Click here to see present value and future value tables) A. If the discount rate is 12%, compute the NPV of each project. Round your present value factor to three decimal places and final answer to answer to 2 decimal places. Alpha Project $ Beta Project $ B. Which project should be recommended.

Chapter10: Project Cash Flows And Risk

Section: Chapter Questions

Problem 16PROB

Related questions

Question

G.219.

Transcribed Image Text:Ch 11 Problems

eBook

There are two projects under consideration by the Rainbow factory. Each of the projects will require an initial investment of $36,000 and is expected to generate the following cash flows:

First Year Second Year Third Year Total

Alpha Project

$4,500 $58,500

$22,000

23,000

Beta Project

28,000

59,000

(Click here to see present value and future value tables)

A. If the discount rate is 12%, compute the NPV of each project. Round your present value factor to three decimal places and final answer to answer to 2 decimal places.

Alpha Project $

Beta Project $

B. Which project should be recommended.

$32,000

8,000

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 4 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you