There is a 0.0087 probability that a randomly selected 27-year-old male lives through the year. A life insurance company charges $150 for insuring that the male will live through the year. If the male does not survive the year, the policy pays out s00,000 as a death benefit. Complete parts (a) through (c) below. a. From the perspective of the 27-year-old male, what are the monetary values corresponding to the two events of surviving the year and not surviving? The value corresponding to surviving the year is s. The value corresponding to not surviving the yea i (Type integers or decimals. Do not round.) b. If the 27-year-old male purchases the policy, what is his expected value? The expected value is sO (Round to the nearest cent as needed.) o. Can the insurance company expect to make a profit from many such policies? Why? because the insurance company expects to make an average profit of $ on every 27-year-old male it insures for 1 year. (Round to the nearest cent as needed.)

There is a 0.0087 probability that a randomly selected 27-year-old male lives through the year. A life insurance company charges $150 for insuring that the male will live through the year. If the male does not survive the year, the policy pays out s00,000 as a death benefit. Complete parts (a) through (c) below. a. From the perspective of the 27-year-old male, what are the monetary values corresponding to the two events of surviving the year and not surviving? The value corresponding to surviving the year is s. The value corresponding to not surviving the yea i (Type integers or decimals. Do not round.) b. If the 27-year-old male purchases the policy, what is his expected value? The expected value is sO (Round to the nearest cent as needed.) o. Can the insurance company expect to make a profit from many such policies? Why? because the insurance company expects to make an average profit of $ on every 27-year-old male it insures for 1 year. (Round to the nearest cent as needed.)

Chapter5: Gross Income: Exclusions

Section: Chapter Questions

Problem 23CE

Related questions

Question

Would you help me with this problem. Thank you

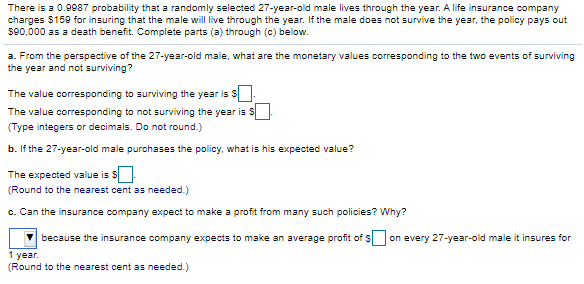

Transcribed Image Text:There is a 0.9987 probability that a randomly selected 27-year-old male lives through the year. A life insurance company

charges $159 for insuring that the male will live through the year. If the male does not survive the year, the policy pays out

s90,000 as a death benefit. Complete parts (a) through (c) below.

a. From the perspective of the 27-year-old male, what are the monetary values corresponding to the two events of surviving

the year and not surviving?

The value corresponding to surviving the year is S

The value corresponding to not surviving the year is S

(Type integers or decimals. Do not round.)

b. If the 27-year-old male purchases the policy, what is his expected value?

The expected value is S-

(Round to the nearest cent as needed.)

c. Can the insurance company expect to make a profit from many such policies? Why?

because the insurance company expects to make an average profit of $

on every 27-year-old male it insures for

1 year.

(Round to the nearest cent as needed.)

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 4 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Recommended textbooks for you

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT