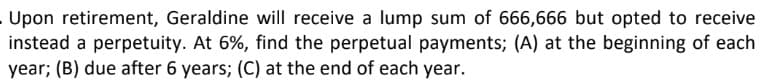

Upon retirement, Geraldine will receive a lump sum of 666,666 but opted to receive instead a perpetuity. At 6%, find the perpetual payments; (A) at the beginning of each year; (B) due after 6 years; (C) at the end of each year.

Upon retirement, Geraldine will receive a lump sum of 666,666 but opted to receive instead a perpetuity. At 6%, find the perpetual payments; (A) at the beginning of each year; (B) due after 6 years; (C) at the end of each year.

Chapter27: The Federal Gift And Estate Taxes

Section: Chapter Questions

Problem 5BCRQ

Related questions

Question

Transcribed Image Text:. Upon retirement, Geraldine will receive a lump sum of 666,666 but opted to receive

instead a perpetuity. At 6%, find the perpetual payments; (A) at the beginning of each

year; (B) due after 6 years; (C) at the end of each year.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps with 3 images

Recommended textbooks for you