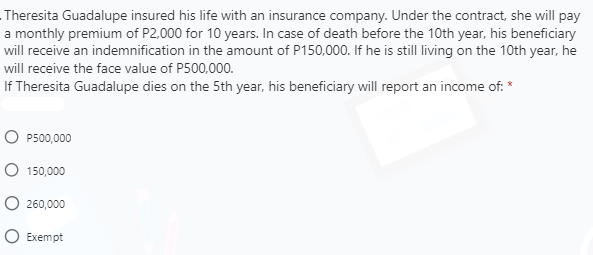

Theresita Guadalupe insured his life with an insurance company. Under the contract, she will pay a monthly premium of P2,000 for 10 years. In case of death before the 10th year, his beneficiary will receive an indemnification in the amount of P150,000. If he is still living on the 10th year, he will receive the face value of P500,000. If Theresita Guadalupe dies on the 5th year, his beneficiary will report an income of: * O P500,000 O 150,000 O 260,000 O Exempt

Theresita Guadalupe insured his life with an insurance company. Under the contract, she will pay a monthly premium of P2,000 for 10 years. In case of death before the 10th year, his beneficiary will receive an indemnification in the amount of P150,000. If he is still living on the 10th year, he will receive the face value of P500,000. If Theresita Guadalupe dies on the 5th year, his beneficiary will report an income of: * O P500,000 O 150,000 O 260,000 O Exempt

Chapter2: Gross Income And Exclusions

Section: Chapter Questions

Problem 15P: Greg died on July 1,2019 , and left Lea, his wife, a $45,000 life insurance policy which she elects...

Related questions

Question

19

Transcribed Image Text:Theresita Guadalupe insured his life with an insurance company. Under the contract, she will pay

a monthly premium of P2,000 for 10 years. In case of death before the 10th year, his beneficiary

will receive an indemnification in the amount of P150,000. If he is still living on the 10th year, he

will receive the face value of P500,000.

If Theresita Guadalupe dies on the 5th year, his beneficiary will report an income of: *

O P500,000

O 150,000

O 260,000

O Exempt

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Recommended textbooks for you

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT