These financial statement items are for Sandhill Company at year-end, July 31, 2020. Salaries and wages payable $2,300 Notes payable (long-term) $1,800 Salaries and wages expense 51,500 Cash 14,300 Utilities expense 23,000 Accounts receivable 10,400 Equipment 29,000 Accumulated depreciation―equipment 6,400 Accounts payable 4,700 Owner’s drawings 3,200 Service revenue 60,800 Depreciation expense 4,300 Rent revenue 8,400 Owner’s Capital (beginning of the year) 51,300

These financial statement items are for Sandhill Company at year-end, July 31, 2020. Salaries and wages payable $2,300 Notes payable (long-term) $1,800 Salaries and wages expense 51,500 Cash 14,300 Utilities expense 23,000 Accounts receivable 10,400 Equipment 29,000 Accumulated depreciation―equipment 6,400 Accounts payable 4,700 Owner’s drawings 3,200 Service revenue 60,800 Depreciation expense 4,300 Rent revenue 8,400 Owner’s Capital (beginning of the year) 51,300

Chapter2: Introduction To Financial Statements

Section: Chapter Questions

Problem 8EA: Here are facts for the Hudson Roofing Company for December. Assuming no investments or withdrawals,...

Related questions

Topic Video

Question

These financial statement items are for Sandhill Company at year-end, July 31, 2020.

| Salaries and wages payable | $2,300 | Notes payable (long-term) | $1,800 | |||

|---|---|---|---|---|---|---|

| Salaries and wages expense | 51,500 | Cash | 14,300 | |||

| Utilities expense | 23,000 | 10,400 | ||||

| Equipment | 29,000 | Accumulated |

6,400 | |||

| Accounts payable | 4,700 | Owner’s drawings | 3,200 | |||

| Service revenue | 60,800 | Depreciation expense | 4,300 | |||

| Rent revenue | 8,400 | Owner’s Capital (beginning of the year) | 51,300 |

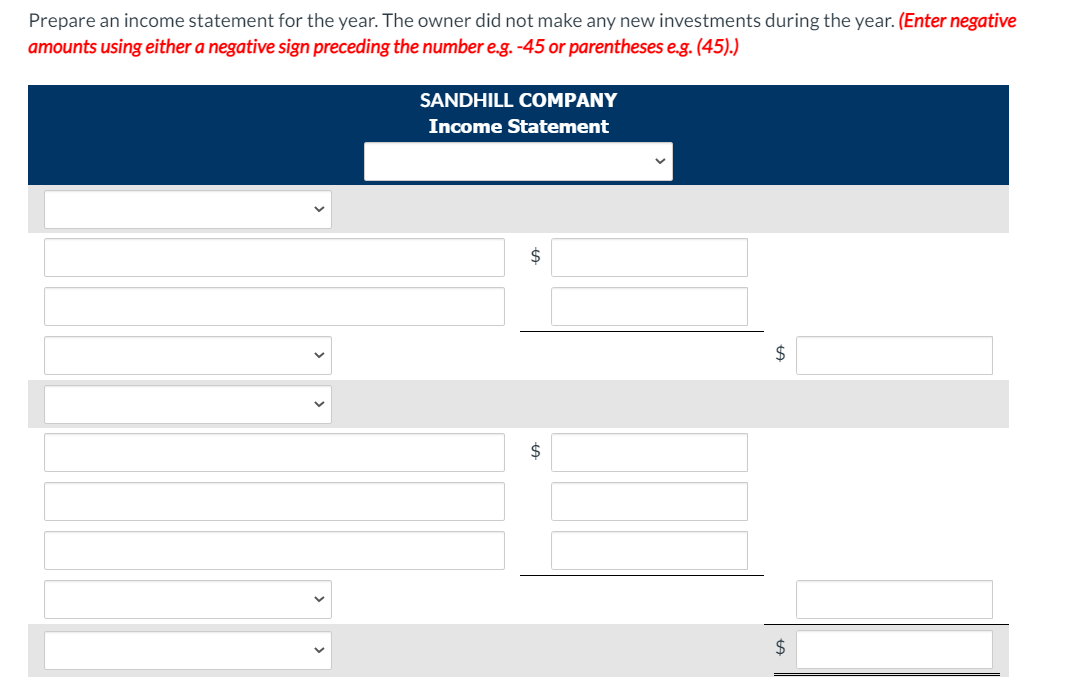

Transcribed Image Text:Prepare an income statement for the year. The owner did not make any new investments during the year. (Enter negative

amounts using either a negative sign preceding the number e.g. -45 or parentheses e.g. (45).)

SANDHILL COMPANY

Income Statement

$

2$

$

2$

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Financial Accounting

Accounting

ISBN:

9781337272124

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Financial Accounting

Accounting

ISBN:

9781337272124

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning