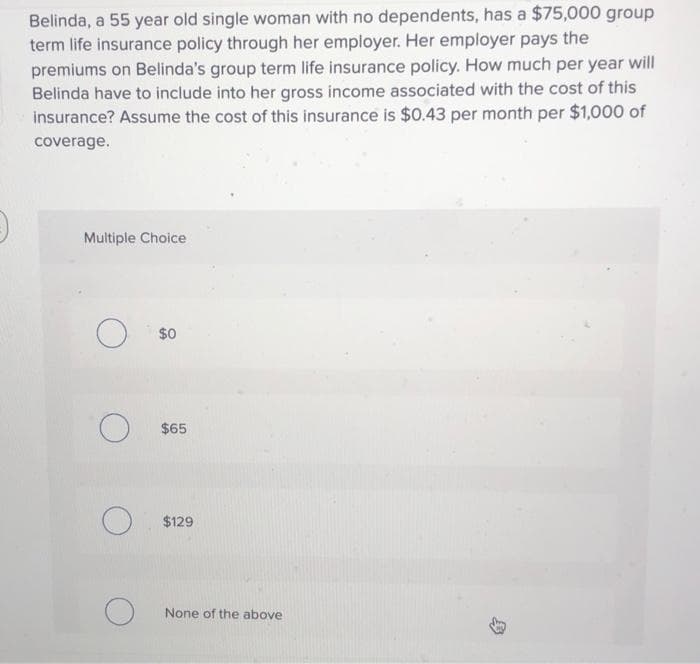

Belinda, a 55 year old single woman with no dependents, has a $75,000 gröup term life insurance policy through her employer. Her employer pays the premiums on Belinda's group term life insurance policy. How much per year will Belinda have to include into her gross income associated with the cost of this insurance? Assume the cost of this insurance is $0.43 per month per $1,000 of coverage. Multiple Choice $0 $65 $129 None of the above

Belinda, a 55 year old single woman with no dependents, has a $75,000 gröup term life insurance policy through her employer. Her employer pays the premiums on Belinda's group term life insurance policy. How much per year will Belinda have to include into her gross income associated with the cost of this insurance? Assume the cost of this insurance is $0.43 per month per $1,000 of coverage. Multiple Choice $0 $65 $129 None of the above

Chapter5: Gross Income: Exclusions

Section: Chapter Questions

Problem 22CE: Ellie purchases an insurance policy on her life and names her brother, Jason, as the beneficiary....

Related questions

Question

Transcribed Image Text:Belinda, a 55 year old single woman with no dependents, has a $75,000 group

term life insurance policy through her employer. Her employer pays the

premiums on Belinda's group term life insurance policy. How much per year will

Belinda have to include into her gross income associated with the cost of this

insurance? Assume the cost of this insurance is $0.43 per month per $1,000 of

coverage.

Multiple Choice

$0

$65

$129

None of the above

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Recommended textbooks for you

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT